Green Card Through Property Investment A Comprehensive Guide

Green Card through property investment offers a unique pathway to permanent residency in the United States. This approach leverages the EB-5 Investor Visa Program, which allows foreign nationals to secure a Green Card by investing in American businesses, often through real estate projects. The program, however, requires a significant investment, a commitment to job creation, and a thorough understanding of the legal and financial complexities involved.

This guide delves into the intricacies of the EB-5 program, providing insights into the eligibility criteria, investment options, financial requirements, and the potential risks and rewards associated with property investment. We will explore the process of navigating the program, from selecting the right property project to securing financing and fulfilling the necessary documentation requirements. We will also examine the economic impact of these investments, highlighting their role in job creation and community development.

EB-5 Investor Visa Program

The EB-5 Investor Visa Program is a United States immigration program that grants permanent residency (Green Card) to foreign investors who invest a significant amount of capital in a U.S. business and create a certain number of jobs for American workers. This program is designed to stimulate the U.S. economy by attracting foreign investment and creating jobs.

Eligibility Criteria for the EB-5 Investor Visa Program

To be eligible for the EB-5 Investor Visa Program, individuals must meet specific requirements, including:

- Invest a minimum amount of capital in a U.S. business.

- Create at least 10 full-time jobs for U.S. workers.

- Demonstrate that the investment is in a commercial enterprise.

- Prove that the investment is at risk.

- Meet certain financial and business experience requirements.

Requirements for Obtaining a Green Card Through Property Investment

The EB-5 Investor Visa Program allows individuals to obtain a Green Card through property investment by investing in a U.S. commercial real estate project. This investment must meet the following criteria:

- The property must be located in a designated Targeted Employment Area (TEA).

- The investment must be used to develop or renovate the property.

- The project must create at least 10 full-time jobs for U.S. workers.

Investment Options Available Within the EB-5 Program

The EB-5 Investor Visa Program offers several investment options for individuals seeking to obtain a Green Card through property investment. These options include:

- Regional Center Investments: This option allows investors to invest in a project within a designated Regional Center, which is a specific geographic area that has been approved by the U.S. Citizenship and Immigration Services (USCIS). Regional Centers are typically located in economically distressed areas, and they provide investors with a streamlined investment process and access to a wider range of projects.

- Direct Investments: This option allows investors to invest directly in a U.S. business, such as a commercial real estate project. Direct investments offer investors more control over their investment, but they also require more due diligence and a higher level of involvement.

Minimum Investment Amount Required for Property Investment

The minimum investment amount required for the EB-5 Investor Visa Program is $900,000 for investments in Targeted Employment Areas (TEAs). This amount is $1.8 million for investments in areas that are not designated as TEAs.

Step-by-Step Guide on the Application Process for the EB-5 Investor Visa Program

The application process for the EB-5 Investor Visa Program is complex and involves several steps. Here is a general Artikel of the process:

- Identify an Investment Opportunity: Investors must first identify a suitable investment opportunity that meets the EB-5 program requirements. This may involve working with an immigration attorney or a regional center to find a project.

- File an I-526 Petition: Once an investment opportunity is identified, investors must file an I-526 Petition with USCIS. This petition must demonstrate that the investor has met all the eligibility requirements for the EB-5 program.

- Receive Conditional Green Card: If the I-526 Petition is approved, the investor will receive a Conditional Green Card, which allows them to live and work in the United States for a period of two years.

- File an I-829 Petition: After two years, investors must file an I-829 Petition to remove the conditions on their Green Card. This petition must demonstrate that the investor has maintained their investment and created the required number of jobs.

- Receive Unconditional Green Card: If the I-829 Petition is approved, the investor will receive an Unconditional Green Card, which grants them permanent residency in the United States.

Documentation Required for the EB-5 Investor Visa Program Application

The documentation required for the EB-5 Investor Visa Program application can vary depending on the specific circumstances of the investor. However, some common documents include:

- Investment Plan: This document Artikels the investor’s investment strategy, including the details of the project, the amount of capital being invested, and the job creation plan.

- Financial Documents: These documents include bank statements, tax returns, and other financial records that demonstrate the investor’s ability to invest the required amount of capital.

- Business Plan: This document provides a detailed overview of the business being invested in, including its financial projections, market analysis, and management team.

- Job Creation Plan: This document Artikels how the investment will create the required number of jobs for U.S. workers.

- Legal Documents: These documents may include the investor’s passport, visa, and other relevant legal documents.

Benefits and Drawbacks of Obtaining a Green Card Through Property Investment

| Benefits | Drawbacks |

|---|---|

| Potential for significant returns on investment. | High investment amount. |

| Opportunity to live and work in the United States. | Complex and lengthy application process. |

| Access to U.S. healthcare and education systems. | Risk of investment loss. |

| Path to U.S. citizenship. | Uncertainty surrounding job creation requirements. |

Financial Requirements

The EB-5 program mandates that investors demonstrate a legitimate source of funds for their investment. This means that the funds used for the investment must be acquired through legal means and can be traced back to their origin. You must provide detailed documentation that supports your claims about your finances.

Demonstrating Financial Capability

To prove your financial capability, you must submit comprehensive documentation that Artikels the source of your funds and their legal origin. This documentation can include bank statements, tax returns, business records, and other relevant financial documents. The U.S. Citizenship and Immigration Services (USCIS) will carefully review these documents to determine if your funds are legally obtained and sufficient for the EB-5 investment.

Breakdown of Expenses, Green card through property investment

The EB-5 investment involves several expenses beyond the initial investment amount. These expenses include:

- Investment Capital: This is the primary investment amount, typically $800,000 for a Targeted Employment Area (TEA) project or $1.05 million for a non-TEA project.

- Administrative Fees: These fees cover the costs associated with processing the EB-5 application and managing the investment project. These fees can range from $10,000 to $20,000 or more, depending on the regional center and the project.

- Legal Fees: You will need legal representation to navigate the complex EB-5 process. Legal fees can vary depending on the complexity of the case and the experience of the attorney.

- Due Diligence Costs: You may incur costs for conducting due diligence on the investment project to ensure its viability and credibility. This may involve independent research, financial audits, and other assessments.

- Travel Expenses: If you need to travel to the United States for interviews or other purposes related to the EB-5 process, you will have to cover these expenses.

- Living Expenses: You may need to cover living expenses while in the United States during the application process and before receiving your Green Card.

Role of Financial Advisors and Legal Counsel

Financial advisors and legal counsel play a crucial role in managing your EB-5 investment funds. Financial advisors can help you understand the risks and rewards of the investment, develop a sound financial plan, and manage your investments. Legal counsel can guide you through the complex legal process of obtaining an EB-5 visa, ensuring compliance with all regulations, and protecting your interests.

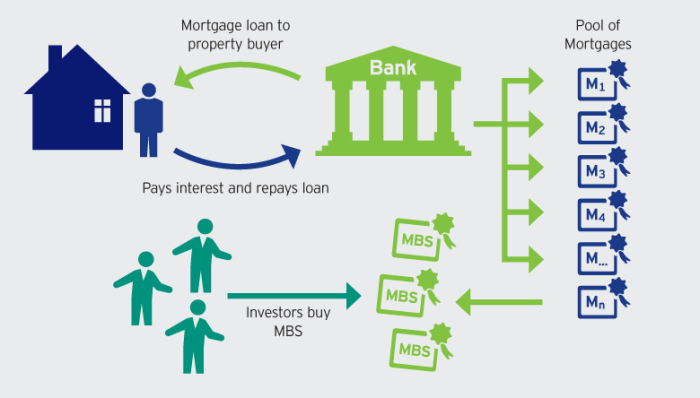

Securing Financing for Property Investment Projects

Securing financing for property investment projects can be a complex process, requiring a solid business plan and a strong financial track record. You may need to approach various lenders, including banks, private investors, and specialized EB-5 lenders, to obtain the necessary funds. It’s important to shop around for the best financing options and to secure a loan with favorable terms.

Financial Documents Checklist

To ensure a smooth application process, you should compile the following financial documents:

- Bank Statements: Provide at least two years of bank statements, showing the source of funds and their movement.

- Tax Returns: Submit personal or business tax returns for the past two to three years, depending on the requirements.

- Business Records: If you are a business owner, provide business records, including income statements, balance sheets, and profit and loss statements.

- Investment Documents: Include any documents related to your investments, such as stock certificates, bond certificates, or real estate deeds.

- Financial Statements: Provide audited financial statements, if applicable.

- Letters of Explanation: Prepare letters explaining any unusual financial transactions or discrepancies in your financial records.

- Other Supporting Documents: Provide any other relevant documents that support your financial claims.

Legal and Regulatory Considerations

The EB-5 Investor Visa Program is a complex legal framework governed by a combination of federal laws, regulations, and agency guidance. Understanding these legal considerations is crucial for successful navigation of the program.

Regulations Governing Property Investment Projects

The U.S. Citizenship and Immigration Services (USCIS) issues specific regulations that govern the EB-5 program, including those related to property investment projects. These regulations Artikel the requirements for project eligibility, investment amounts, job creation, and other aspects of the program.

- Regional Centers: EB-5 property investments are often made through Regional Centers, designated entities that provide a structured framework for investment projects. Regional Centers must meet specific criteria and are subject to ongoing oversight by USCIS.

- Targeted Employment Areas (TEAs): Projects located in TEAs, areas with high unemployment rates, generally require a lower investment amount. These areas are designated by USCIS and are subject to change.

- Job Creation: The EB-5 program requires investors to create at least 10 full-time jobs for U.S. workers. For property investments, job creation is often calculated based on the project’s economic impact, including construction jobs, permanent employment opportunities, and indirect job creation through the project’s economic activity.

- Project Feasibility: USCIS reviews the feasibility of proposed projects, including their financial viability, market demand, and potential for job creation. Investors and Regional Centers must provide comprehensive documentation to demonstrate the project’s viability.

Role of Immigration Attorneys and Legal Counsel

Navigating the EB-5 program requires specialized legal expertise. Immigration attorneys with experience in the EB-5 program play a critical role in:

- Evaluating Project Eligibility: Attorneys assess the project’s compliance with EB-5 regulations, including job creation requirements, investment amounts, and project feasibility.

- Preparing and Filing Petitions: Attorneys prepare and file the necessary petitions with USCIS, ensuring accurate and complete documentation.

- Navigating Regulatory Changes: The EB-5 program is subject to changes and updates. Experienced attorneys stay abreast of these changes and advise clients on their implications.

- Resolving Potential Issues: Attorneys can assist in resolving potential issues that may arise during the application process, such as requests for additional evidence or administrative delays.

Recent Changes and Updates to the EB-5 Program

The EB-5 program has undergone significant changes in recent years, including:

- Investment Amount Increase: In 2019, the minimum investment amount for EB-5 projects was increased from $500,000 to $900,000 for projects outside of TEAs and from $1 million to $1.8 million for projects in TEAs. This increase was aimed at attracting investments to rural areas and economically distressed communities.

- Focus on Rural Development: The program has placed an increased emphasis on rural development projects, with incentives for investments in designated rural areas.

- Increased Scrutiny: USCIS has increased its scrutiny of EB-5 projects, particularly those involving Regional Centers. This includes more rigorous review of project feasibility, job creation, and investor due diligence.

- Extension of Temporary Program: The EB-5 program was extended in 2021, but with several key changes. The program is now subject to an annual reauthorization process and faces ongoing uncertainty about its future.

Key Legal and Regulatory Requirements for Property Investment

| Requirement | Description |

|---|---|

| Investment Amount | Minimum investment of $900,000 for projects outside of TEAs and $1.8 million for projects in TEAs. |

| Job Creation | Creation of at least 10 full-time jobs for U.S. workers. |

| Project Feasibility | Demonstrated financial viability, market demand, and potential for job creation. |

| Regional Center Involvement | Projects are often structured through Regional Centers, which must meet specific criteria and be approved by USCIS. |

| Targeted Employment Areas (TEAs) | Projects located in TEAs may qualify for a lower investment amount. |

| Due Diligence | Investors must conduct thorough due diligence on the project and the Regional Center, including financial audits and legal reviews. |

| Compliance with Laws and Regulations | Projects must comply with all applicable federal, state, and local laws and regulations. |

Case Studies and Success Stories

The EB-5 program has a history of successful property investment projects, showcasing the potential for investors to achieve both financial returns and immigration benefits. These projects serve as valuable examples of how property investment can be a viable pathway to obtaining a Green Card.

Successful Property Investment Projects

Here are some notable examples of successful property investment projects under the EB-5 program:

- The Ritz-Carlton Residences, Fort Lauderdale: This luxury condominium project in Florida attracted EB-5 investors who contributed to the development of a prime waterfront property. The project generated significant economic activity, creating jobs and boosting local tourism. Investors who participated in this project successfully obtained their Green Cards.

- The Cosmopolitan Hotel and Casino in Las Vegas: This iconic Las Vegas property was partially financed through EB-5 investment. The project created numerous jobs in construction, hospitality, and entertainment, contributing to the economic growth of the city. EB-5 investors who contributed to this project received their Green Cards, illustrating the program’s potential to support large-scale developments.

Challenges and Strategies of Successful Investors

Successful EB-5 investors often face a number of challenges, including:

- Project Selection: Investors must carefully evaluate potential projects, considering factors such as the project’s viability, job creation potential, and the developer’s track record. They must also consider the risk associated with the project, as well as the potential for returns on investment. Successful investors often engage in thorough due diligence, consulting with experienced legal and financial advisors.

- Financial Management: Managing finances effectively is crucial for EB-5 investors. They must carefully budget their investment, including the cost of legal fees, processing fees, and other expenses. Successful investors often develop a comprehensive financial plan that Artikels their investment strategy and risk management approach.

- Navigating the Legal and Regulatory Framework: The EB-5 program is subject to complex legal and regulatory requirements. Successful investors must navigate these regulations effectively, ensuring compliance with all applicable laws and guidelines. They often work closely with immigration attorneys and other professionals to ensure their investment complies with the program’s rules.

Factors Contributing to Project Success

Several factors contribute to the success of EB-5 property investment projects:

- Strong Project Viability: Projects with a clear business plan, a proven track record of the developer, and a strong market demand are more likely to succeed. Investors should look for projects that demonstrate a solid financial foundation and a realistic path to profitability.

- Effective Job Creation: Projects that create a significant number of jobs, particularly in targeted employment areas (TEAs), are more likely to meet the program’s requirements. Investors should consider the project’s potential to generate jobs and its impact on the local economy.

- Experienced Developers: Working with reputable and experienced developers is crucial for EB-5 investors. Developers with a proven track record of successful projects are more likely to deliver on their promises and ensure the project’s success.

Case Studies: Demonstrating the Potential of Property Investment

| Project | Location | Investment Amount | Job Creation | Outcomes |

|—|—|—|—|—|

| The Ritz-Carlton Residences, Fort Lauderdale | Fort Lauderdale, Florida | $500,000+ | 100+ jobs | Green Cards issued to investors |

| The Cosmopolitan Hotel and Casino | Las Vegas, Nevada | $500,000+ | 500+ jobs | Green Cards issued to investors |

| The Trump International Hotel and Tower | Chicago, Illinois | $500,000+ | 200+ jobs | Green Cards issued to investors |

| The Fontainebleau Miami Beach | Miami Beach, Florida | $500,000+ | 300+ jobs | Green Cards issued to investors |

Securing a Green Card through property investment can be a complex and challenging journey, requiring careful planning, thorough due diligence, and expert guidance. However, for those seeking a path to permanent residency in the United States, this avenue offers a unique opportunity to invest in the American economy while building a future for themselves and their families. By understanding the intricacies of the EB-5 program, carefully evaluating investment options, and navigating the legal and regulatory landscape, individuals can increase their chances of success in this endeavor.

FAQ Insights: Green Card Through Property Investment

What are the minimum investment requirements for the EB-5 program?

The minimum investment amount for the EB-5 program varies depending on the location of the investment. In Targeted Employment Areas (TEAs), the minimum investment is $800,000. In non-TEA areas, the minimum investment is $1.8 million.

What are the job creation requirements for the EB-5 program?

Investors must create at least 10 full-time jobs for U.S. workers in the project they invest in. These jobs can be direct or indirect.

What are the benefits of obtaining a Green Card through property investment?

Benefits include permanent residency in the United States, the ability to work and live freely, access to U.S. healthcare and education, and the potential for financial returns on your investment.

What are the risks associated with property investment under the EB-5 program?

Risks include potential loss of investment, delays in the application process, and potential changes in immigration laws or regulations.

Obtaining a green card through property investment can be a complex process, requiring careful consideration of investment strategies and market trends. For insights into the world of investing, you might want to check out the Jim Cramer Investment Club , a popular resource for investment advice. While the club focuses on a broader range of investments, understanding the principles of successful investing can be valuable when navigating the intricacies of property investment for green card purposes.

Obtaining a green card through property investment can be a lucrative path to US residency, but it requires a significant financial commitment. If you’re looking for ways to boost your income before making such a large investment, consider exploring alternative avenues like how to earn money online without investment. These strategies can help you build a solid financial foundation, allowing you to pursue your green card aspirations with greater confidence.

Obtaining a green card through property investment can be a complex process, but it’s a path many explore. Understanding the nuances of real estate investments is crucial, and exploring careers in real estate investment trusts (REITs) can be a valuable learning experience. To gain insights into the world of REITs and if they offer a suitable career path, consider reading this informative article: is real estate investment trusts a good career path.

This knowledge can then be applied to your own property investment strategy, potentially leading to a successful green card application.

Securing a green card through property investment can be a compelling path to US residency, but it’s essential to understand the intricacies of the program. Before making any decisions, it’s wise to explore the investment opportunities near me and assess if they align with your financial goals and the requirements of the EB-5 visa program. This will help you make an informed choice about whether property investment is the right strategy for your green card journey.

Obtaining a green card through property investment can be a complex process, requiring significant capital and careful planning. While real estate can be a lucrative investment, it’s important to consider other options like annuities, which can provide a steady stream of income. To learn more about whether annuities are a good investment for you, check out this article: are annuities a good investment.

Ultimately, the best strategy for acquiring a green card through property investment will depend on your individual financial situation and goals.