Top 5 Car Insurance Companies With Pip Coverage In The Us

Top 5 Car Insurance Companies With PIP Coverage in the US

Navigating the complexities of car insurance can often feel like deciphering an ancient language. With myriad terms, coverage options, and companies vying for your attention, it’s challenging to make informed decisions about your protection plan. Among the flood of terms, “Personal Injury Protection” or “PIP coverage” frequently stands out as a critical component of comprehensive car insurance, offering peace of mind when accidents occur.

But what exactly is PIP coverage, and why is it so important? In the simplest terms, Personal Injury Protection is a portion of auto insurance that covers medical expenses and, in some cases, lost wages and other damages. It shields you from the immediate financial burden that comes with accidents, regardless of who was at fault—a boon for anyone residing in the twelve “no-fault” states of the US, where PIP has become a mandatory staple of car insurance policies.

Therefore, finding the right car insurance provider with robust PIP coverage is crucial for ensuring your financial security and wellbeing. Yet, with countless insurance companies broadcasting claims of “comprehensive coverage” and “best rates,” how do you decide which insurer truly has your best interest at heart? That’s why we are here today—to guide you on this journey by highlighting the top five car insurance companies offering stellar PIP coverage in the US.

So, what makes a great PIP insurance provider? Is it competitive pricing, the breadth of coverage, customer service, or perhaps a combination of all these factors? As you will discover, selecting the right insurance company is not a one-size-fits-all scenario. Your choice may depend on individual needs such as your state’s regulations, your driving habits, and your financial situation. Our mission is to arm you with essential knowledge and insights to make a well-informed choice tailored to your unique circumstances.

In the sections that follow, we will dive deep into the world of car insurance to unmask and examine the top five insurance providers in the US renowned for their impeccable PIP coverage plans. We’ll explore what sets them apart, their pros and cons, and crucially, how they support policyholders when accidents disrupt their daily lives.

From industry stalwarts to emerging players redefining how we perceive customer service and value, our selection covers an array of brands that have continuously exemplified reliability, innovation, and a customer-first approach. In a world where transparency and trust are paramount, these companies have established a track record of excellence that will undoubtedly resonate with you.

Join us as we embark on this thorough exploration to identify the crème de la crème of car insurance companies offering PIP coverage. Whether you’re on the hunt for a new provider or simply wish to learn more about the best options available, our in-depth analysis will serve as an invaluable resource in your insurance quest.

Buckle up and prepare to dive into a world where protection meets precision, ensuring you’re well-equipped to make informed decisions that provide safety and security on the road.

Understanding PIP Coverage

Personal Injury Protection (PIP) coverage plays a crucial role in car insurance policies, particularly in no-fault states where each driver’s insurance covers their own injuries, regardless of who caused the accident. PIP is designed to cover medical expenses, lost wages, and sometimes, rehabilitation costs for you and your passengers after an accident. Given its significance, selecting an insurance company with robust PIP coverage is essential for comprehensive protection.

Criteria for Selecting the Top Car Insurance Companies

In selecting our top pick for car insurance companies offering PIP coverage, we considered several factors:

- Coverage Options: Companies must provide extensive PIP options covering medical expenses, lost income, and additional benefits.

- Customer Service: Reliable customer service is essential for ensuring claims processing is hassle-free during the stressful period following an accident.

- Claim Process: An efficient and straightforward claims process is valuable for policyholders who need timely support.

- Customer Reviews: Real-world experiences of customers, reflected in ratings and reviews, offer insight into the effectiveness of coverage and service.

- Financial Stability: The company’s ability to meet claims obligations hinges on its financial health.

Geico: Competitive Pricing with Flexible Options

Geico is renowned for competitive pricing and a suite of flexible options, including comprehensive PIP coverage. Policyholders appreciate Geico’s easy-to-use mobile app, which simplifies managing policies and filing claims. Geico’s strong financial standing, along with its numerous customer service awards, makes it a solid choice for those seeking reliable PIP coverage. The company’s ability to provide quick and efficient payouts supports its reputation for quality service.

State Farm: Personalized Service with Robust Offerings

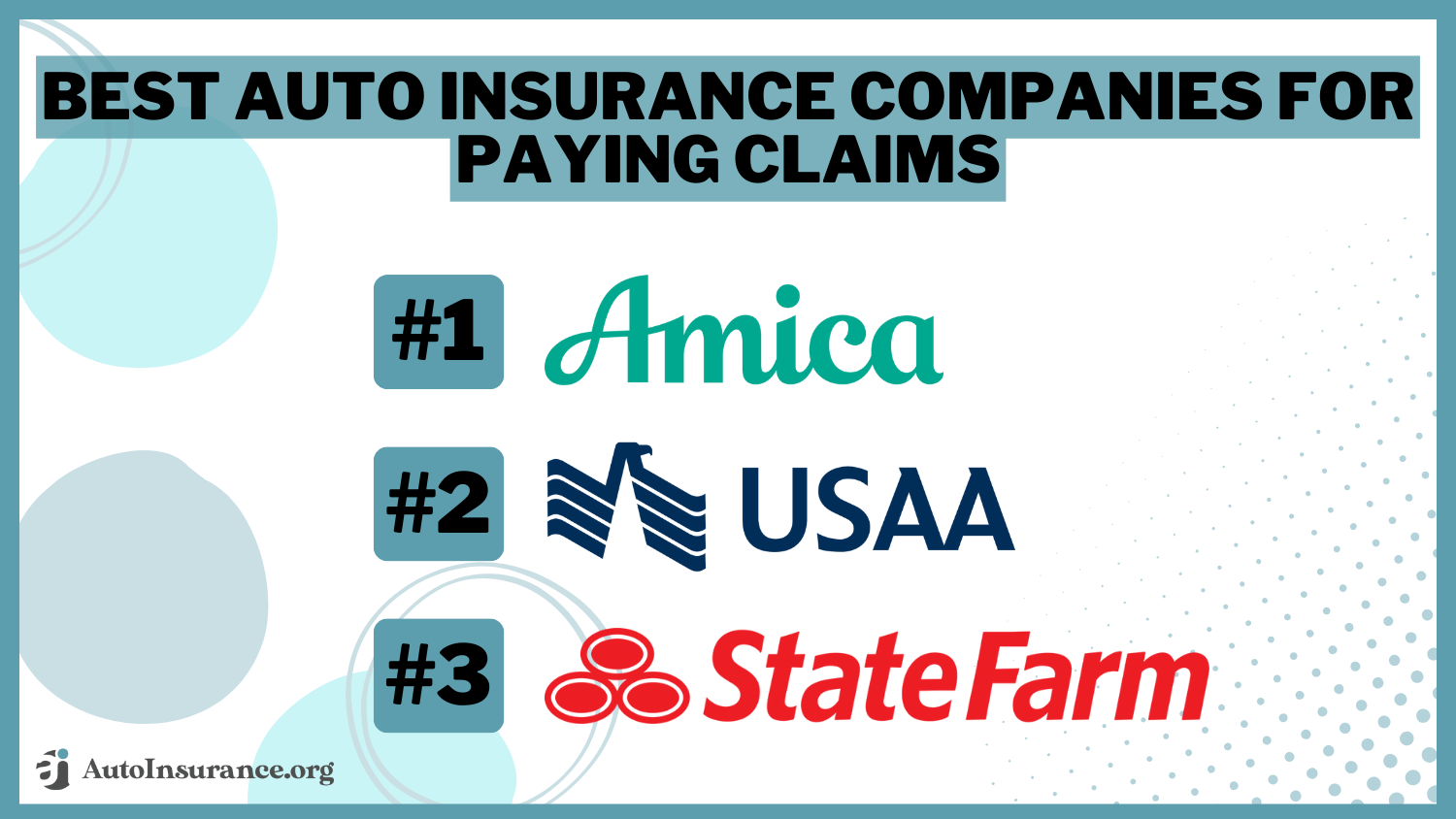

State Farm is well-regarded for offering personalized customer service through its extensive network of agents across the country. For PIP coverage, State Farm provides a wide range of options that can be tailored to individual needs, ensuring policyholders only pay for what they need. The company also excels at maintaining high customer satisfaction scores, partly due to its strong claims handling process. State Farm’s financial strength further ensures your protection is supported by one of the industry’s most stable providers.

Allstate: Comprehensive Coverage with Quality Support

Allstate stands out for its comprehensive coverage offerings, accompanied by helpful customer support resources. Their PIP options ensure policyholders are well-protected, with coverage extending to medical costs, income continuation, and essential service benefits. Customers frequently praise the company’s “claims satisfaction guarantee,†which underscores Allstate’s commitment to excellence in handling claims. Coupled with innovative tools like the Allstate mobile app, managing your car insurance needs with Allstate is both convenient and effective.

Progressive: Innovation and Customer Choice

Progressive is recognized for pioneering new technologies and serving diverse customer preferences. The company’s PIP coverage is flexible, featuring adjustable limits that cater to a variety of driver profiles. Progressive is best known for its ‘Name Your Price’ tool, allowing consumers to customize coverages according to budgetary constraints without sacrificing necessary protection. The ability to file claims online easily, coupled with a responsive customer service team, makes Progressive a preferred choice for many drivers.

USAA: Exceptional Service for Military Members

USAA exclusively caters to military members and their families, earning an unparalleled reputation for customer satisfaction and service quality. Within the PIP coverage spectrum, USAA provides solid protection options, backed by customer-focused service that’s highly regarded. Despite being exclusive in its membership, USAA consistently scores top marks in customer advocacy and is known for handling claims efficiently and fairly. Members frequently highlight USAA’s robust discounts and personalized service as pivotal in enhancing their insurance experience.

Key Considerations When Choosing PIP Coverage

When deciding on PIP coverage, it’s important to consider the following:

- State Requirements: Some states have minimum PIP requirements; ensure your chosen coverage meets or exceeds them.

- Coverage Limits: Assess your and your passengers’ potential needs to select adequate coverage limits.

- Additional Benefits: Evaluate additional perks, such as funeral expenses or rehabilitation services, offered by the insurer.

- Premium Costs: Balance premium costs against the level of coverage and service provided to ensure value for money.

Conclusion

Choosing the right car insurance company for PIP coverage can profoundly impact your financial safety and peace of mind in the event of an accident. The companies highlighted above – Geico, State Farm, Allstate, Progressive, and USAA – demonstrate excellence across innovation, customer service, and comprehensive coverage options. By evaluating your personal needs and the offerings of these top companies, you’re well-positioned to make an informed decision that ensures you and your passengers are well-protected.

Making an Informed Decision on PIP Coverage

As we conclude our exploration of the top five car insurance companies offering Personal Injury Protection (PIP) coverage in the United States, it’s important to revisit the key insights and considerations we’ve delved into. PIP coverage stands as a critical component of auto insurance in many states, designed to ensure that you and your passengers can receive timely medical treatment in the event of an accident, without the delays and complexities of proving fault.

In the introduction, we emphasized the necessity of understanding your unique needs and the specific requirements of your state. PIP coverage’s purpose is to provide financial protection and peace of mind, helping to cover medical expenses, lost wages, and other costs that may arise following an accident. This foundational understanding should guide your selection process, enabling you to make a choice that aligns well with your personal circumstances and legal obligations.

Key Takeaways from Our Analysis

Let’s summarize the critical aspects of the five insurance companies we examined, each with its own strengths in delivering robust PIP coverage:

- Geico: Known for its competitive rates and extensive customer service network, Geico offers a comprehensive PIP plan that appeals to many budget-conscious drivers. Their user-friendly platform also simplifies managing your policy.

- State Farm: With a longstanding reputation for reliability, State Farm provides customizable PIP options that allow policyholders to tailor their coverage in accordance with specific needs. This flexibility is paramount for families or individuals with special medical considerations.

- Progressive: Innovative in digital solutions, Progressive excels in providing detailed policy information at your fingertips, making it easy to understand and adjust your PIP coverage and ensuring the plan grows with your evolving needs.

- Allstate: Focusing on user experience, Allstate’s robust customer support system and comprehensive coverage options make it a great choice for those who prioritize clear communication and support throughout their policy lifecycle.

- USAA: Renowned for their service to military members and their families, USAA offers superb PIP policies that incorporate unique benefits tailored to its clientele. The value-added services and coverage options make them stand out for those eligible for membership.

The Perfect PIP Coverage: Tailoring to Your Needs

Each insurance company brings unique offerings to the table, and the ideal choice hinges on personal preferences, budget constraints, and specific legal stipulations. Here are some essential questions to ponder as you make your decision:

- What are the minimum state requirements for PIP coverage in your area, and do you need more substantial coverage?

- How does each provider balance cost with comprehensive services, especially in terms of customer support and claims handling?

- What additional benefits or discounts can you access through bundling or loyalty programs, and how do these align with your long-term financial plans?

The overarching advice in this journey is to adopt a proactive approach: engage with insurers, ask questions, and utilize online tools to compare and contrast different policies effectively. Remember, PIP’s true value is in the peace of mind it bestows, ensuring you’re prepared for unexpected circumstances without enduring additional financial strain.

Engage Further: A Call to Action

As you consider the best PIP coverage for your needs, remember that the landscape of car insurance is continually evolving. Stay informed about new offerings, policy changes, and emerging trends that might prove beneficial. We encourage you to:

- Request quotes from multiple providers to better understand your options and potential savings.

- Visit customer review sites to gather feedback from current policyholders that reflect on real-world experiences.

- Tap into online forums and insurance community forums to gain insight from peers navigating similar decisions.

Ultimately, while the process of selecting car insurance with PIP coverage can seem daunting, it is an opportunity to empower yourself with knowledge and readiness. With careful research and a clear understanding of your needs, you can choose a policy that not only adheres to state requirements but also affirms your financial security and peace of mind.

Thank you for joining us in this deep dive into PIP coverage options. We hope this guide has provided clarity and confidence as you navigate your path to the best car insurance policy. Feel free to contact us with any questions or share your experiences in the comments below. Your journey to optimal coverage starts with a single step—stay informed and drive safely!

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology