Unit Investment Trusts A Comprehensive Guide

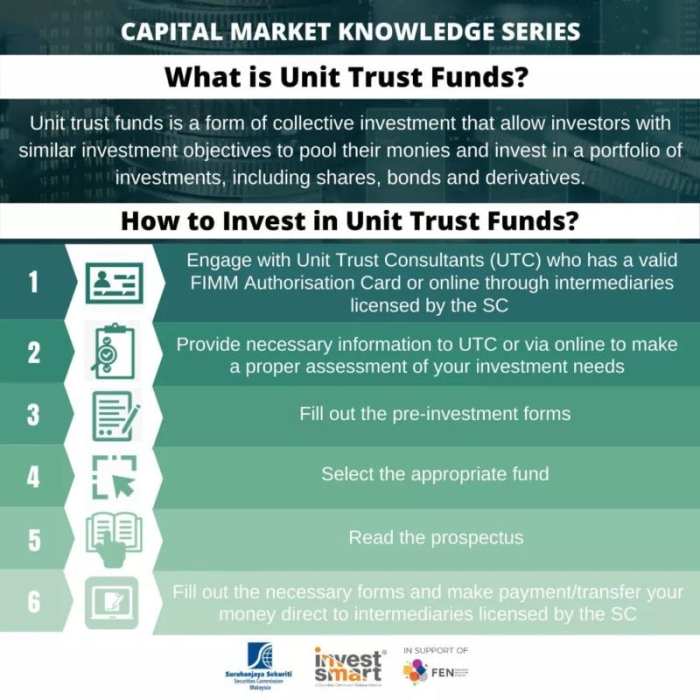

Unit investment trusts (UITs) are a type of investment vehicle that allows investors to diversify their portfolios by holding a fixed basket of securities. UITs offer a unique approach to investing, combining elements of both mutual funds and exchange-traded funds (ETFs) while maintaining their distinct characteristics.

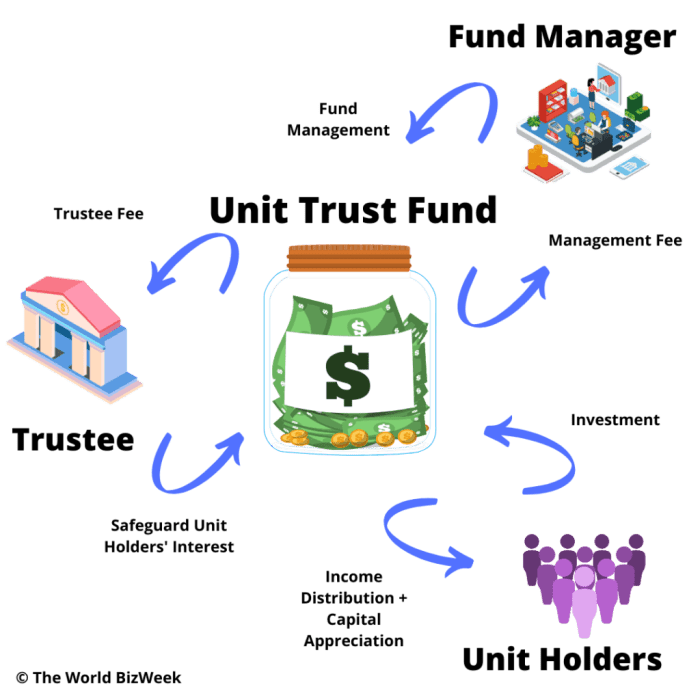

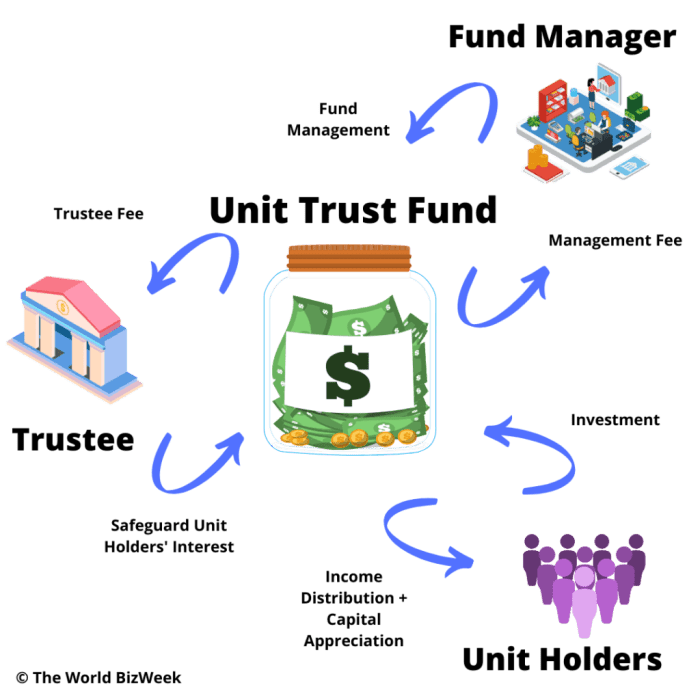

UITs are typically structured as a trust, with a trustee responsible for managing the underlying assets. They offer investors a predetermined portfolio with a specific investment strategy, often focused on a particular asset class, such as bonds, stocks, or real estate.

What are Unit Investment Trusts?

Unit investment trusts (UITs) are a type of investment vehicle that allows investors to participate in a fixed portfolio of securities. These trusts are structured as a fixed portfolio of securities, typically bonds or stocks, that are held in a trust for a predetermined period.

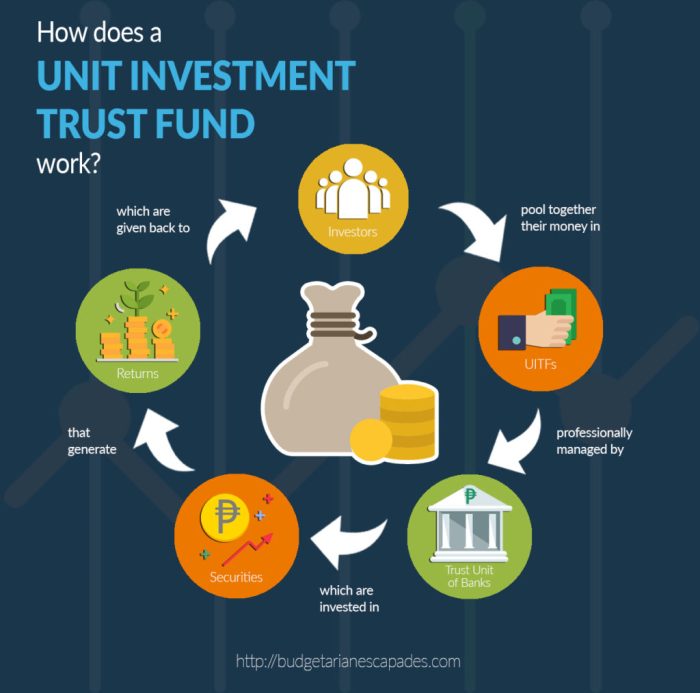

UITs operate in a straightforward manner. When a UIT is created, a trustee purchases a specific set of securities, known as the “portfolio,” and then divides the portfolio into units. Each unit represents a fractional ownership interest in the underlying securities. Investors purchase units in the UIT, which allows them to participate in the performance of the portfolio.

UITs Compared to Other Investment Vehicles

UITs offer a unique approach to investing, and it’s important to understand how they compare to other common investment vehicles.

UITs differ from mutual funds and ETFs in several key aspects:

- Fixed Portfolio: UITs have a fixed portfolio that remains unchanged throughout the life of the trust. In contrast, mutual funds and ETFs can adjust their holdings based on market conditions and investment strategies.

- Passive Management: UITs are passively managed, meaning the trustee does not actively buy or sell securities within the portfolio. Mutual funds and ETFs can be actively managed, where fund managers make decisions about buying and selling securities.

- Maturity Date: UITs have a predetermined maturity date. Upon maturity, the trust is liquidated, and investors receive the proceeds from the sale of the underlying securities. Mutual funds and ETFs do not have a maturity date and are designed to be held for the long term.

- Fees: UITs typically have lower fees than mutual funds or ETFs. This is because they are passively managed and have a fixed portfolio.

Investment Objectives and Strategies

Unit Investment Trusts (UITs) are designed to meet a variety of investment goals, offering investors a structured and diversified approach to wealth accumulation. They typically aim to provide investors with a predetermined portfolio of securities, allowing them to benefit from the potential growth and income generated by these assets.

Investment Objectives

The investment objectives of UITs are clearly defined in their prospectus, providing investors with a transparent understanding of the fund’s goals. These objectives are usually aligned with specific financial needs, such as:

- Capital Appreciation: UITs focused on capital appreciation seek to increase the value of their underlying assets over time, often investing in stocks, bonds, or other growth-oriented securities.

- Income Generation: UITs designed for income generation prioritize investments that provide regular interest or dividend payments, such as high-yield bonds or dividend-paying stocks.

- Preservation of Capital: UITs with a capital preservation objective focus on investments that aim to minimize risk and protect the principal investment, often investing in low-risk securities like government bonds or money market instruments.

- Tax-Efficient Income: Some UITs are structured to provide tax-efficient income, investing in assets that generate income that is taxed at a lower rate, such as municipal bonds or REITs.

Investment Strategies

UITs employ a variety of investment strategies to achieve their stated objectives. These strategies are typically described in detail in the prospectus and can include:

- Index Tracking: UITs that track a specific market index, such as the S&P 500, aim to replicate the performance of that index by investing in the same securities in the same proportions.

- Sector Specific: UITs may focus on specific sectors of the economy, such as energy, technology, or healthcare, providing investors with targeted exposure to a particular industry.

- Fixed Income: UITs focused on fixed income investments typically invest in bonds, notes, or other debt securities, providing investors with regular interest payments and potential capital appreciation.

- Alternative Investments: Some UITs may invest in alternative assets, such as real estate, commodities, or private equity, offering investors diversification beyond traditional stocks and bonds.

Using UITs to Achieve Financial Goals, Unit investment trust

UITs can be valuable tools for achieving a range of financial goals, including:

- Retirement Planning: UITs can be used as part of a diversified retirement portfolio, providing exposure to different asset classes and potential growth over the long term.

- College Savings: UITs can be an effective way to save for college expenses, offering potential growth and a structured investment approach.

- Estate Planning: UITs can be incorporated into estate planning strategies, providing beneficiaries with a diversified and potentially appreciating asset.

Advantages and Disadvantages of UITs: Unit Investment Trust

Unit investment trusts (UITs) offer a unique approach to investing, providing a fixed portfolio of securities with a predetermined maturity date. While they can be an attractive option for investors seeking simplicity and diversification, it’s essential to understand both the benefits and potential drawbacks before making a decision.

Advantages of UITs

UITs present several advantages for investors, particularly those seeking a straightforward and diversified investment strategy.

- Simplicity: UITs are relatively easy to understand and invest in. Investors know exactly what securities they are buying and the weight of each holding in the portfolio. This transparency can be appealing to investors who prefer a clear and straightforward approach to investing.

- Diversification: UITs offer instant diversification across various asset classes, such as stocks, bonds, or real estate. This diversification can help mitigate risk by spreading investments across different sectors and industries, reducing the impact of any single investment’s performance on the overall portfolio.

- Fixed Portfolio: UITs maintain a fixed portfolio throughout their lifespan, providing a predictable investment strategy. Investors know exactly what assets they are holding and how their portfolio is structured, eliminating the need for constant monitoring or rebalancing.

- Professional Management: UITs are managed by experienced professionals who select and oversee the underlying securities. This can be beneficial for investors who lack the time or expertise to manage their investments independently.

Disadvantages of UITs

While UITs offer certain advantages, they also have some limitations that investors should consider.

- Limited Flexibility: UITs have a fixed maturity date, meaning investors cannot easily adjust their holdings or withdraw funds before maturity. This lack of flexibility can be a drawback for investors with changing financial needs or investment goals.

- Potential for Capital Loss: Like any investment, UITs carry the risk of capital loss. If the underlying securities in the portfolio decline in value, the value of the UIT will also decrease, potentially resulting in losses for investors.

- Lack of Active Management: UITs are passively managed, meaning the portfolio is not actively traded or adjusted to market conditions. This can be a disadvantage in volatile markets, as the portfolio may not be able to capitalize on emerging opportunities or mitigate potential risks.

- Limited Trading Opportunities: UITs are typically traded on exchanges, which can limit trading opportunities and increase transaction costs compared to mutual funds or ETFs.

Comparison of UITs with Other Investment Options

UITs offer a unique approach to investing, but they are not the only option available. Comparing UITs with other investment options can help investors determine which strategy best suits their needs.

- Mutual Funds: Mutual funds offer similar diversification benefits as UITs but with more flexibility. Investors can buy or sell shares of mutual funds at any time, and they benefit from active management that adjusts the portfolio based on market conditions.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but are traded on exchanges like stocks. They offer diversification, liquidity, and lower expense ratios than UITs. However, ETFs also lack the fixed portfolio structure of UITs.

- Individual Securities: Investing in individual stocks, bonds, or other securities offers greater control and potential for higher returns. However, it also requires significant research, expertise, and risk tolerance. Individual securities may not provide the same level of diversification as UITs.

Types of UITs

Unit investment trusts (UITs) are offered in a variety of types, each with its own investment strategy and associated risks and returns. The specific type of UIT you choose will depend on your individual investment goals and risk tolerance.

UIT Types Based on Underlying Assets

UITs can be broadly categorized based on the underlying assets they invest in. The most common types of UITs are:

| Type | Description | Investment Strategy | Risks | Potential Returns |

|---|---|---|---|---|

| Bond UITs | Bond UITs invest in a fixed portfolio of bonds, such as government bonds, corporate bonds, or municipal bonds. | Bond UITs aim to provide investors with regular income payments and capital appreciation. | Bond UITs are generally considered less risky than stock UITs, but they are still subject to interest rate risk. If interest rates rise, the value of existing bonds will decline. | Bond UITs typically offer lower potential returns than stock UITs, but they can provide a steady stream of income. |

| Stock UITs | Stock UITs invest in a fixed portfolio of stocks, such as large-cap stocks, small-cap stocks, or growth stocks. | Stock UITs aim to provide investors with capital appreciation and potentially higher returns than bond UITs. | Stock UITs are generally considered more risky than bond UITs, as the value of stocks can fluctuate significantly. | Stock UITs have the potential to generate higher returns than bond UITs, but they also carry a higher risk of loss. |

| Money Market UITs | Money market UITs invest in short-term, low-risk debt securities, such as commercial paper, treasury bills, and certificates of deposit. | Money market UITs aim to provide investors with a safe and stable investment that offers a relatively low return. | Money market UITs are considered very safe, as they invest in short-term, high-quality debt securities. However, they may not keep pace with inflation. | Money market UITs typically offer low returns, but they are a safe and liquid investment option. |

| Real Estate UITs | Real estate UITs invest in a portfolio of real estate assets, such as commercial properties, residential properties, or REITs. | Real estate UITs aim to provide investors with exposure to the real estate market and potential for capital appreciation. | Real estate UITs are subject to market risk, interest rate risk, and the risk of property value declines. | Real estate UITs have the potential to generate higher returns than other UITs, but they also carry a higher risk of loss. |

| Commodity UITs | Commodity UITs invest in a portfolio of commodities, such as gold, oil, or agricultural products. | Commodity UITs aim to provide investors with exposure to the commodity market and potential for capital appreciation. | Commodity UITs are subject to market risk, price volatility, and the risk of supply disruptions. | Commodity UITs have the potential to generate higher returns than other UITs, but they also carry a higher risk of loss. |

UIT Types Based on Investment Strategy

UITs can also be categorized based on their investment strategy. Some common UIT strategies include:

- Growth-oriented UITs: These UITs invest in assets that are expected to grow in value over time, such as stocks or real estate. Growth-oriented UITs typically have a higher risk profile, but they also have the potential for higher returns.

- Income-oriented UITs: These UITs invest in assets that are expected to generate regular income payments, such as bonds or preferred stocks. Income-oriented UITs typically have a lower risk profile than growth-oriented UITs, but they also have the potential for lower returns.

- Balanced UITs: These UITs invest in a mix of assets, such as stocks, bonds, and real estate. Balanced UITs aim to provide investors with a balance of growth and income potential. Balanced UITs are typically considered to be less risky than growth-oriented UITs, but they may not generate the same level of returns.

Suitability and Risk Management

Unit investment trusts (UITs) can be a valuable addition to a diversified investment portfolio, but it’s crucial to consider whether they align with your individual financial goals and risk tolerance.

Understanding the potential risks and benefits of UITs is essential for making informed investment decisions. This section will explore the types of investors who might find UITs suitable, the importance of considering risk tolerance and investment goals, and strategies for managing the risks associated with UIT investments.

Unit investment trusts, or UITs, offer a diversified way to invest in a specific asset class. While they are often associated with bonds or stocks, UITs can also target niche markets like luxury property investments. This allows investors to gain exposure to a high-end real estate market without needing to directly purchase a luxury property themselves. The structure of a UIT provides a streamlined approach to managing these investments, allowing investors to benefit from the expertise of the fund manager while enjoying the potential growth of the underlying assets.

Identifying Suitable Investors

UITs can be attractive to a variety of investors, depending on their individual circumstances and investment objectives. Here are some examples of investors who might benefit from UITs:

- Investors seeking diversification: UITs offer a simple way to diversify a portfolio across a range of asset classes, such as stocks, bonds, or real estate. This can help to reduce overall portfolio risk.

- Investors with a long-term investment horizon: UITs are typically designed for long-term investment, as they have a fixed maturity date. This makes them suitable for investors who are comfortable with a longer-term time horizon.

- Investors seeking professional management: UITs are managed by professional investment managers, who select the underlying securities and make investment decisions. This can be beneficial for investors who prefer not to actively manage their own investments.

- Investors with a specific investment objective: UITs are often structured around a particular investment objective, such as growth, income, or a specific sector. This can help investors to achieve their specific financial goals.

Risk Tolerance and Investment Goals

Before investing in a UIT, it’s crucial to carefully consider your risk tolerance and investment goals. Your risk tolerance reflects your ability and willingness to accept potential losses in exchange for the possibility of higher returns. Your investment goals refer to your specific financial objectives, such as retirement planning, saving for a down payment on a house, or funding your children’s education.

Unit investment trusts (UITs) are a type of investment vehicle that offers diversification across a specific asset class. When choosing a UIT, it’s crucial to consider the underlying assets and the potential for growth. If you’re considering real estate, researching the best cities for investment properties can be a valuable step. This research can help you determine the most promising locations for your UIT investments, ensuring you’re making informed decisions for your financial future.

For instance, an investor with a high risk tolerance and a long-term investment horizon might consider investing in a UIT that focuses on growth stocks. This type of UIT could potentially provide higher returns over time, but it also carries a higher risk of losses. On the other hand, an investor with a low risk tolerance and a short-term investment horizon might prefer a UIT that invests in conservative bonds. This type of UIT is less likely to experience significant fluctuations in value, but it may also generate lower returns.

Unit investment trusts are a type of investment fund that holds a fixed portfolio of assets, often offering a diversified approach. While these trusts typically invest in a variety of securities, some may choose to focus on specific sectors like real estate. For example, you might find a unit investment trust that specializes in commercial investment properties in Lincoln, NE , offering investors exposure to this particular market.

This type of specialized unit investment trust can provide a way to diversify your portfolio and potentially generate returns through the growth of commercial real estate.

Managing Risks

While UITs offer a number of potential benefits, they also carry certain risks. Here are some strategies for managing the risks associated with UIT investments:

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your portfolio by investing in a variety of asset classes, including UITs, stocks, bonds, and real estate. This can help to reduce your overall portfolio risk.

- Understand the underlying securities: Before investing in a UIT, carefully review the prospectus and understand the underlying securities that the UIT holds. This will give you a better understanding of the potential risks and rewards of the investment.

- Monitor the UIT’s performance: Regularly monitor the performance of the UIT and compare it to its benchmark. If the UIT’s performance is consistently lagging behind its benchmark, it may be time to consider selling your investment.

- Consider the UIT’s maturity date: UITs have a fixed maturity date, at which point they are liquidated and the proceeds are distributed to investors. Make sure that the maturity date aligns with your investment horizon. If the maturity date is too far in the future, you may be exposed to greater risk.

Future Trends in UITs

The Unit Investment Trust (UIT) market is constantly evolving, driven by technological advancements, regulatory changes, and shifts in investor preferences. These forces are shaping the future of UITs, influencing their structure, investment strategies, and overall appeal to investors.

Impact of Technology

Technological advancements are profoundly impacting the UIT market, leading to increased efficiency, transparency, and accessibility.

- Automated Portfolio Management: UITs are increasingly leveraging artificial intelligence (AI) and machine learning (ML) algorithms for portfolio management. These technologies can analyze vast amounts of data, identify market trends, and execute trades with greater precision, potentially leading to improved returns for investors. For example, a UIT focused on a specific sector might use AI to analyze company financials, news articles, and social media sentiment to identify potential investment opportunities within that sector.

- Digital Platforms: The rise of digital platforms is simplifying the process of investing in UITs. Investors can now access information about UITs, compare different options, and make investment decisions online, eliminating the need for traditional intermediaries. This increased accessibility can attract a wider range of investors, particularly younger generations who are comfortable with digital tools.

- Blockchain Technology: Blockchain technology holds the potential to revolutionize UITs by providing a secure and transparent platform for managing and tracking investments. Smart contracts on blockchain can automate the distribution of dividends and ensure that investors receive accurate and timely information about their holdings. This increased transparency and efficiency could enhance investor confidence and make UITs more attractive to a wider audience.

Regulatory Landscape

The regulatory landscape is also evolving, impacting how UITs are structured and managed.

- Increased Regulation: Regulators are increasingly focusing on investor protection and transparency in the financial markets. This has led to stricter regulations for UITs, including requirements for greater disclosure, risk management practices, and investor education. These regulations aim to ensure that UITs are structured and operated in a way that protects investors and promotes market integrity.

- Focus on Sustainability: There is a growing emphasis on sustainable investing, and regulators are encouraging financial products that align with environmental, social, and governance (ESG) principles. UITs are adapting to this trend by offering products that invest in companies with strong ESG ratings. This focus on sustainability can attract investors who are looking to align their investments with their values.

- Cross-Border Regulations: The increasing globalization of financial markets is leading to more complex cross-border regulations. UITs that operate in multiple jurisdictions need to comply with a variety of regulatory requirements, which can be challenging. However, these regulations are essential for ensuring investor protection and promoting market stability.

Evolving Investment Landscape

UITs are well-positioned to play a significant role in the evolving investment landscape.

- Diversification: UITs offer investors a simple and efficient way to diversify their portfolios across a range of asset classes, including stocks, bonds, and real estate. This diversification can help mitigate risk and enhance potential returns.

- Accessibility: UITs are often considered more accessible than other investment vehicles, such as mutual funds, because they typically have lower minimum investment requirements. This makes them attractive to investors with limited capital. For example, a UIT focused on emerging markets could provide access to a diverse range of companies in developing economies, making it easier for investors to participate in this growth area.

- Transparency: UITs are known for their transparency, as the underlying assets in the portfolio are clearly defined and disclosed to investors. This transparency can help investors understand the risks and potential returns associated with the investment.

Understanding the advantages and disadvantages of UITs is crucial for investors seeking to incorporate them into their investment strategies. While UITs offer diversification and potential for growth, they also come with limitations such as limited flexibility and potential for capital loss. By carefully considering their investment objectives and risk tolerance, investors can determine if UITs align with their financial goals.

Helpful Answers

What is the difference between a UIT and a mutual fund?

UITs have a fixed portfolio that doesn’t change, while mutual funds can adjust their holdings based on market conditions.

How long do UITs typically last?

UITs have a limited lifespan, usually between 10 and 20 years, after which they are liquidated.

Are UITs suitable for all investors?

UITs are best suited for investors with a long-term investment horizon and a moderate to high risk tolerance.

What are the tax implications of investing in UITs?

UITs are taxed similarly to mutual funds, with capital gains and dividends distributed to investors.

Unit investment trusts are a popular investment option, particularly for those looking for diversification and professional management. Investing in real estate through a unit investment trust can offer exposure to a variety of properties, potentially providing a steady stream of income. If you’re considering this strategy, research the best cities for property investment to identify areas with strong growth potential and a favorable rental market.

This can help you make informed decisions about your unit investment trust choices.