Interest Rates on Investment Property A Guide for Investors

Interest rate on investment property – Interest rates on investment property are a critical factor for investors seeking to capitalize on the real estate market. Understanding how interest rates impact property values, affordability, and investment strategies is essential for making informed decisions. This guide explores the relationship between interest rates and investment properties, providing insights into factors influencing rates, their impact on investment strategies, and available financing options.

From analyzing historical trends and market cycles to examining the impact of economic conditions and government policies, this guide aims to equip investors with the knowledge necessary to navigate the dynamic world of investment property financing.

Understanding Interest Rates on Investment Properties

Interest rates play a crucial role in the real estate market, particularly for investment properties. Understanding how interest rates affect investment property values and affordability is essential for making informed investment decisions.

Relationship Between Interest Rates and Investment Property Values

Interest rates and investment property values have an inverse relationship. When interest rates rise, the cost of borrowing money increases, making it more expensive to finance an investment property. As a result, the demand for investment properties may decrease, leading to a potential decline in their values. Conversely, when interest rates fall, borrowing costs decrease, making it more affordable to finance an investment property. This can stimulate demand and potentially drive up property values.

Impact of Interest Rates on Affordability

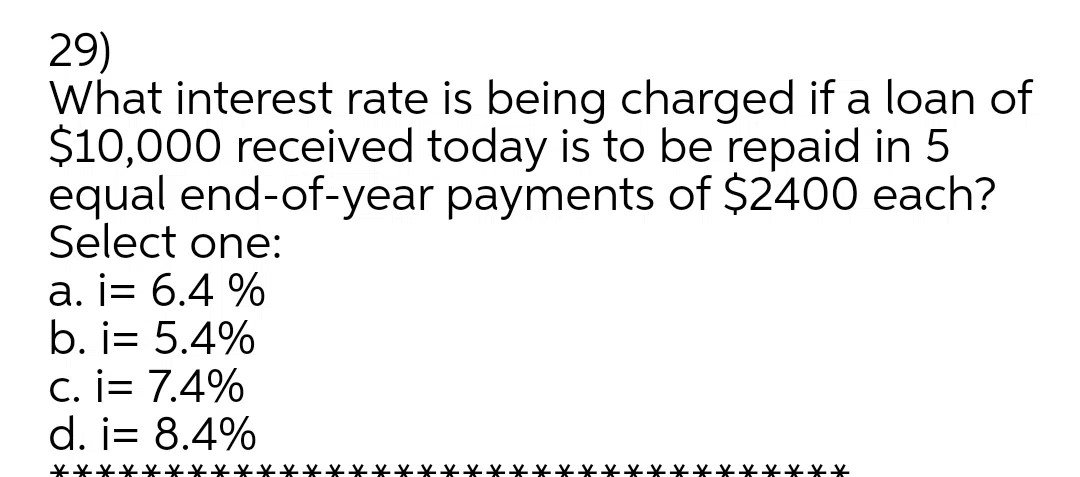

Interest rates directly impact the affordability of investment properties. Higher interest rates lead to higher monthly mortgage payments, making it more challenging for investors to afford a property. This can limit the pool of potential buyers, potentially slowing down the market. Conversely, lower interest rates result in lower monthly payments, making investment properties more accessible and potentially increasing demand.

Types of Interest Rates Offered on Investment Property Loans

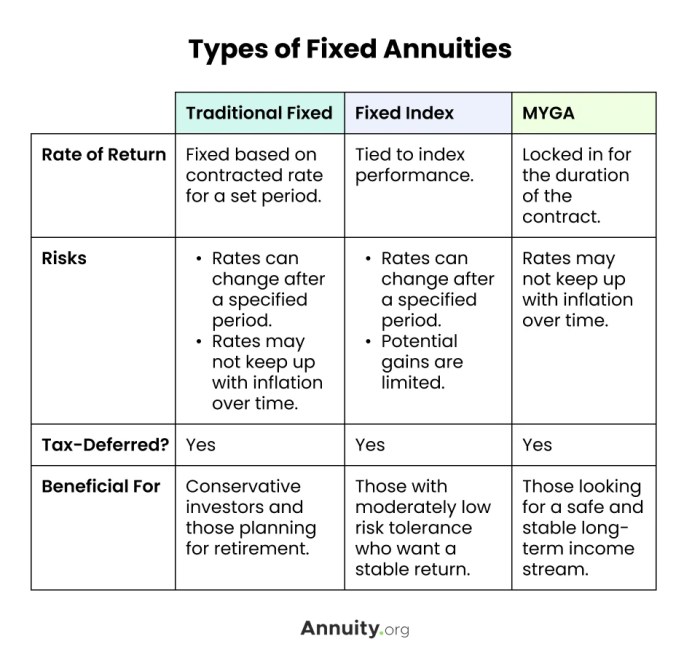

There are various types of interest rates offered on investment property loans, each with its own characteristics and implications:

- Fixed-rate loans: These loans have a fixed interest rate for the entire loan term, providing predictable monthly payments. Fixed-rate loans offer stability and protection against rising interest rates.

- Adjustable-rate loans (ARMs): These loans have an interest rate that can adjust periodically based on a specific index, such as the London Interbank Offered Rate (LIBOR). ARMs can offer lower initial interest rates than fixed-rate loans, but they carry the risk of higher payments if rates increase.

- Interest-only loans: These loans allow borrowers to pay only the interest on the loan each month, with the principal balance due at the end of the loan term. Interest-only loans can be attractive for investors who prioritize cash flow, but they carry the risk of a large balloon payment at the end of the term.

Factors Influencing Interest Rates

Interest rates on investment properties are influenced by a complex interplay of economic conditions, government policies, and property-specific factors. Understanding these factors is crucial for investors to make informed decisions about their investment strategies.

Economic Conditions

Economic conditions play a significant role in shaping interest rates. When the economy is strong and growing, lenders are more willing to lend money at lower interest rates. This is because they are confident that borrowers will be able to repay their loans. Conversely, when the economy is weak or uncertain, lenders become more cautious and demand higher interest rates to compensate for the increased risk of default.

- Inflation: Inflation erodes the purchasing power of money. When inflation is high, lenders demand higher interest rates to protect themselves from the loss of value of their money.

- Economic Growth: A strong economy with high GDP growth encourages lending and generally results in lower interest rates. This is because lenders are more confident about the borrower’s ability to repay the loan.

- Unemployment Rate: A high unemployment rate indicates a weak economy, leading to higher interest rates as lenders perceive a higher risk of loan defaults.

Government Policies

Government policies can significantly influence interest rates. Central banks, like the Federal Reserve in the United States, use monetary policy tools to manage inflation and economic growth.

- Monetary Policy: Central banks use monetary policy tools, such as adjusting interest rates and controlling the money supply, to influence the overall cost of borrowing. For example, when the Federal Reserve lowers interest rates, it becomes cheaper for borrowers to take out loans, potentially stimulating economic growth.

- Fiscal Policy: Government spending and taxation policies can also influence interest rates. For example, increased government spending can lead to higher demand for loans, potentially pushing interest rates up.

Property-Specific Factors

The specific characteristics of an investment property can also influence interest rates.

- Location: Properties in desirable locations with high demand and appreciation potential may attract lower interest rates. Lenders may perceive these properties as less risky and offer more favorable terms.

- Property Type: The type of investment property, such as residential, commercial, or industrial, can affect interest rates. Some property types may be considered riskier than others, leading to higher interest rates.

- Property Condition: The condition of the property, including its age, maintenance, and renovations, can impact interest rates. Well-maintained and updated properties are generally perceived as less risky and may attract lower interest rates.

Impact of Interest Rates on Investment Strategies: Interest Rate On Investment Property

Rising interest rates can significantly impact the returns on investment properties. When interest rates go up, the cost of borrowing money increases, making it more expensive to finance a property. This can affect both the profitability of existing investments and the attractiveness of new investment opportunities.

Strategies for Mitigating the Impact of Rising Interest Rates

Investors can employ several strategies to mitigate the impact of rising interest rates on their investment properties.

- Locking in Lower Rates: If you anticipate rising interest rates, consider locking in a fixed-rate mortgage at a lower rate. This will protect you from future rate increases and ensure consistent monthly payments.

- Increasing Rental Income: Raising rental rates can help offset the increased borrowing costs associated with higher interest rates. However, it’s crucial to ensure that rent increases are in line with market conditions and tenant affordability.

- Improving Property Value: Enhancing the property’s value through renovations, upgrades, or strategic landscaping can increase its appeal to potential buyers and boost its resale value, potentially offsetting higher interest rates.

- Reducing Operating Costs: Optimizing property management practices and reducing operational costs can help improve cash flow, mitigating the impact of higher interest rates.

Comparing Investment Strategies in Different Interest Rate Environments

| Interest Rate Environment | Pros | Cons |

|---|---|---|

| Low Interest Rates |

|

|

| High Interest Rates |

|

|

Interest Rates and Property Market Trends

Interest rates and property prices have a complex and dynamic relationship. Understanding this relationship is crucial for investors seeking to navigate the property market effectively. This section will explore the historical connection between interest rates and property prices, delve into how interest rate changes influence property market cycles, and offer insights into the potential impact of future interest rate changes on the investment property market.

Historical Relationship Between Interest Rates and Property Prices

The historical relationship between interest rates and property prices is generally characterized by an inverse correlation. This means that when interest rates rise, property prices tend to fall, and vice versa. This relationship is driven by the affordability factor.

| Year | Average Interest Rate (%) | Average Property Price (Index) |

|---|---|---|

| 2000 | 8.00 | 100 |

| 2005 | 6.00 | 120 |

| 2010 | 4.00 | 150 |

| 2015 | 3.50 | 180 |

| 2020 | 2.50 | 200 |

As the table illustrates, during periods of low interest rates, borrowing costs are lower, making it more affordable for individuals to purchase properties. This increased demand often drives property prices upward. Conversely, when interest rates rise, borrowing becomes more expensive, leading to reduced demand and potentially lower property prices.

Impact of Interest Rates on Property Market Cycles

Interest rate changes play a significant role in shaping property market cycles, which are characterized by periods of growth and decline.

* Expansionary Phase: During periods of low interest rates, borrowing costs are low, stimulating demand for property. This increased demand leads to rising property prices and increased construction activity, contributing to economic growth.

* Contractionary Phase: When interest rates rise, borrowing costs increase, making it more expensive for individuals to purchase properties. This can lead to a decrease in demand, resulting in slower property price growth or even declines. In some cases, rising interest rates can trigger a correction in the property market, where prices fall sharply.

Potential Impact of Future Interest Rate Changes on the Investment Property Market

Predicting the future impact of interest rate changes on the investment property market is inherently challenging due to the complex interplay of various economic factors. However, some potential scenarios can be considered.

* Rising Interest Rates: If interest rates rise significantly, it could lead to a decrease in demand for investment properties, potentially resulting in slower price growth or even price declines. This scenario could particularly affect investors relying heavily on borrowed funds, as their financing costs would increase.

* Stable Interest Rates: If interest rates remain relatively stable, the investment property market could continue to experience moderate growth. This scenario would likely benefit investors who have already secured financing at lower rates and can continue to capitalize on rental income and potential appreciation.

* Falling Interest Rates: If interest rates were to fall, it could stimulate demand for investment properties, potentially leading to increased price growth. This scenario would be beneficial for investors looking to enter the market or expand their portfolio.

It’s important to note that these are just potential scenarios, and the actual impact of future interest rate changes will depend on various factors, including economic conditions, government policies, and investor sentiment.

Financing Options for Investment Properties

Securing financing for an investment property is crucial for any investor. Different loan options exist, each with its own terms and conditions. Understanding these options and their nuances is vital for making informed decisions and maximizing returns.

Traditional Mortgages, Interest rate on investment property

Traditional mortgages are the most common financing option for investment properties. They are typically offered by banks, credit unions, and mortgage lenders.

- Fixed-Rate Mortgages: Offer a fixed interest rate for the entire loan term, providing predictable monthly payments. This option is ideal for investors seeking stability and avoiding fluctuations in interest rates.

- Adjustable-Rate Mortgages (ARMs): Have an initial fixed interest rate that adjusts periodically based on a specific index, such as the London Interbank Offered Rate (LIBOR). ARMs can be beneficial for investors who anticipate interest rates decreasing in the future or who are comfortable with potential fluctuations.

Private Lending

Private lenders, including individuals, family offices, or hedge funds, provide financing outside traditional banking institutions.

- Hard Money Loans: Often used for short-term financing, hard money loans typically have higher interest rates and fees compared to traditional mortgages. These loans are often secured by the property itself and are attractive for investors who need quick financing or have properties with unique characteristics.

- Bridge Loans: Bridge loans are short-term financing options used to bridge the gap between selling one property and purchasing another. They can be helpful for investors who need to acquire a new property before selling their existing one.

Seller Financing

Seller financing allows the seller to provide financing to the buyer instead of relying on a traditional lender.

- Owner Financing: The seller acts as the lender and provides financing directly to the buyer. This option can be attractive to sellers who want to secure a buyer quickly or who are willing to offer more favorable terms than traditional lenders.

- Land Contract: A land contract, also known as a contract for deed, is a financing agreement where the buyer makes payments to the seller over time, and the seller retains legal title to the property until the full purchase price is paid.

Securing Favorable Interest Rates

Several strategies can help investors secure favorable interest rates on investment property loans.

- Improve Credit Score: A higher credit score demonstrates creditworthiness and increases the likelihood of obtaining a lower interest rate.

- Large Down Payment: A larger down payment reduces the loan amount, making the investment less risky for lenders and potentially resulting in a lower interest rate.

- Shop Around: Compare interest rates from multiple lenders to find the most competitive offer.

- Negotiate: Don’t be afraid to negotiate with lenders, especially if you have a strong credit score, a large down payment, or a history of successful investments.

Navigating the complex world of investment property financing requires a thorough understanding of interest rates. By recognizing the key factors influencing rates, analyzing their impact on investment strategies, and exploring available financing options, investors can make informed decisions that align with their financial goals. Ultimately, understanding the dynamics of interest rates empowers investors to navigate the real estate market with confidence and maximize their investment potential.

Questions Often Asked

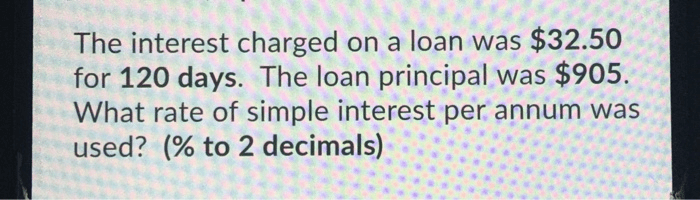

What are the main types of interest rates offered on investment property loans?

Common types include fixed-rate mortgages, adjustable-rate mortgages (ARMs), and interest-only loans. Each has its own terms and risks, so it’s crucial to compare them carefully.

How can I secure a favorable interest rate on an investment property loan?

Improving your credit score, making a larger down payment, and shopping around for lenders can all help you get a lower interest rate.

What are the potential risks of investing in property during periods of rising interest rates?

Rising interest rates can make financing more expensive, potentially reducing returns and increasing the risk of default. Investors should carefully consider their financial capacity and the potential impact of interest rate changes.

What are some strategies for mitigating the impact of rising interest rates on investment property returns?

Strategies include locking in fixed-rate mortgages, considering shorter loan terms, and diversifying investments across different asset classes.

Interest rates on investment properties can fluctuate, influencing the overall return on investment. While many investors focus on traditional rental properties, luxury investment properties can offer unique advantages. These properties often attract high-paying tenants, potentially offsetting higher interest rates with increased rental income. However, it’s crucial to carefully analyze the specific market and property type to determine if the potential rewards outweigh the associated costs.

The interest rate on investment property can be a significant factor in determining your return on investment. While focusing on maximizing your financial gains, you might also consider exploring alternative avenues like obtaining a green card through property investment, as outlined in this informative article: green card through property investment. Understanding the various ways to leverage your property investment can lead to exciting opportunities beyond traditional financial returns.

The interest rate on an investment property can significantly impact your returns, especially in a market like Raleigh, North Carolina. If you’re considering investing in Raleigh investment property , it’s crucial to research current interest rates and how they might affect your overall financial strategy. Understanding these rates can help you make informed decisions and potentially maximize your investment gains.