Capital Investment Definition A Guide to Business Growth

Capital investment definition refers to the acquisition of long-term assets, such as property, plant, and equipment, with the expectation of generating future returns. It is a crucial aspect of business growth and profitability, as it enables companies to expand their operations, enhance efficiency, and introduce new products or services.

Understanding capital investment is essential for any business owner, investor, or financial analyst. It involves a careful assessment of potential projects, considering factors like costs, risks, and potential returns. This guide delves into the intricacies of capital investment, exploring its different types, importance, decision-making processes, sources of funding, and management strategies.

Definition of Capital Investment

Capital investment refers to the funds that a business allocates to acquire or upgrade long-term assets, such as property, plant, and equipment (PP&E). These investments are intended to increase the business’s productive capacity, improve efficiency, or expand into new markets.

Characteristics of Capital Investment

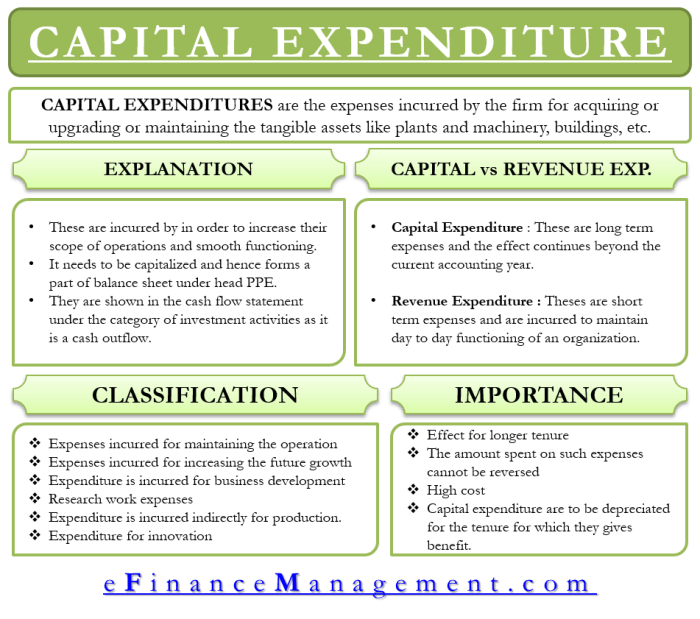

Capital investments are characterized by several key features that distinguish them from other types of expenditures:

- Long-Term Nature: Capital investments typically involve assets with a useful life of more than one year, providing benefits over an extended period.

- Significant Cost: Capital investments often represent substantial financial outlays for businesses, requiring careful planning and analysis.

- Strategic Importance: Capital investments are often linked to the strategic goals and objectives of a business, aiming to enhance its competitiveness or market position.

- Irreversible Nature: Once a capital investment is made, it is difficult or costly to reverse, highlighting the importance of thorough due diligence.

Distinguishing Capital Investment from Other Investments

It’s crucial to differentiate capital investment from other types of investments to ensure proper financial management and decision-making.

Operating Expenses

Operating expenses are the ongoing costs associated with the day-to-day operations of a business, such as salaries, rent, and utilities. Unlike capital investments, operating expenses are consumed within a single accounting period and do not result in the acquisition of long-term assets.

Financial Investments

Financial investments involve the purchase of securities, such as stocks, bonds, or mutual funds, with the aim of generating returns. While financial investments can be strategic, they differ from capital investments in that they do not directly contribute to the acquisition or improvement of physical assets used in the business’s operations.

Capital investment is the lifeblood of a business, driving growth, efficiency, and innovation. Understanding its characteristics and distinguishing it from other investment types is essential for making informed financial decisions.

Types of Capital Investment

Capital investments can be broadly categorized into different types based on their nature, purpose, and impact on a business. Understanding these classifications helps businesses make informed decisions about allocating their resources effectively.

Tangible vs. Intangible Capital Investment, Capital investment definition

Tangible and intangible investments represent distinct categories of capital expenditure, each with its unique characteristics and implications for a business.

- Tangible Capital Investment: This type of investment involves the acquisition of physical assets that can be touched and seen. These assets are typically long-lived, such as buildings, machinery, equipment, and vehicles. Tangible investments contribute to the physical infrastructure of a business and enhance its production capacity or operational efficiency.

- Intangible Capital Investment: Intangible investments, on the other hand, involve the acquisition of assets that lack physical form but hold significant value for a business. These assets include intellectual property, such as patents, trademarks, and copyrights, as well as software, databases, and brand reputation. Intangible investments can provide a competitive edge, enhance innovation, and drive long-term growth.

Expansion vs. Replacement Capital Investment

Capital investments can also be categorized based on their purpose, whether they are intended to expand the business or replace existing assets.

- Expansion Capital Investment: This type of investment aims to increase the scale of operations, production capacity, or market reach of a business. Examples include building new factories, acquiring additional equipment, or expanding into new markets. Expansion investments are driven by a desire to capitalize on growth opportunities, increase market share, or diversify product offerings.

- Replacement Capital Investment: Replacement investments are made to replace existing assets that have reached the end of their useful life or are no longer meeting the needs of the business. These investments are crucial for maintaining operational efficiency, ensuring safety, and preventing costly downtime. Examples include replacing outdated machinery, upgrading aging infrastructure, or replacing worn-out vehicles.

Other Types of Capital Investment

In addition to tangible vs. intangible and expansion vs. replacement, there are other types of capital investments that businesses may consider:

- Maintenance Capital Investment: These investments are made to maintain the existing assets of a business and ensure their continued functionality. They may involve regular repairs, preventive maintenance, or minor upgrades to existing equipment or infrastructure. These investments are essential for extending the lifespan of assets, reducing operational costs, and minimizing downtime.

- Growth Capital Investment: This type of investment focuses on supporting the long-term growth of a business. It may involve investments in research and development, new product development, or marketing initiatives. Growth capital investments aim to create new revenue streams, expand market share, or enhance the competitive position of the business.

- Strategic Capital Investment: Strategic investments are made to acquire or develop assets that align with the overall business strategy and long-term objectives. These investments may involve mergers and acquisitions, joint ventures, or the development of new technologies or capabilities. Strategic investments are often made to gain access to new markets, enhance competitive advantage, or create new opportunities for growth.

Capital Investment Decision-Making

The decision to invest in a capital project is a crucial one for any business. It requires careful planning, analysis, and consideration of various factors. This section delves into the key steps involved in the capital investment decision-making process, the methods used to evaluate these projects, and the factors that influence these decisions.

Key Steps in Capital Investment Decision-Making

The capital investment decision-making process is a systematic approach to evaluating and selecting the best investment opportunities. The process typically involves the following key steps:

- Generating Investment Ideas: The process begins with identifying potential investment opportunities. This may involve brainstorming, market research, or analyzing industry trends.

- Analyzing Investment Proposals: Once potential investment ideas are identified, they are analyzed in detail. This includes gathering information about the project, estimating its costs and benefits, and assessing its risks.

- Evaluating Investment Proposals: This step involves using various financial evaluation techniques to assess the profitability and attractiveness of each investment proposal.

- Planning and Budgeting: After evaluating the proposals, the company needs to plan and budget for the selected projects. This includes determining the project’s timeline, allocating resources, and securing funding.

- Monitoring and Controlling: Once the project is underway, it’s crucial to monitor its progress and control its costs. This helps ensure the project stays on track and meets its objectives.

- Post-Audit: After the project is completed, a post-audit is conducted to evaluate its actual performance against the initial expectations. This helps identify areas for improvement in future investment decisions.

Methods for Evaluating Capital Investment Projects

Several methods are used to evaluate capital investment projects, each with its strengths and weaknesses. Here are some of the most commonly used methods:

Net Present Value (NPV)

The Net Present Value (NPV) method is a widely used technique that calculates the present value of all future cash flows generated by a project, discounted at a specific rate. This rate is typically the company’s cost of capital.

NPV = Present Value of Cash Inflows – Present Value of Cash Outflows

If the NPV is positive, it indicates that the project is expected to generate more value than it costs and is therefore considered a good investment. If the NPV is negative, it suggests that the project is not expected to generate enough value to cover its costs and should be rejected.

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is another popular method that calculates the discount rate at which the NPV of a project equals zero. In other words, it represents the project’s expected rate of return.

IRR = Discount Rate at which NPV = 0

If the IRR is higher than the company’s cost of capital, the project is considered a good investment. If the IRR is lower than the cost of capital, the project should be rejected.

Payback Period

The Payback Period is a simple method that calculates the time it takes for a project to recover its initial investment. It is a useful measure for assessing the liquidity of a project.

Payback Period = Initial Investment / Annual Cash Inflow

A shorter payback period is generally preferred, as it means the investment will be recouped faster.

Profitability Index (PI)

The Profitability Index (PI) is a measure of the profitability of a project relative to its initial investment. It is calculated by dividing the present value of future cash inflows by the initial investment.

PI = Present Value of Cash Inflows / Initial Investment

A PI greater than 1 indicates that the project is expected to be profitable, while a PI less than 1 suggests it is not.

Accounting Rate of Return (ARR)

The Accounting Rate of Return (ARR) is a measure of the project’s average annual profit as a percentage of the initial investment.

ARR = Average Annual Profit / Initial Investment

The ARR is a simple measure to calculate but can be misleading as it does not consider the time value of money.

Factors Influencing Capital Investment Decisions

The decision to invest in a capital project is influenced by various factors, both internal and external to the company. Some of the key factors include:

Internal Factors

- Company’s Financial Position: The company’s financial resources, debt levels, and profitability play a significant role in investment decisions.

- Company’s Strategy: The project must align with the company’s overall strategic goals and objectives.

- Management’s Risk Appetite: Different companies have different levels of risk tolerance. Some companies are more willing to take on risky projects, while others prefer more conservative investments.

- Availability of Resources: The company must have the necessary resources, such as skilled labor, equipment, and materials, to undertake the project.

External Factors

- Economic Conditions: Factors such as interest rates, inflation, and economic growth can impact the attractiveness of capital projects.

- Industry Trends: The industry’s growth prospects, competition, and technological advancements can influence investment decisions.

- Government Regulations: Regulations, taxes, and subsidies can impact the profitability of capital projects.

- Social and Environmental Factors: Companies are increasingly considering the social and environmental impact of their investments.

Capital investment is not simply about spending money; it’s about strategic allocation of resources to fuel long-term growth and success. By carefully evaluating investment opportunities, understanding the nuances of decision-making, and implementing effective management strategies, businesses can leverage capital investment to unlock their full potential and navigate the ever-evolving economic landscape.

Question Bank: Capital Investment Definition

What are some examples of capital investment?

Examples include purchasing new machinery, constructing a new factory, acquiring a company, or investing in research and development.

How does capital investment differ from operating expenses?

Operating expenses are incurred in the day-to-day operations of a business, while capital investment refers to long-term assets that will be used for multiple periods.

What are the risks associated with capital investment?

Risks include project failure, technological obsolescence, changes in market demand, and economic downturns.

What are some common methods for evaluating capital investment projects?

Common methods include net present value (NPV), internal rate of return (IRR), and payback period.

Capital investment refers to the money spent on acquiring assets that are expected to generate future income or benefits. This can include a wide range of assets, from physical property like buildings and machinery to intangible assets like patents and trademarks. When considering capital investment, it’s important to research potential opportunities, like investment properties in NJ , to determine if they align with your investment goals and risk tolerance.

Ultimately, a wise capital investment strategy should balance short-term gains with long-term sustainability and growth.

Capital investment refers to the funds allocated to acquire assets that are expected to generate income or value over time. This can range from tangible assets like machinery and buildings to intangible assets like intellectual property. A prime example of a capital investment opportunity is in the real estate market, specifically in areas like orlando investment properties.

The growth and appeal of these markets offer potential for strong returns on investment, making them attractive to investors seeking long-term gains.

Capital investment, in its simplest form, is the money put into an asset with the expectation of future returns. One common area where this principle is applied is in property development investment , where investors allocate funds to create or improve real estate, anticipating appreciation and rental income. This form of capital investment offers a tangible asset with potential for long-term growth and passive income.