Top 5 Car Insurance Companies With Pip Coverage In The Us

Top 5 Car Insurance Companies With PIP Coverage in the US

In the bustling, fast-paced world of American roads, car insurance stands as an indispensable guardian for drivers nationwide. While many see it merely as a regulatory demand, seasoned drivers understand that choosing the right insurance policy could mean the difference between a minor inconvenience and a significant financial setback. Among the myriad of insurance options available, Personal Injury Protection (PIP) coverage emerges as a crucial facet of any comprehensive auto insurance policy. But why is PIP coverage so essential, and who provides the best options in an ocean of choices?

Picture this: you’re driving home after a long day at work, mentally scrolling through your to-do list, when out of nowhere, a vehicle rear-ends you at a red light. The jolt leaves you with a sore neck and an endless list of questions. Who pays for the medical bills? How will you cover the lost income from hours missed at work due to doctor visits? Enter Personal Injury Protection.

PIP insurance, often known as “no-fault” insurance, is designed to pay for medical expenses, lost wages, and other costs associated with injuries from a car accident, regardless of who is at fault. Unlike liability insurance, which covers the damages you may cause to another person, PIP is all about self-protection – covering you and your passengers in the event of an accident.

The peace of mind offered by PIP coverage is invaluable, but not all insurance companies are created equal when it comes to the scope and efficiency of their PIP options. In a world brimming with catchy advertisements and complex policy details, identifying the top car insurance companies with the best PIP coverage can seem daunting.

As we plunge into this labyrinth of policy terms and insurance jargon, this blog post is dedicated to spotlighting the top five insurance firms that excel in providing PIP coverage in the United States. From understanding the nuances of what each company offers to evaluating customer satisfaction, cost-effectiveness, and reliability, our journey will guide you to discover which insurer deserves your trust.

In the following sections, we’ll delve into the specifics of these top contenders. We will explore how they differentiate themselves in a fiercely competitive market, what unique benefits they provide to their policyholders, and the anecdotes from real customers that illuminate their effectiveness.

Are you ready to navigate this essential aspect of your automotive safety net? Let’s embark on this quest to unveil the most reputable and customer-friendly car insurance companies that offer unparalleled PIP coverage, ensuring your peace of mind on every drive.

Understanding PIP Coverage

Before we dive into the top car insurance companies that offer PIP (Personal Injury Protection) coverage, it’s essential to understand what PIP coverage is and why it is necessary. Personal Injury Protection is a component of auto insurance that covers your medical expenses and, in some cases, lost wages in the event of a car accident, regardless of who was at fault. This type of insurance is particularly critical in no-fault states where your own insurance covers your injuries after an accident.

Factors to Consider When Choosing a Car Insurance Company for PIP Coverage

When selecting a car insurance provider with PIP coverage, there are several factors you should consider:

- Coverage Limits: Ensure the company offers sufficient coverage limits that match your needs.

- Customer Service: Evaluate the quality of customer service, as excellent support is vital during claims processing.

- Financial Stability: Choose a company with robust financial health to ensure they can pay claims when needed.

- Premium Costs: Compare premium rates across different companies to find competitive pricing without sacrificing coverage.

- Claim Process: Look into the efficiency and accessibility of the company’s claims process.

Top 5 Car Insurance Companies with PIP Coverage in the US

1. GEICO

GEICO is renowned for its affordable rates and comprehensive insurance packages, making it a popular choice for those seeking PIP coverage. Not only does GEICO offer competitive premiums, but their policies are known for flexibility in terms of tailoring additional coverage options, including PIP.

- Pros: User-friendly online platform, competitive pricing, and excellent mobile app functionality.

- Cons: Limited number of local offices for in-person service.

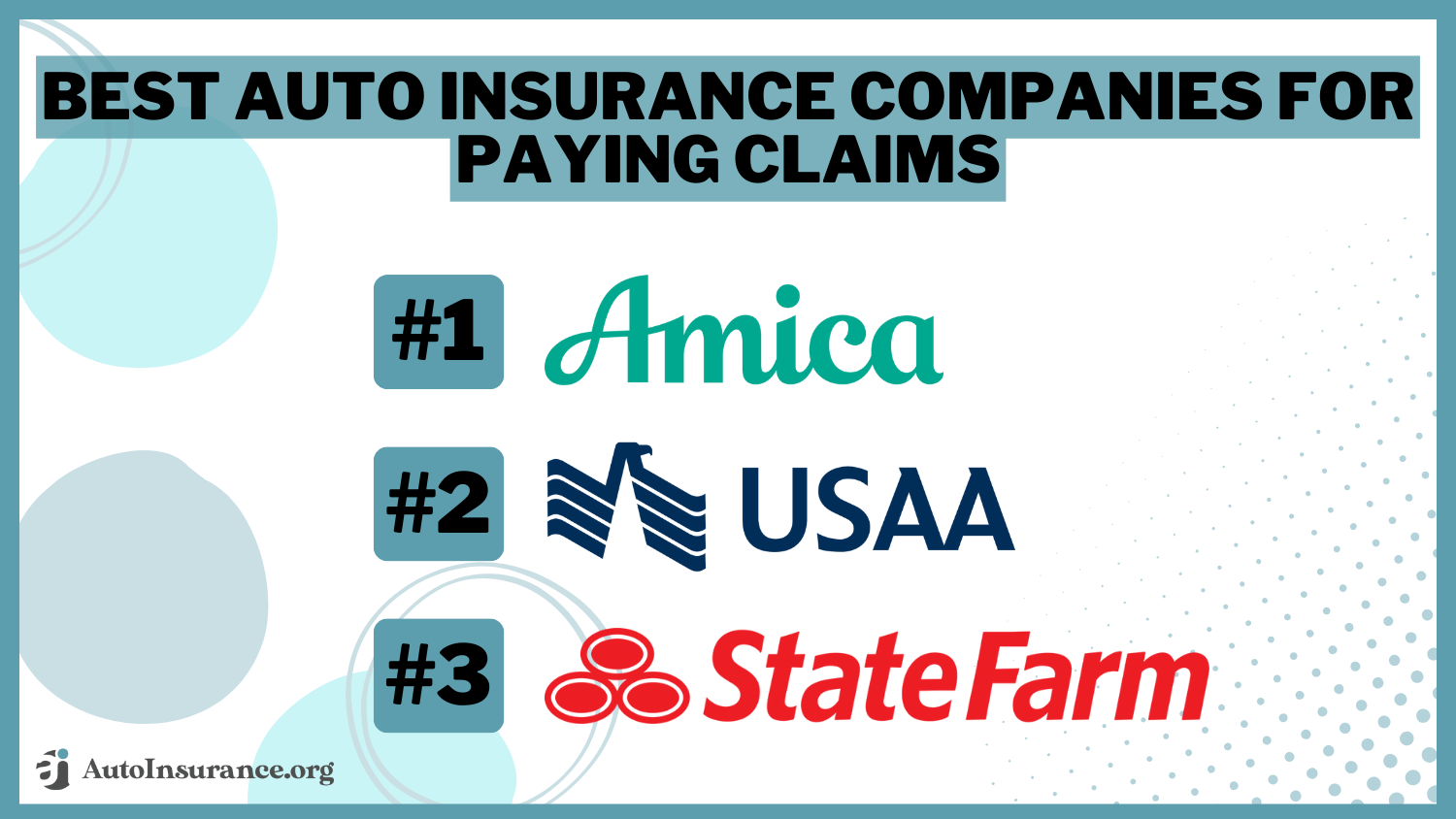

2. State Farm

State Farm is another leading name in the auto insurance industry with commendable PIP coverage options. Their strong network of agents allows for personalized service and assistance in filing claims, which is highly valued by customers.

- Pros: Extensive network of agents, strong financial stability, and discounts for bundling policies.

- Cons: Premiums may be higher compared to other providers without discounts.

3. Progressive

Progressive is known for its innovative approach to insurance, offering a suite of tools that help consumers manage their policies effectively. Their Name Your Price tool lets policyholders tailor their coverage to suit their budgets, and their PIP offerings are as flexible as their other products.

- Pros: Flexible coverage options, numerous discounts, and strong online resources.

- Cons: Customer service experience can vary dramatically depending on location.

4. Allstate

Allstate offers a Balance® billing process for PIP claims, which simplifies claim processing and can lead to quicker payouts. They provide comprehensive guidelines and support to help policyholders understand and manage their PIP claims.

- Pros: Comprehensive claims support, various policy discounts, and a proven track record of customer satisfaction.

- Cons: Somewhat higher premium rates.

5. USAA

USAA stands out for offering superior service to military members and their families. Its PIP coverage is a part of its suite of personalized services, ensuring that policyholders have access to all necessary resources in the event of an accident.

- Pros: Top-rated customer service, exclusive military-focused benefits, and competitive premiums.

- Cons: Coverage is limited to military personnel and their families, which restricts availability.

Making the Right Choice for Your PIP Coverage

Choosing the right car insurance company with PIP coverage involves more than just comparing prices. It’s about finding a provider that aligns with your financial situation and personal needs. Each of the top companies listed here offers unique advantages, whether it’s USAA’s tailored services for military families or Progressive’s budget-friendly options. It’s crucial to assess your personal circumstances, such as financial status, driving habits, and health coverage needs, when evaluating these options.

Additionally, leveraging online resources such as policy comparison tools and customer reviews can provide valuable insights into a company’s reliability and customer satisfaction.

Remember, while cost is a significant concern, the level of service, claims processing speed, and overall coverage are equally important in ensuring that your PIP insurance meets your expectations and requirements.

Your decision should also take into consideration the specific requirements of your state, especially if you reside in a no-fault state where PIP coverage is mandatory.

Making Informed Decisions on PIP Coverage

As we draw our exploration of the top five car insurance companies offering Personal Injury Protection (PIP) coverage in the United States to a close, it’s important to reflect on the core elements that guide this crucial decision. Throughout this blog post, we’ve navigated the complex landscape of insurance providers and their offerings, aiming to equip you with the knowledge needed to make informed choices about your coverage.

Understanding PIP Coverage

Initially, we delved into the fundamentals of PIP coverage, outlining its role and importance in safeguarding against significant financial consequences in the event of an automobile accident. Unlike standard liability insurance that covers damages to others, PIP directly supports you and your passengers. This means it plays a critical role in covering medical expenses, lost wages, and other essential costs associated with recovery, which can otherwise be financially burdensome.

The Selection Process: Key Considerations

Choosing the right PIP coverage involves multiple considerations, as highlighted in our overview of the top providers. Here are the key factors summarized for easy reference:

- Coverage Options: Each insurance company offers various levels of PIP coverage. We stressed the importance of evaluating these options in line with your personal needs and financial situation. Companies such as Provider A and Provider B were noted for their extensive and customizable plans.

- Financial Stability and Reputation: We underscored selecting insurers with proven track records of financial stability and customer satisfaction. Firms like Provider C demonstrate these qualities, enhancing trust and reliability in their offerings.

- Customer Service and Claims Process: The efficiency and responsiveness of an insurance company’s claims process were identified as fundamental to the customer experience. Providers such as Provider D excel in delivering exceptional service, facilitating smooth and stress-free claim resolutions.

- Cost and Discounts: Although price should not be the sole determinant, it remains a crucial aspect. We discussed ways to assess cost-effectiveness by examining deductible options and available discounts, as evidenced by providers like Provider E, who offer competitive pricing without sacrificing coverage quality.

- State Requirements and Individual Needs: Since PIP requirements vary across states, familiarizing yourself with specific regulations is essential. Additionally, assessing your individual needs, such as driving habits or medical coverage, ensures your policy aligns with your lifestyle and risk level.

Your Roadmap to Choosing the Right Insurer

With the factors identified, our detailed examination of each company’s PIP offerings showcased their strengths and unique attributes. The goal here is to synchronize your preferences and necessities with the insurer that best meets these criteria. Armed with a comprehensive understanding of PIP coverage and a clear roadmap of your priorities, you can proceed more confidently in selecting the insurer that ensures your peace of mind on the road.

A Call to Explore Further

As you consider your next steps, we encourage you to engage actively with the resources and options available. This knowledge is power – it empowers you to ask the right questions, rigorously compare plans, and ultimately secure an insurance solution that optimally protects your interests.

Here’s what you can do to continue this journey:

- Schedule Consultations: Reach out to representatives from the insurance companies reviewed in this post. Inquire about specific scenarios relevant to you, and request detailed explanations of their PIP policies.

- Utilize Online Tools: Explore online calculators and comparison tools to visualize coverage costs and benefits effectively. This technology enables you to conduct a side-by-side comparison in real-time, helping identify value-driven options.

- Seek Professional Advice: Consider consulting with an insurance advisor or agent who can provide personalized guidance tailored to your circumstances. Their expertise can be instrumental in clarifying complex policy language and aligning coverage with your existing financial planning.

- Review Regularly: Commit to evaluating your insurance needs periodically, particularly after significant life events such as purchasing a new vehicle or relocating. Continuous review ensures your policy remains relevant and cost-efficient.

We hope this blog post has enriched your understanding of Personal Injury Protection and inspired you to take proactive measures in safeguarding your automotive journey. Delve deeper into each company, reflect on your circumstances, and let the insights gained here guide you towards optimal protection and peace of mind.

Get Involved in the Discussion

Your experience and insights are invaluable. Share your thoughts: what factors do you consider most important when choosing PIP coverage? How has your personal experience shaped your insurance decisions? Join the conversation in the comments below or connect with us on our social media platforms. Together, we can foster a community dedicated to informed, effective decision-making in the realm of car insurance.

Thank you for embarking on this exploration with us. Drive safely, insured, and informed!

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology