Investment Properties Florida USA A Guide to Success

Investment properties florida usa – Investment properties in Florida, USA, offer a unique blend of opportunity and challenge. The Sunshine State boasts a dynamic real estate market, driven by strong population growth, a thriving tourism industry, and a desirable lifestyle. From beachfront condos to inland single-family homes, Florida presents a diverse range of investment options for those seeking to capitalize on its vibrant economy and growing demand for housing.

This guide explores the intricacies of investing in Florida real estate, providing insights into market trends, property types, investment strategies, and essential considerations for success. Whether you’re a seasoned investor or a newcomer to the Florida market, this comprehensive overview will equip you with the knowledge needed to navigate the opportunities and challenges of this exciting investment landscape.

Florida Real Estate Market Overview

Florida’s real estate market, particularly for investment properties, has consistently attracted investors seeking lucrative opportunities. The state’s warm climate, diverse attractions, and strong economic growth have fueled a robust real estate landscape.

Florida Real Estate Market Trends

The Florida real estate market is characterized by strong demand and a limited supply of available properties. This dynamic has resulted in consistent price appreciation, making it a favorable environment for investment. According to the Florida Realtors, the median home price in Florida reached a record high of $400,000 in 2022, reflecting a significant increase from previous years. This upward trend is expected to continue, driven by factors such as population growth, strong economic activity, and limited new construction.

Factors Influencing Investment Decisions

Several key factors influence investment decisions in the Florida real estate market. These include:

- Population Growth: Florida’s population has been steadily increasing for decades, driven by factors such as retirement migration, job opportunities, and a favorable climate. This ongoing population growth creates a consistent demand for housing, contributing to price appreciation.

- Economic Growth: Florida’s economy is diverse and robust, with significant contributions from tourism, healthcare, and technology sectors. The state’s strong economic performance attracts businesses and residents, further fueling the demand for real estate.

- Tourism Industry: Florida is a renowned tourist destination, attracting millions of visitors annually. The tourism industry contributes significantly to the state’s economy, creating a steady stream of rental income for investment property owners.

- Favorable Tax Climate: Florida is a tax-friendly state, with no state income tax. This makes the state an attractive destination for retirees and investors seeking to minimize their tax burden.

History of Florida Real Estate Market Fluctuations

Florida’s real estate market has experienced significant fluctuations throughout its history. The state’s real estate boom in the early 2000s was followed by a sharp downturn during the housing crisis of 2008. However, the market has since recovered and experienced sustained growth, demonstrating its resilience and long-term potential.

“The Florida real estate market is cyclical, but it has a history of strong recovery after downturns.”

Key Statistics and Trends

Here are some key statistics and trends that highlight the Florida real estate market’s current state:

- Inventory Levels: The number of available homes for sale in Florida has been consistently low, creating a seller’s market. This limited inventory further contributes to price appreciation.

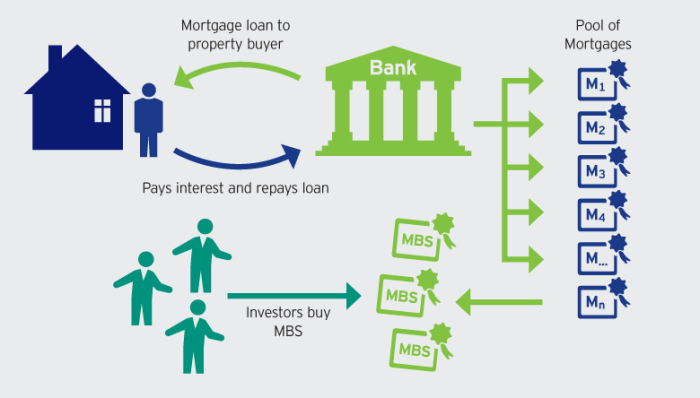

- Mortgage Rates: Interest rates have been rising in recent years, which can impact affordability and demand. However, Florida’s strong economic fundamentals and continued population growth are expected to offset this impact.

- Rental Demand: Florida’s rental market remains strong, with high occupancy rates and steady rental income. This makes investment properties attractive for generating passive income.

- Investment Activity: Investors continue to show strong interest in Florida real estate, particularly in popular areas like Miami, Orlando, and Tampa. This sustained investment activity fuels further price appreciation and market growth.

Investment Property Types in Florida

Florida’s diverse real estate market offers a variety of investment property options, each with its unique advantages and disadvantages. Understanding the different types of investment properties available is crucial for investors to make informed decisions and maximize their returns.

Single-Family Homes

Single-family homes are detached residential properties that offer privacy and independence. They are a popular choice for investors seeking long-term appreciation, rental income, or both.

Advantages

- Potential for appreciation: Single-family homes historically have shown strong appreciation potential in Florida, especially in desirable areas.

- Rental income: They can generate consistent rental income, providing a steady stream of cash flow.

- Tax benefits: Investors can deduct expenses related to the property, such as mortgage interest, property taxes, and insurance, from their taxable income.

- Customization: Investors have the freedom to renovate and upgrade the property to enhance its value and appeal.

Disadvantages

- Higher upfront costs: Single-family homes typically require a larger down payment and higher closing costs than other investment property types.

- Maintenance responsibilities: Investors are responsible for all maintenance and repairs, which can be time-consuming and costly.

- Vacancy risk: Finding reliable tenants and minimizing vacancy periods can be challenging.

Condominiums

Condominiums are individual units within a larger building or complex, offering a more affordable entry point into the real estate market. They are particularly popular among investors seeking rental income in high-demand areas.

Advantages

- Lower upfront costs: Condos typically have lower down payments and closing costs compared to single-family homes.

- Amenities and services: Residents often enjoy access to shared amenities like pools, fitness centers, and security services, which can enhance the property’s appeal to tenants.

- Less maintenance responsibility: Condo associations typically handle exterior maintenance and landscaping, reducing the burden on investors.

- Strong rental demand: Condos in popular tourist destinations or urban areas often experience high rental demand.

Disadvantages

- Limited customization: Condo owners typically have limited control over renovations and upgrades, subject to association rules and regulations.

- Homeowner association fees: Investors must pay monthly HOA fees, which can add to the overall cost of ownership.

- Potential for special assessments: HOA fees can increase unexpectedly due to major repairs or improvements, impacting cash flow.

- Limited appreciation: Condo appreciation can be influenced by factors like market conditions and the overall health of the HOA.

Multi-Family Units

Multi-family units, such as duplexes, triplexes, and fourplexes, offer investors the potential for higher rental income and greater diversification.

Advantages

- Higher rental income: Multiple units can generate significantly higher rental income compared to single-family homes or condos.

- Diversification: Having multiple units reduces the risk associated with vacancy or tenant issues in a single unit.

- Tax benefits: Investors can deduct expenses related to the property, including mortgage interest, property taxes, insurance, and depreciation.

- Potential for appreciation: Multi-family properties can appreciate in value over time, particularly in growing areas.

Disadvantages

- Higher upfront costs: Multi-family units typically require a larger down payment and higher closing costs.

- Increased management responsibilities: Investors need to manage multiple tenants, handle maintenance requests, and ensure compliance with local regulations.

- Potential for tenant conflicts: Managing multiple tenants can lead to potential conflicts or disputes that require careful handling.

- Limited control over renovations: Renovations and upgrades may require approval from tenants or local authorities.

Vacation Rentals, Investment properties florida usa

Vacation rentals, often located in popular tourist destinations, offer investors the opportunity to generate short-term rental income and capitalize on seasonal demand.

Advantages

- Higher rental income: Vacation rentals can command higher nightly rates compared to long-term rentals, especially during peak season.

- Flexibility: Investors can set their own rental rates and availability, maximizing income potential.

- Tax benefits: Investors can deduct expenses related to the property, including mortgage interest, property taxes, insurance, and depreciation.

- Potential for appreciation: Vacation rentals in popular tourist destinations can experience strong appreciation potential.

Disadvantages

- Higher maintenance costs: Vacation rentals often require more frequent cleaning, repairs, and upkeep due to high turnover.

- Seasonal fluctuations: Rental income can fluctuate significantly based on seasonality and local events.

- Regulatory challenges: Local regulations regarding vacation rentals can be complex and vary widely, requiring careful compliance.

- Marketing and management: Investors need to actively market their property, handle bookings, and manage guest interactions.

Investment Property Types in Florida: A Comparative Table

| Property Type | Key Features | Investment Potential | Potential Risks |

|---|---|---|---|

| Single-Family Homes | Detached residential properties, offering privacy and independence | Long-term appreciation, rental income | Higher upfront costs, maintenance responsibilities, vacancy risk |

| Condominiums | Individual units within a larger building, offering affordability and amenities | Rental income, access to amenities | Limited customization, HOA fees, potential for special assessments |

| Multi-Family Units | Multiple units within a single property, offering higher rental income and diversification | Higher rental income, diversification, tax benefits | Higher upfront costs, increased management responsibilities, potential for tenant conflicts |

| Vacation Rentals | Properties rented out for short-term stays, offering seasonal income | Higher nightly rates, flexibility, tax benefits | Higher maintenance costs, seasonal fluctuations, regulatory challenges |

Florida Investment Property Locations

Florida’s diverse landscape and thriving economy make it a haven for real estate investors. From bustling metropolitan areas to charming coastal towns, the Sunshine State offers a wide range of investment opportunities.

Understanding the unique characteristics and potential returns of each location is crucial for making informed investment decisions. This section delves into popular investment locations in Florida, highlighting the factors that make them attractive for investors.

Popular Investment Locations in Florida

Florida’s booming real estate market attracts investors seeking lucrative returns. The state’s robust economy, driven by tourism, healthcare, and technology, fuels strong demand for rental properties. Here are some of the most popular investment locations in Florida:

- Miami: Miami is a global hub for finance, tourism, and culture. Its vibrant nightlife, world-class beaches, and growing population make it a prime location for investment. The city’s strong rental market, fueled by a steady influx of tourists and residents, offers attractive returns for investors. However, high property prices and competition can make it challenging to find deals.

- Orlando: Known as the “Theme Park Capital of the World,” Orlando attracts millions of tourists annually. The city’s strong tourism industry, coupled with its growing population and robust job market, creates a high demand for rental properties. The presence of major theme parks, such as Walt Disney World, Universal Studios, and SeaWorld, makes Orlando an ideal location for short-term rentals.

- Tampa: Tampa is a major metropolitan city with a thriving economy, driven by industries such as healthcare, finance, and tourism. The city’s affordable housing options and growing job market make it an attractive destination for both residents and investors. The proximity of Tampa to popular beaches, including Clearwater Beach and St. Pete Beach, further enhances its appeal for investors seeking to capitalize on the tourism industry.

- Jacksonville: Jacksonville is the largest city in Florida by land area and is experiencing significant growth. The city’s diverse economy, strong job market, and affordable housing options make it a promising investment location. Jacksonville’s proximity to the coast and its burgeoning downtown area contribute to its increasing popularity among investors.

- Fort Lauderdale: Fort Lauderdale is a popular tourist destination known for its beautiful beaches, vibrant nightlife, and luxurious lifestyle. The city’s thriving tourism industry and growing population create a strong demand for rental properties. Investors seeking to capitalize on the luxury market will find Fort Lauderdale an attractive option.

- Sarasota: Sarasota is a charming coastal city with a relaxed atmosphere and a thriving arts and culture scene. The city’s beautiful beaches, world-class restaurants, and affordable housing options attract a diverse population of residents and investors. Sarasota’s strong rental market and growing tourism industry offer attractive returns for investors.

- Naples: Naples is a luxurious coastal city known for its pristine beaches, upscale shopping, and world-class dining. The city’s affluent population and strong tourism industry create a high demand for luxury rentals. Investors seeking to capitalize on the luxury market will find Naples an attractive option.

- Pensacola: Pensacola is a historic city with a charming downtown area and beautiful beaches. The city’s affordable housing options and growing tourism industry make it an attractive investment location. Pensacola’s proximity to the Gulf of Mexico and its rich history attract a diverse population of residents and investors.

- Palm Beach Gardens: Palm Beach Gardens is a affluent suburb located north of West Palm Beach. The city’s luxurious lifestyle, world-class shopping, and proximity to the beach make it an attractive destination for investors seeking high-end properties. The city’s strong rental market and growing population create a high demand for rental properties.

Factors Influencing Investment Decisions

Several factors influence investment decisions in Florida’s real estate market. Understanding these factors is crucial for investors seeking to maximize their returns.

- Population Growth: Florida’s population has been steadily growing for decades, driven by factors such as favorable weather, a strong economy, and a growing retirement population. This population growth fuels demand for housing, making it a favorable market for real estate investors.

- Job Market: Florida’s diverse economy, with major industries such as tourism, healthcare, and technology, creates a robust job market. The presence of major employers, such as Walt Disney World, Universal Studios, and major healthcare providers, attracts a skilled workforce, further driving demand for housing.

- Tourism: Florida is a major tourist destination, attracting millions of visitors annually. The state’s beautiful beaches, theme parks, and attractions create a strong demand for short-term rentals. Investors seeking to capitalize on the tourism industry will find Florida an attractive option.

- Economic Growth: Florida’s economy has been steadily growing in recent years, with low unemployment rates and a strong job market. This economic growth fuels demand for housing, making it a favorable market for real estate investors.

- Infrastructure Development: Florida is investing heavily in infrastructure development, including transportation, utilities, and technology. These investments are attracting businesses and residents, further driving demand for housing.

Mapping Key Investment Hotspots

Here is a map of key investment hotspots in Florida, with descriptions of each location’s advantages and disadvantages.

Investing in Florida real estate can be a smart move, especially if you’re looking for a steady stream of rental income. To get a better understanding of the current market trends and potential investment opportunities, it might be helpful to check out the Jim Cramer Investment Club , which often provides insights on various sectors, including real estate.

With its warm climate, beautiful beaches, and growing economy, Florida remains a popular destination for both residents and tourists, making it a promising location for investment properties.

Note: This is a simplified representation and should not be considered definitive. Further research is recommended for a comprehensive understanding of each location’s unique characteristics.

Investing in Florida real estate can be a lucrative venture, especially when you consider the state’s booming tourism industry and strong rental market. If you’re looking to expand your portfolio, financing options like a HELOC on an investment property can be a valuable tool. A HELOC can provide the flexibility and funds you need to purchase, renovate, or even refinance existing properties, making it an attractive option for savvy Florida investors.

Investment Strategies in Florida: Investment Properties Florida Usa

Florida’s real estate market presents a diverse range of investment opportunities, catering to various financial goals and risk appetites. Understanding the most common investment strategies can help you navigate this dynamic market and make informed decisions.

Buy-and-Hold

The buy-and-hold strategy involves purchasing a property with the intention of holding it for an extended period, typically several years or even decades. This strategy relies on long-term appreciation and rental income to generate returns.

- Pros:

- Passive income: Rental income provides a steady stream of cash flow, potentially offsetting mortgage payments and generating positive returns.

- Long-term appreciation: Florida’s real estate market historically exhibits consistent growth, leading to substantial appreciation over time.

- Tax advantages: Investors can benefit from tax deductions on mortgage interest, property taxes, and depreciation.

- Lower risk: Compared to short-term strategies, buy-and-hold offers more stability and reduced risk, as it’s less susceptible to market fluctuations.

- Cons:

- Significant upfront investment: Purchasing a property requires substantial capital, including down payment, closing costs, and potential renovation expenses.

- Time commitment: Managing rental properties involves ongoing responsibilities like tenant screening, maintenance, and rent collection.

- Market volatility: While Florida’s real estate market is generally stable, it’s not immune to economic downturns or local market fluctuations.

- Potential for vacancy: Finding reliable tenants and maintaining occupancy can be challenging, leading to periods of lost income.

Fix-and-Flip

Fix-and-flip involves purchasing distressed properties, renovating them, and reselling them for a profit. This strategy focuses on capital appreciation within a shorter timeframe.

- Pros:

- Potential for high returns: By acquiring undervalued properties and enhancing their value through renovations, investors can achieve substantial profits within a shorter period.

- Flexibility: Fix-and-flip allows for a quicker turnaround compared to buy-and-hold, providing more liquidity and the opportunity to reinvest profits in other projects.

- Control over renovation: Investors have direct control over the renovation process, ensuring quality and maximizing potential returns.

- Cons:

- Higher risk: Fix-and-flip involves a higher degree of risk, as it relies on accurate property valuation, successful renovations, and a favorable market environment.

- Significant upfront investment: Funding renovations requires substantial capital, potentially involving short-term loans or lines of credit.

- Time commitment: The renovation process can be time-consuming and demanding, requiring project management skills and coordination with contractors.

- Unforeseen expenses: Unexpected repairs or delays during renovations can significantly impact profitability, increasing the risk of financial losses.

Rental Income Generation

This strategy involves purchasing properties specifically for generating rental income. Investors aim to acquire properties in high-demand areas with strong rental markets to maximize cash flow.

- Pros:

- Steady cash flow: Rental income provides a consistent stream of revenue, potentially covering mortgage payments and generating positive returns.

- Tax advantages: Investors can deduct expenses related to rental properties, including mortgage interest, property taxes, and depreciation.

- Diversification: Investing in multiple rental properties can diversify your portfolio and reduce overall risk.

- Cons:

- Significant upfront investment: Purchasing rental properties requires substantial capital, including down payment, closing costs, and potential renovation expenses.

- Time commitment: Managing rental properties involves ongoing responsibilities like tenant screening, maintenance, and rent collection.

- Potential for vacancy: Finding reliable tenants and maintaining occupancy can be challenging, leading to periods of lost income.

- Market volatility: Rental markets can be influenced by economic factors, local job markets, and competition, impacting occupancy rates and rental income.

Investment Strategies Comparison

| Strategy | Expected Returns | Risks | Required Resources |

|---|---|---|---|

| Buy-and-Hold | Long-term appreciation and rental income | Lower risk, but requires significant upfront investment and ongoing management | High capital, time commitment, and ongoing management expertise |

| Fix-and-Flip | Potential for high returns within a shorter timeframe | Higher risk due to market fluctuations, renovation costs, and potential delays | Significant capital, project management skills, and renovation expertise |

| Rental Income Generation | Steady cash flow from rental income | Moderate risk, with potential for vacancy and market volatility | Moderate capital, time commitment, and ongoing property management skills |

Tax Benefits and Considerations

Owning an investment property in Florida comes with certain tax advantages that can make it a lucrative investment. Understanding these tax benefits and how they apply to your specific investment strategy is crucial for maximizing your returns.

Depreciation Deductions

Depreciation is a tax-deductible expense that allows you to recover the cost of your investment property over time. In the case of rental properties, you can deduct a portion of the property’s value each year, which reduces your taxable income. This deduction is available for both residential and commercial properties. The IRS provides specific guidelines for calculating depreciation, which depends on the property’s type, purchase date, and other factors.

Depreciation is a non-cash expense, meaning you don’t actually pay it out of pocket. It’s a way to account for the gradual decline in value of your property due to wear and tear.

Capital Gains Exemptions

When you sell an investment property, you may have to pay capital gains tax on any profit you make. However, Florida offers some exemptions that can reduce or eliminate this tax liability. For example, the Homestead Exemption protects the first $500,000 of capital gains from taxation for Florida residents who have lived in their primary residence for at least three years. Additionally, there are exemptions for certain types of property, such as agricultural land and timber.

Tax Implications of Different Investment Strategies

The tax implications of your investment strategy can significantly impact your overall returns. Here’s a comparison of the tax considerations for buy-and-hold versus fix-and-flip:

| Strategy | Tax Considerations |

|---|---|

| Buy-and-Hold |

|

| Fix-and-Flip |

|

Key Tax Considerations

Here’s a table summarizing the key tax considerations for Florida investment property owners:

| Tax Consideration | Description |

|---|---|

| Deductions |

|

| Exemptions |

|

| Tax Liabilities |

|

Risks and Challenges of Investing in Florida

Investing in Florida real estate can be lucrative, but it’s crucial to acknowledge the inherent risks and challenges. While Florida’s sunny climate, beautiful beaches, and thriving tourism industry attract investors, it’s essential to consider potential downsides before committing.

Natural Disasters

Florida is highly susceptible to natural disasters like hurricanes, floods, and wildfires. These events can cause significant damage to properties, disrupt rental income, and increase insurance premiums.

Strategies for Mitigation

- Secure Adequate Insurance: Invest in comprehensive insurance policies covering hurricane damage, flood risks, and other potential hazards.

- Choose Properties in Safe Zones: Opt for properties located in areas with lower risk of flooding or hurricane impact.

- Reinforce Structures: Consider strengthening your property’s structure to withstand hurricane winds and flooding.

Market Fluctuations

Florida’s real estate market can experience fluctuations due to factors like economic downturns, changes in interest rates, and seasonal variations. These fluctuations can impact property values, rental income, and overall investment returns.

Strategies for Mitigation

- Diversify Investments: Spread your investments across different property types, locations, and rental strategies to reduce exposure to market fluctuations.

- Stay Informed About Market Trends: Continuously monitor local real estate market conditions, including supply and demand, interest rates, and economic indicators.

- Develop a Long-Term Investment Strategy: Avoid making impulsive decisions based on short-term market swings. Instead, focus on a long-term investment strategy that accounts for market cycles.

Regulatory Changes

Florida’s government frequently introduces new regulations impacting real estate, such as property taxes, zoning laws, and rental restrictions. These changes can affect investment costs, rental income, and property values.

Strategies for Mitigation

- Stay Updated on Regulatory Changes: Monitor legislative developments and stay informed about new regulations affecting real estate in Florida.

- Consult with Legal Professionals: Engage legal counsel to understand the implications of new regulations on your investment strategy.

- Consider Long-Term Investment Horizons: Recognize that regulatory changes can occur, and plan your investment strategy with a long-term perspective.

Checklist of Potential Risks and Challenges

- Hurricane Risk: Consider the likelihood of hurricane damage in your chosen location and ensure adequate insurance coverage.

- Flood Risk: Assess the flood risk in your target area and explore options for mitigation, such as elevation or flood insurance.

- Property Taxes: Understand the property tax rates in Florida and factor them into your investment calculations.

- Insurance Premiums: Anticipate potentially high insurance premiums due to Florida’s susceptibility to natural disasters.

- Market Volatility: Be prepared for fluctuations in property values and rental income due to economic and seasonal factors.

- Regulatory Changes: Stay informed about new regulations impacting real estate, such as zoning laws and rental restrictions.

- Competition: Recognize the competitive nature of Florida’s real estate market, especially in popular areas.

- Maintenance Costs: Factor in potential maintenance costs, including repairs, landscaping, and pool upkeep.

- Tenant Management: Consider the challenges of managing tenants, including finding reliable renters and addressing potential issues.

Investing in Florida real estate requires careful planning, thorough research, and a strategic approach. By understanding the market dynamics, evaluating different property types, and considering various investment strategies, you can position yourself for success in this dynamic and rewarding market. Remember to consult with financial professionals and real estate experts to make informed decisions and navigate the complexities of Florida’s investment landscape.

FAQ Summary

What are the current interest rates for investment property mortgages in Florida?

Interest rates for investment property mortgages in Florida can vary depending on factors like your credit score, loan type, and the specific lender. It’s best to contact several lenders to compare rates and find the best deal for your situation.

What are the typical property taxes in Florida?

Property taxes in Florida are generally lower than in other states. The exact rate varies by county and municipality, but you can expect to pay around 1% of your property’s assessed value in taxes.

What are the best neighborhoods in Florida for rental income?

Popular rental markets in Florida include Tampa, Orlando, Miami, and Jacksonville. The best neighborhoods for rental income depend on your investment strategy and target renter demographic. Research is crucial to determine the most profitable areas for your investment.

Florida’s booming real estate market offers a diverse range of investment opportunities, from luxury condos to single-family homes. For those interested in a career path within real estate, exploring the world of Real Estate Investment Trusts (REITs) can be a rewarding option. Is real estate investment trusts a good career path can provide valuable insights into this industry.

REITs allow investors to participate in a diversified portfolio of properties, including those in Florida, potentially minimizing risk and maximizing returns.

Florida’s booming real estate market offers a wealth of opportunities for savvy investors seeking to capitalize on the Sunshine State’s growth. If you’re considering diving into the world of investment properties in Florida, you might want to explore the expertise of Bridge Investment Group , a leading player in the field. They offer a range of services designed to guide investors through the complexities of the Florida market, from identifying promising properties to navigating the intricacies of financing and management.

Investing in Florida real estate can be a smart move, particularly with the state’s strong economy and growing population. If you’re looking for a company with expertise in real estate investments, consider arcline investment management , known for their strategic approach and impressive track record. Their knowledge of the Florida market could be invaluable as you navigate the complexities of investment properties in the Sunshine State.