HELOCs on Investment Property A Guide

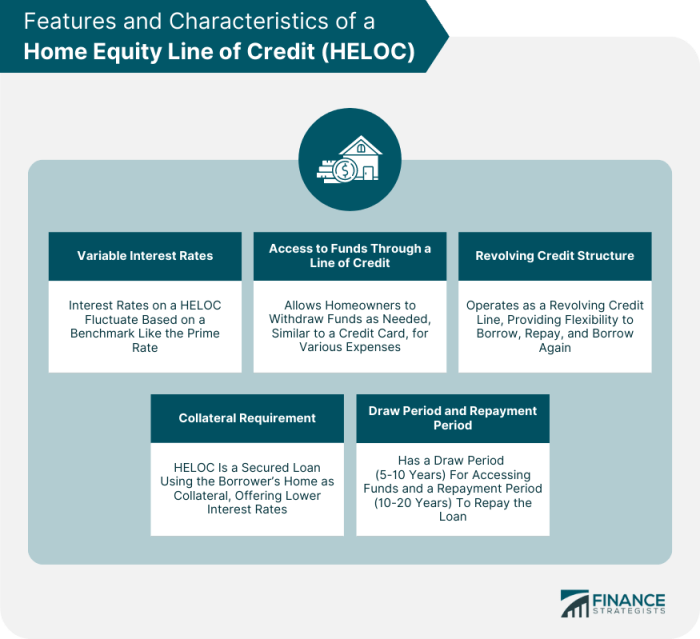

Heloc on investment property – HELOCs on investment property can be a powerful tool for real estate investors, offering access to flexible financing for a variety of purposes. A HELOC, or Home Equity Line of Credit, is essentially a revolving line of credit secured by your home’s equity. This means you can borrow money against the value of your property, giving you the potential to finance renovations, repairs, or even purchase additional investment properties. However, it’s crucial to understand the intricacies of HELOCs, including their variable interest rates, repayment terms, and potential risks, before deciding if this financing option is right for you.

This guide delves into the advantages and disadvantages of using a HELOC for investment properties, exploring key considerations such as qualifying for a loan, managing debt responsibly, and navigating the potential tax implications. We’ll also discuss strategies for maximizing the benefits of a HELOC while minimizing financial strain.

Using a HELOC for Investment Property Expenses: Heloc On Investment Property

A Home Equity Line of Credit (HELOC) can be a valuable tool for financing various expenses related to your investment property. It allows you to borrow against the equity you’ve built in your home, providing access to funds for renovations, repairs, or even covering property taxes. This flexibility can be particularly beneficial for landlords and investors seeking to enhance their property’s value or manage unexpected costs.

Using a HELOC to Finance Investment Property Expenses

A HELOC can be a suitable financing option for a variety of investment property expenses. Here are some examples:

- Renovations and Improvements: A HELOC can help you finance significant renovations, such as kitchen or bathroom upgrades, that can increase the property’s rental income or market value.

- Repairs and Maintenance: Unexpected repairs, like a leaky roof or malfunctioning HVAC system, can be costly. A HELOC can provide the necessary funds to address these issues promptly and avoid further damage.

- Property Taxes: If you’re facing a sudden increase in property taxes, a HELOC can help you cover the costs, ensuring you avoid penalties or foreclosure.

- Insurance Premiums: A HELOC can help you pay for insurance premiums, especially if you’re dealing with a substantial increase due to factors like rising property values or changes in coverage.

- Acquisition Costs: In some cases, a HELOC can be used to supplement your down payment for a new investment property, allowing you to access a larger property or diversify your portfolio.

Tax Implications of Using a HELOC for Investment Property Expenses, Heloc on investment property

It’s important to consider the tax implications of using a HELOC for investment property expenses. While interest paid on a HELOC is generally deductible, certain rules apply:

- Investment Property: Interest paid on a HELOC used to acquire, improve, or maintain an investment property is typically deductible as an expense on your tax return.

- Personal Residence: If you use a HELOC for expenses related to your primary residence, the interest is only deductible up to a certain amount, subject to limitations based on the loan amount and the home’s fair market value.

- Consult a Tax Professional: It’s essential to consult with a qualified tax professional to understand the specific tax implications of using a HELOC for your investment property. They can help you determine the deductible interest amount and ensure you’re following all applicable tax regulations.

HELOC Strategies for Investment Property Owners

A Home Equity Line of Credit (HELOC) can be a valuable tool for investment property owners, offering flexibility and potential for financial gains. By understanding and implementing effective HELOC strategies, you can maximize the benefits while minimizing risks.

Maximizing HELOC Benefits

A well-structured HELOC strategy can significantly enhance your investment property ownership experience.

- Strategic Use of Funds: Utilize HELOC funds for essential property improvements, such as renovations or upgrades, that increase rental income or property value.

- Bridging Financing: HELOCs can serve as a bridge loan while you secure permanent financing for a new investment property, allowing you to act quickly on opportunities.

- Capitalizing on Market Fluctuations: If interest rates are low, consider using a HELOC to refinance existing investment property debt at a lower rate, potentially reducing your monthly payments and freeing up cash flow.

- Tax Advantages: Interest paid on a HELOC used for investment property expenses may be deductible, depending on your specific circumstances and tax laws. Consult with a tax professional for personalized guidance.

Managing HELOC Debt Responsibly

Responsible HELOC management is crucial for avoiding financial strain.

- Set a Budget and Stick to It: Create a clear budget that includes your HELOC payments and other expenses related to your investment property. This will help you stay on track and avoid overextending yourself.

- Maintain a Healthy Debt-to-Income Ratio: Aim for a comfortable debt-to-income ratio, ensuring your HELOC payments don’t strain your overall financial health.

- Make Extra Payments When Possible: Consider making additional payments on your HELOC to reduce the principal balance faster and save on interest costs over time.

- Monitor Interest Rates: Keep an eye on interest rates and consider refinancing your HELOC if rates drop significantly. This can potentially lower your monthly payments and save you money.

HELOC Exit Strategies

Having an exit strategy for your HELOC is essential, ensuring you can manage your debt effectively.

- Refinancing: When your HELOC reaches maturity, consider refinancing the remaining balance into a fixed-rate mortgage. This can provide stability and predictable payments.

- Selling the Property: If you decide to sell your investment property, the HELOC balance will be paid off from the proceeds. However, remember that any outstanding HELOC debt will reduce your net profit from the sale.

Ultimately, the decision of whether or not to utilize a HELOC for investment property hinges on your individual financial situation, investment goals, and risk tolerance. By carefully assessing your options, understanding the intricacies of HELOCs, and implementing responsible financial strategies, you can leverage this financing tool to potentially unlock new opportunities and achieve your real estate investment objectives.

Key Questions Answered

What are the typical interest rates for HELOCs on investment properties?

HELOC interest rates for investment properties are generally higher than those for primary residences. They are also variable, meaning they can fluctuate based on market conditions.

Can I use a HELOC to purchase an investment property?

While some lenders may allow using a HELOC to purchase an investment property, it’s not the most common practice. Traditional mortgages are typically preferred for outright property purchases.

What are the tax implications of using a HELOC for investment property expenses?

Interest paid on a HELOC used for investment property expenses is generally deductible as an investment expense. However, it’s essential to consult with a tax professional for specific guidance.

A HELOC on an investment property can be a valuable tool for financing renovations or acquiring additional properties. If you’re considering Florida as a location for your next investment, you might want to explore the opportunities available in florida investment properties. Once you’ve secured your investment property, a HELOC can help you maximize its potential by providing access to funds for essential improvements or strategic acquisitions.

A HELOC on an investment property can be a useful tool for accessing funds for repairs or improvements, but it’s important to consider the potential risks. If you’re looking for a more traditional mortgage option, an FHA loan might be a good fit, especially if you’re a first-time investor. You can learn more about the requirements for an fha loan for investment property to see if it aligns with your financial goals.

Ultimately, the best financing option for your investment property will depend on your individual circumstances and the specific property itself.

A HELOC on an investment property can be a valuable tool for financing renovations or acquiring additional properties. If you’re considering expanding your portfolio, exploring industrial property investment might be a lucrative option. Industrial properties offer consistent rental income and long-term appreciation potential, making them an attractive asset class for HELOC borrowers.

A HELOC on an investment property can be a great way to access funds for renovations or additional acquisitions. If you’re looking to expand your portfolio in the Midwest, consider exploring the market for commercial investment properties in Lincoln, NE. This growing city offers a diverse range of opportunities, and a HELOC can provide the flexibility you need to capitalize on them.

A HELOC on an investment property can be a valuable tool for financing renovations or improvements, but it’s important to consider the potential risks. If you’re a veteran looking for financing options, you might want to explore the possibility of a VA loan for investment property , which offers unique benefits for eligible borrowers. While HELOCs are typically used for existing properties, VA loans can be used to purchase or refinance an investment property, providing more flexibility for your real estate investments.