Start a Property Investment Company A Step-by-Step Guide

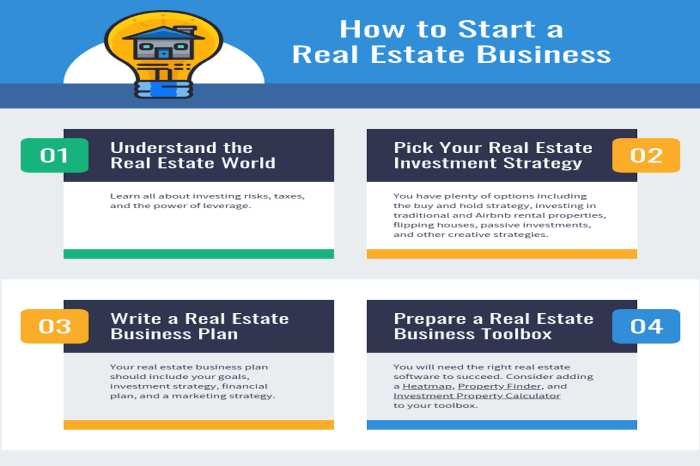

How to start a property investment company is a question that sparks the interest of many aspiring entrepreneurs. The world of real estate offers a unique blend of tangible assets and potential for significant returns, making it an attractive avenue for building wealth and securing financial independence. But navigating the complexities of this industry requires careful planning, thorough research, and a well-defined strategy.

This guide provides a comprehensive overview of the key steps involved in establishing and managing a successful property investment company. From understanding the different types of property investments to navigating the legal requirements and financial aspects, we will delve into each stage of the journey, equipping you with the knowledge and insights needed to embark on this exciting venture.

Understanding the Property Investment Landscape

The property investment landscape encompasses various avenues for generating returns, each with its own set of characteristics, advantages, and risks. Understanding the nuances of each type of property investment is crucial for making informed decisions that align with your financial goals and risk tolerance.

Types of Property Investments

The property investment landscape offers diverse avenues for generating returns. These can be broadly categorized as follows:

- Residential Properties: This category includes single-family homes, townhouses, condominiums, and multi-family dwellings. These properties are primarily intended for habitation and can offer rental income, appreciation potential, and tax advantages.

- Commercial Properties: This category encompasses office buildings, retail spaces, hotels, and industrial facilities. These properties are designed for commercial use and can provide rental income, appreciation potential, and long-term lease agreements.

- Industrial Properties: This category includes warehouses, factories, distribution centers, and other properties used for manufacturing, storage, and logistics. These properties offer the potential for high rental income, appreciation potential, and long-term leases, but they can also carry higher risks and require specialized knowledge.

- Land: This category includes undeveloped land, vacant lots, and agricultural land. Investing in land can offer appreciation potential, but it typically involves long-term holding periods and may not generate immediate income.

- Real Estate Investment Trusts (REITs): These are publicly traded companies that own and operate income-producing real estate. REITs offer investors the opportunity to diversify their real estate portfolio and gain exposure to various property types without the direct management responsibilities.

Advantages and Disadvantages of Different Property Investment Types

Each type of property investment comes with its own set of advantages and disadvantages, which investors should carefully consider before making any decisions:

| Type of Property Investment | Advantages | Disadvantages |

|---|---|---|

| Residential Properties |

|

|

| Commercial Properties |

|

|

| Industrial Properties |

|

|

| Land |

|

|

| REITs |

|

|

Key Factors to Consider When Choosing a Property Investment Strategy

Choosing the right property investment strategy involves considering various factors that align with your individual goals and risk tolerance:

- Financial Resources: Assess your available capital, debt capacity, and cash flow projections. Consider your ability to manage potential expenses, such as mortgage payments, property taxes, and maintenance costs.

- Investment Goals: Define your investment objectives, whether it’s generating passive income, capital appreciation, or tax advantages. Your goals will influence the type of property, location, and investment strategy you pursue.

- Risk Tolerance: Evaluate your comfort level with risk. Different property investments carry varying levels of risk, from the relative stability of residential rentals to the higher volatility of commercial properties.

- Time Horizon: Consider your investment timeframe. Some property investments, such as land, require a long-term horizon, while others, such as short-term rentals, offer faster returns.

- Market Conditions: Analyze the current and projected real estate market conditions in your target area. Factors such as supply and demand, economic growth, and interest rates can significantly impact property values and rental income.

- Location: Choose a location with strong demographics, a growing economy, and desirable amenities. Location is a key driver of property value and rental demand.

- Property Type: Consider the specific type of property that aligns with your goals, risk tolerance, and financial resources. Each type of property has its own advantages and disadvantages, as discussed earlier.

Comparing Risks and Rewards of Different Property Investment Strategies, How to start a property investment company

Different property investment strategies offer varying levels of risk and reward. Understanding these dynamics is crucial for making informed decisions:

- Buy-and-Hold Strategy: This involves purchasing a property and holding it for an extended period, typically with the goal of generating rental income and capital appreciation. It generally carries lower risk than short-term strategies but requires a longer time horizon. The risk is associated with potential market downturns and tenant issues, while the reward is long-term appreciation and passive income.

- Fix-and-Flip Strategy: This involves purchasing a property, renovating it, and selling it for a profit. It carries higher risk due to the uncertainties of renovation costs and market conditions, but it also offers the potential for higher returns. The risk is associated with unexpected renovation costs and a declining market, while the reward is the potential for a quick and substantial profit.

- Short-Term Rentals: This involves renting out a property for short periods, typically through platforms like Airbnb or VRBO. It offers the potential for higher rental income but also carries higher risk due to increased tenant turnover and regulatory challenges. The risk is associated with high tenant turnover, regulatory changes, and seasonal fluctuations, while the reward is the potential for high rental income.

- Commercial Real Estate Investment: This involves investing in properties for commercial use, such as office buildings, retail spaces, and industrial facilities. It typically requires a higher initial investment but can offer higher potential returns. The risk is associated with longer lease terms, vacancy rates, and economic downturns, while the reward is the potential for high rental income and appreciation.

- Real Estate Investment Trusts (REITs): This involves investing in publicly traded companies that own and operate income-producing real estate. REITs offer investors the opportunity to diversify their real estate portfolio and gain exposure to various property types without the direct management responsibilities. The risk is associated with the performance of the REIT and the overall real estate market, while the reward is the potential for dividends and capital appreciation.

Setting Up Your Property Investment Company

Setting up a property investment company requires careful planning and adherence to legal requirements. You’ll need to determine the legal structure, create a business plan, and establish a strong foundation for your company’s operations.

Legal Requirements for Establishing a Property Investment Company

The legal requirements for establishing a property investment company vary depending on your location and the type of company you want to set up. However, some common requirements include:

* Choosing a Legal Structure: You need to decide on the legal structure of your company. Common options include sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has its own advantages and disadvantages in terms of liability, taxation, and administrative burden.

* Registering Your Company: You’ll need to register your company with the relevant authorities. This typically involves filing articles of incorporation or similar documents and obtaining a business license.

* Complying with Regulatory Requirements: You’ll need to comply with various regulatory requirements, such as obtaining permits and licenses for specific types of property investments, adhering to zoning laws, and complying with environmental regulations.

* Obtaining Financing: You’ll need to secure funding to acquire properties, cover operating expenses, and manage your investments. This can be done through personal savings, loans, or attracting investors.

* Hiring Professionals: It’s advisable to hire professionals such as lawyers, accountants, and property managers to ensure compliance with legal and financial requirements.

Developing a Business Plan for Your Property Investment Company

A well-structured business plan is crucial for the success of your property investment company. It serves as a roadmap for your operations, outlining your goals, strategies, and financial projections.

* Executive Summary: This section provides a concise overview of your company, its mission, and key objectives.

* Company Description: This section details your company’s structure, ownership, and management team. It also describes your target market, investment strategy, and value proposition.

* Market Analysis: This section analyzes the current and projected state of the property market in your target area. It identifies trends, opportunities, and potential risks.

* Products and Services: This section describes the types of properties you intend to invest in and the services you will offer to clients.

* Marketing and Sales Strategy: This section Artikels your plan for attracting investors and clients. It may include strategies such as online marketing, networking, and building relationships with real estate professionals.

* Financial Projections: This section includes detailed financial statements such as income statements, balance sheets, and cash flow statements. It also projects your company’s financial performance over a specific period.

* Management Team: This section introduces your company’s management team, outlining their experience, expertise, and roles.

* Appendix: This section contains supporting documents such as resumes, market research reports, and legal documents.

Organizing the Structure of Your Property Investment Company

The structure of your company will determine how it is owned, managed, and governed.

* Ownership: This refers to the individuals or entities that hold ownership stakes in your company. You need to decide on the ownership structure and the percentage of ownership each individual or entity will hold.

* Management: This refers to the individuals responsible for day-to-day operations of your company. You need to define the roles and responsibilities of the management team and establish clear lines of authority.

* Governance: This refers to the framework for making decisions and ensuring accountability within your company. It involves establishing a board of directors or other governing bodies, defining their responsibilities, and setting up a system for reporting and oversight.

Creating a Marketing Plan to Attract Investors and Clients

A comprehensive marketing plan is essential for attracting investors and clients to your property investment company.

* Target Audience: You need to identify your target audience, which includes potential investors and clients. Consider their demographics, investment goals, and risk tolerance.

* Marketing Channels: You need to choose the most effective marketing channels to reach your target audience. These may include online marketing, social media, networking events, and direct marketing.

* Marketing Message: You need to craft a clear and compelling marketing message that highlights the benefits of investing with your company. This message should focus on your experience, track record, investment strategy, and value proposition.

* Branding and Identity: You need to develop a strong brand identity that reflects your company’s values and differentiates you from competitors. This includes creating a logo, website, and marketing materials that are consistent with your brand.

* Public Relations: You can leverage public relations strategies to build credibility and generate positive media coverage for your company. This may involve issuing press releases, participating in industry events, and engaging with journalists.

Finding and Acquiring Properties

The heart of any property investment company lies in finding and acquiring profitable properties. This involves a strategic approach to sourcing opportunities, meticulously assessing their potential, and securing them at the best possible price.

Sourcing Profitable Property Investment Opportunities

Identifying profitable property investment opportunities requires a multi-pronged approach.

- Networking: Building relationships with real estate agents, property developers, and other investors can provide access to off-market deals and early information about upcoming projects.

- Online Marketplaces: Platforms like Zillow, Realtor.com, and Redfin offer a vast database of properties for sale, allowing you to filter by location, price range, and property type.

- Auctions and Foreclosures: Participating in property auctions or exploring foreclosed properties can present opportunities to acquire properties at discounted prices.

- Direct Marketing: Targeting specific neighborhoods or property types through direct mail campaigns, online advertising, or door-to-door canvassing can generate leads from potential sellers.

Conducting Due Diligence on Potential Properties

Once you’ve identified potential properties, conducting thorough due diligence is crucial to ensure their viability and avoid costly mistakes.

- Property Inspection: A comprehensive inspection by a qualified professional can reveal any hidden issues, such as structural problems, plumbing defects, or electrical hazards.

- Market Analysis: Understanding the local real estate market, including current property values, rental rates, and vacancy rates, is essential for assessing the property’s potential return on investment.

- Financial Review: Analyzing the property’s financial statements, including income and expenses, can help determine its profitability and cash flow.

- Legal Review: A legal professional should review all relevant documents, such as the title deed, zoning regulations, and environmental reports, to ensure there are no legal encumbrances or liabilities associated with the property.

Financing Options for Property Investments

Securing financing is often a critical aspect of property investment.

- Traditional Mortgages: Banks and mortgage lenders offer various mortgage options, including conventional loans, FHA loans, and VA loans, with varying interest rates and down payment requirements.

- Private Lenders: Private investors and lending institutions may provide financing for investment properties, often with more flexible terms and higher interest rates than traditional mortgages.

- Hard Money Loans: Short-term loans, typically used for quick property acquisitions or renovations, often come with higher interest rates and fees but offer faster approval times.

- Seller Financing: In some cases, the seller may be willing to provide financing for the property, often with more flexible terms and lower interest rates than traditional loans.

Negotiating the Best Price for Properties

Negotiating the best price for a property requires a combination of research, preparation, and negotiation skills.

- Market Research: Understanding the current market conditions, comparable properties, and recent sales data provides a solid foundation for your negotiation strategy.

- Presenting a Strong Offer: A well-prepared offer that demonstrates your serious intent and financial capabilities can increase your chances of securing a favorable price.

- Negotiation Tactics: Employing effective negotiation tactics, such as highlighting the property’s strengths, addressing the seller’s concerns, and offering creative solutions, can help you achieve a mutually beneficial agreement.

Managing and Maintaining Properties: How To Start A Property Investment Company

Once you’ve acquired properties, the next crucial step is to effectively manage and maintain them to ensure a steady stream of income and preserve their value. This involves taking on several responsibilities, from collecting rent to addressing tenant issues.

Key Responsibilities in Property Management

Managing properties effectively requires a comprehensive approach. Here are some key responsibilities:

- Rent Collection: Establishing a reliable rent collection system is vital. This involves setting clear payment deadlines, implementing automated payment options, and having a plan for dealing with late payments.

- Expense Management: Track all property expenses, including mortgage payments, insurance, utilities, repairs, and maintenance. This allows you to accurately assess profitability and identify areas for cost optimization.

- Property Maintenance: Regular maintenance is essential to prevent costly repairs and ensure tenant satisfaction. This includes routine inspections, addressing minor issues promptly, and coordinating major repairs when necessary.

- Tenant Communication: Effective communication with tenants is crucial for maintaining a positive relationship and minimizing conflicts. Respond to inquiries promptly, address concerns professionally, and provide clear expectations regarding lease terms and property rules.

- Legal Compliance: Stay informed about local housing laws and regulations to ensure compliance with all legal requirements. This includes fair housing practices, tenant screening, and eviction procedures.

Organizing a System for Property Management

To effectively manage your properties, you need a well-organized system that simplifies tasks and ensures efficient operations.

- Property Management Software: Utilizing property management software can automate many tasks, such as rent collection, expense tracking, tenant communication, and lease management.

- Financial Records: Maintain detailed financial records for each property, including income, expenses, and profit/loss statements. This allows you to monitor performance and make informed investment decisions.

- Maintenance Schedules: Create a schedule for regular maintenance tasks, such as inspections, cleaning, and repairs. This helps prevent major issues and ensures the property remains in good condition.

- Tenant Files: Maintain separate files for each tenant, including lease agreements, rental history, and communication records. This provides a centralized location for important information.

Handling Tenant Issues and Disputes

Tenant issues are inevitable in property management. Having a clear plan for addressing these issues is essential to maintain a positive landlord-tenant relationship.

- Communication: Address tenant concerns promptly and professionally. Encourage open communication to resolve issues amicably.

- Lease Enforcement: Enforce lease terms consistently and fairly. This includes addressing lease violations, such as late rent payments or property damage.

- Mediation: If disagreements arise, consider using mediation to facilitate a resolution. A neutral third party can help find common ground and reach a mutually acceptable solution.

- Legal Action: In extreme cases, legal action may be necessary to resolve disputes. However, this should be a last resort. Consult with an attorney to understand your legal options.

Maximizing Return on Investment

Effective property management is crucial for maximizing the return on your investment. Here are some best practices:

- Rent Optimization: Conduct market research to determine the optimal rent for your properties. Set rents that are competitive but also profitable.

- Expense Control: Minimize unnecessary expenses by negotiating favorable contracts with vendors, utilizing energy-efficient appliances, and addressing minor issues promptly to prevent them from escalating.

- Property Improvements: Invest in strategic property improvements that increase value and attract tenants. This could include upgrades to kitchens, bathrooms, or landscaping.

- Tenant Retention: Happy tenants are more likely to stay longer, reducing vacancy costs and ensuring a steady stream of income. Provide excellent customer service and address concerns promptly.

Starting a property investment company is a challenging but rewarding endeavor. By carefully considering the factors discussed in this guide, you can lay a solid foundation for success in this dynamic industry. Remember, thorough research, meticulous planning, and a keen understanding of the market are crucial for navigating the intricacies of property investments. With dedication, perseverance, and a strategic approach, you can transform your property investment aspirations into a thriving reality.

FAQ Explained

What are the minimum capital requirements to start a property investment company?

The minimum capital requirements can vary widely depending on your investment strategy, the size and type of properties you intend to acquire, and the location. It’s essential to create a detailed business plan that includes your financial projections and determine the initial capital needed to cover expenses, secure financing, and acquire your first property.

What are the common risks associated with property investment?

Property investment comes with inherent risks, including market fluctuations, economic downturns, tenant issues, and unexpected maintenance costs. It’s crucial to conduct thorough due diligence, diversify your portfolio, and have a plan in place to manage these risks effectively.

What are the essential licenses and permits needed to operate a property investment company?

The specific licenses and permits required vary depending on your location and the nature of your business activities. It’s advisable to consult with a legal professional or a local business licensing authority to ensure compliance with all regulations.

How can I find and evaluate potential investment opportunities?

Sourcing profitable property investment opportunities requires a proactive approach. You can explore online real estate listings, network with real estate agents and investors, attend industry events, and analyze market trends to identify promising deals.

Starting a property investment company requires careful planning and research. You’ll need to develop a strong business plan, understand the local real estate market, and secure funding. For those seeking expertise in property investment, you might consider exploring CBRE Investment Management , a leading global real estate investment firm. Their experience and insights could provide valuable guidance as you embark on your property investment journey.

Starting a property investment company requires a solid understanding of the market and a clear business plan. You’ll need to decide on your investment strategy, whether it’s focusing on residential, commercial, or industrial properties. Understanding the nuances of property management and leveraging tools like k1 investment management can streamline your operations. Once you’ve established your strategy, you’ll need to secure funding, build a team, and market your services to attract investors.

Starting a property investment company requires careful planning and research. You’ll need to define your niche, secure funding, and build a team of professionals. While the real estate market can be volatile, it’s worth exploring the strategies shared by the jim cramer investment club , which offers insights into different investment approaches. By understanding the nuances of the market and leveraging the right resources, you can position yourself for success in the property investment world.

Starting a property investment company requires a solid understanding of the market and a well-structured plan. One crucial step is to seek expert guidance, and for that, you can turn to NISA Investment Advisors , who can provide valuable insights and support. Their expertise can help you navigate the complexities of property investment, ensuring your ventures are well-informed and strategically aligned for success.

Starting a property investment company involves careful planning and a solid understanding of the market. One key decision is how to manage your funds, and you may wonder if are annuities a good investment for your company. While annuities can offer stability and income streams, they may not be the best fit for the fluctuating nature of real estate investments.

Ultimately, choosing the right financial strategies for your property investment company depends on your risk tolerance and long-term goals.