Category/finance

Welcome to the World of Finance: Unveiling Opportunities and Overcoming Challenges

In an ever-evolving global economy, navigating through the intricate web of finance can feel both daunting and exhilarating. Whether you’re an aspiring entrepreneur, a savvy investor, or simply someone aiming to better manage your personal finances, understanding the fundamental principles and emerging trends of finance can empower you to make informed decisions that shape your financial future.

Let’s pause for a moment to consider a simple question: What comes to mind when you hear the term “finance”? For many, it might conjure images of bustling stock markets, bank statements, cryptocurrency chatter, or perhaps the complex economic theories discussed in classroom settings. While these are all facets of finance, they merely scratch the surface of a dynamic and multifaceted field that touches every aspect of modern life.

Why Finance Matters

Finance is the lifeblood of our economies, steering everything from the stability of national economies to the success of individual businesses and households. At its core, finance is about the management of money and assets, ensuring that resources are allocated efficiently to drive growth and sustain development. It’s the engine that fuels innovation, supports public welfare, and enables individuals to achieve their personal and financial goals.

Now, more than ever, a deep understanding of financial principles is paramount. In today’s fast-paced world, where digital transformation and globalization are reshaping traditional industries, the finance sector is also undergoing a profound transformation. These changes open up a wealth of opportunities but also present new challenges, making it essential for all of us to stay informed and adaptable.

The Evolving Landscape: Key Trends and Insights

The finance landscape is as dynamic as it is diverse, constantly evolving in response to technological advancements, regulatory shifts, and global market forces. Here are a few key trends and insights that are shaping the future:

- Technological Innovation: From blockchain technology to artificial intelligence, innovation is revolutionizing the finance industry. These technologies promise greater transparency, efficiency, and accessibility, empowering consumers and businesses alike.

- Sustainable Finance: As awareness of environmental and social issues grows, sustainable finance is gaining traction. This trend focuses on incorporating environmental, social, and governance (ESG) factors into financial decision-making.

- Globalization and Geopolitical Dynamics: The interconnectedness of global markets means that financial systems are increasingly influenced by geopolitical events and trade policies.

- Financial Inclusion: Efforts are underway to broaden access to financial services, ensuring that previously underserved communities can participate fully in the economic system.

These topics are crucial components of the modern financial world, and each offers a unique lens through which we can better understand and engage with finance. In the sections that follow, we will delve deep into these areas, exploring how they impact both macroeconomic trends and individual financial behaviors.

Making Finance Work for You

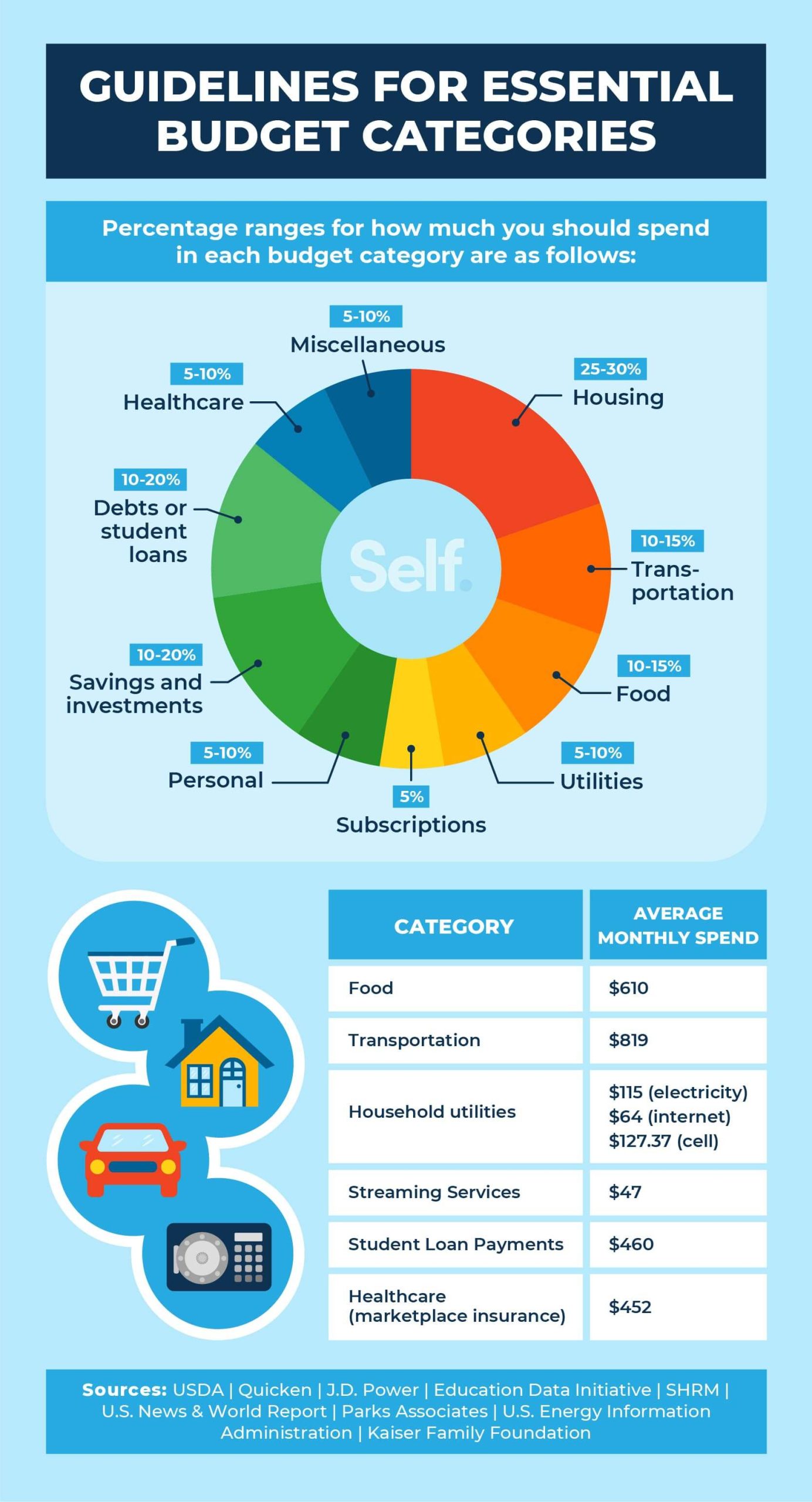

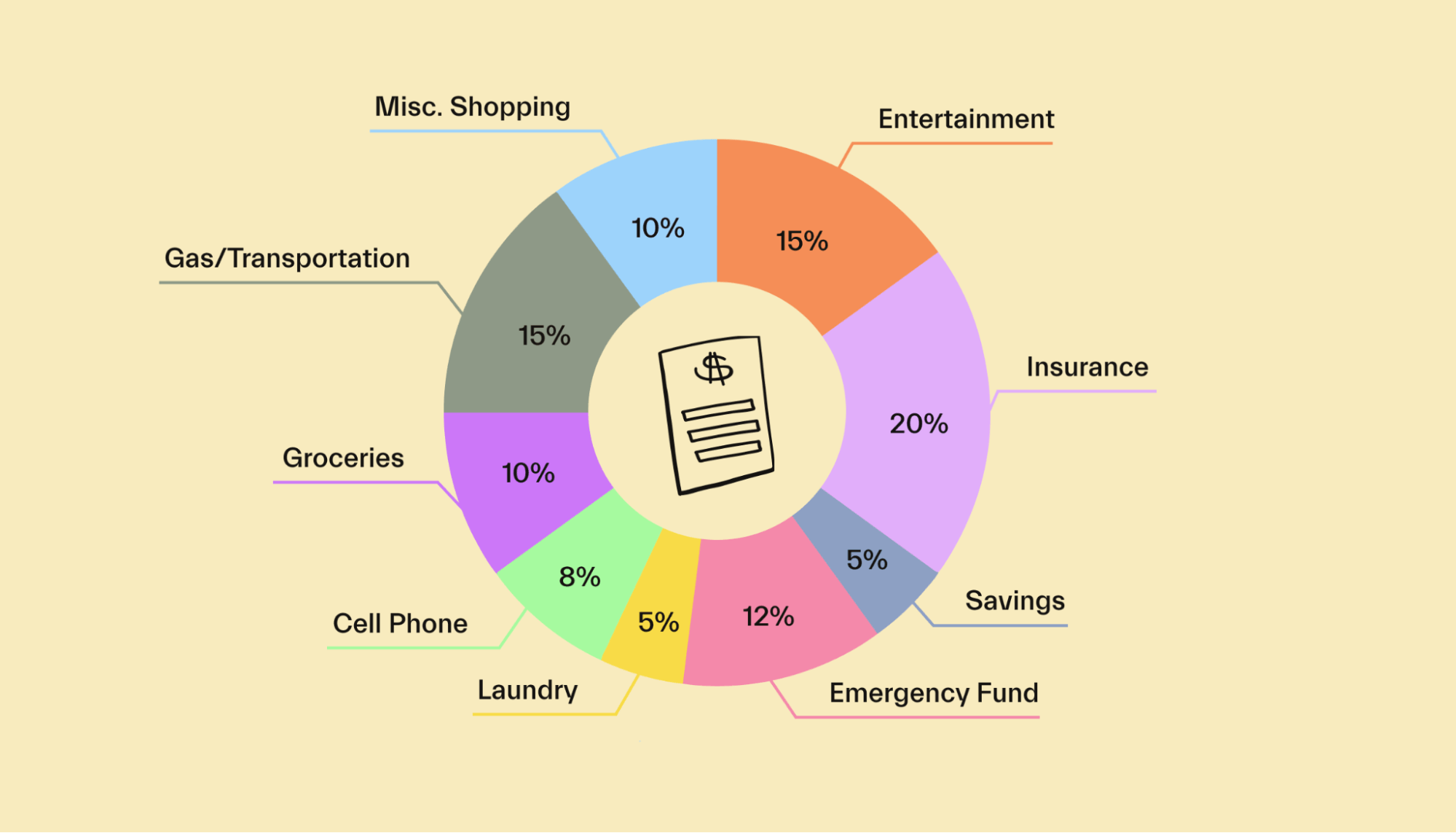

While understanding the broader financial picture is important, applying that knowledge to your personal and professional life is where the real value lies. Whether you’re aiming to optimize your investment portfolio, strategically grow your business, or simply better manage day-to-day expenses, financial literacy and strategic planning are key.

We’ll provide you with practical insights, actionable strategies, and expert advice to help you navigate financial challenges and seize opportunities. From budgeting tips and investment guides to a deeper look at emerging technologies and their implications, our goal is to equip you with the tools you need to thrive in a complex financial landscape.

Ultimately, finance is more than numbers and charts; it’s a course of action that can steer our lives in profound and meaningful ways. Armed with the right knowledge and skills, you can manage risks, build wealth, and generate value that extends beyond financial returns.

Embarking on Your Financial Journey

As you join us on this exploration of the financial world, we invite you to challenge your assumptions, expand your horizons, and engage with the content that follows. Regardless of your current level of financial acumen, there’s always room to grow and learn.

Whether you’re looking to deepen your understanding of fundamental concepts or eager to explore advanced financial strategies, our upcoming posts will provide the comprehensive insights you need. Together, we’ll unlock the potential within the finance category, making complex subjects accessible and applicable to your unique circumstances.

So, take a deep breath and dive in. The future of finance is unfolding, and being prepared is your ultimate advantage.

Emerging Technologies Transforming Finance

The finance industry is undergoing a significant transformation powered by disruptive technologies. These advancements are reshaping operations, enhancing customer experiences, and creating new opportunities. Let’s explore three key technologies: blockchain, artificial intelligence, and big data analytics.

Blockchain Technology

Blockchain provides a decentralized and secure method to record transactions. Its implications for finance are profound, particularly in areas like cross-border payments, fraud reduction, and contract management.

- Cross-Border Payments: Blockchain facilitates quicker transactions with lower fees by eliminating intermediaries typically involved in traditional banking systems. Such efficiency is crucial in weaving a more interconnected global economic framework.

- Fraud Reduction: The immutable nature of blockchain significantly reduces the chance of tampering or fraud, enhancing the security mechanisms of financial institutions.

- Smart Contracts: These self-executing contracts with terms directly written into code automate and streamline agreements, minimizing the need for manual intervention and reducing discrepancies or delays.

Artificial Intelligence

AI is revolutionizing finance with capabilities that enable better decision-making, enhance customer experiences, and automate repetitive tasks.

- Predictive Analytics: Financial firms leverage AI to discern patterns and predict market trends, helping investment professionals make informed decisions.

- Personalized Customer Interactions: Through AI-powered chatbots and virtual assistants, firms can provide 24/7 customer service, tailored advice, and instant resolutions to queries.

- Robo-Advisors: These platforms offer automated, algorithm-driven financial planning services, making investment accessible to a broader audience with lower fees and minimum balances.

Big Data Analytics

Big data analytics provides insights that drive strategic decisions and improve performance metrics in financial operations.

- Risk Management: By analyzing vast amounts of data, financial institutions can better assess risks, optimize portfolios, and forecast potential market disruptions.

- Customer Insights: Institutions use data to gain deep insights into consumer behavior, preferences, and needs, leading to more effective product offerings and targeted marketing campaigns.

- Fraud Detection: Enhanced analytics can identify patterns indicative of fraudulent activity, allowing firms to implement responsive countermeasures swiftly.

The Rise of Fintech: New Players in the Financial Ecosystem

Fintech startups are making finance more accessible, efficient, and user-friendly, challenging traditional banks and financial institutions. Here’s how:

Democratizing Financial Services

Fintech platforms are breaking down barriers that have long excluded large segments of the population from participating fully in the financial system.

- Microfinance and Peer-to-Peer Lending: These services provide funding options for underserved communities, fostering financial inclusion.

- Mobile Banking: Deploying financial services via smartphones empowers users in remote and underserved areas, offering services such as payments, savings, and loans.

Enhanced User Experiences

The integration of technology in finance has raised the bar for customer expectations, prompting a shift towards more intuitive and seamless user experiences.

- Real-Time Payments: Immediate transaction processing is becoming the norm, facilitating commerce and personal transactions with increased speed and ease.

- Simple User Interfaces: Fintech solutions offer streamlined interfaces that simplify complex financial processes, enhancing accessibility for users of all ages and technical expertise.

Regulatory Challenges and Innovations

While the evolution of finance is exciting, it comes with various regulatory challenges. Tackling these hurdles is critical for ensuring a safe and balanced ecosystem.

Regulatory Technology (RegTech)

RegTech solutions are pivotal in helping companies manage compliance with dynamic and complex regulations in a cost-effective manner.

- Automation of Compliance Processes: By automating routine compliance tasks, firms can reduce errors, cut costs, and focus human resources on strategic issues.

- Real-Time Monitoring and Reporting: Advanced analytics and AI can monitor activity in real-time to identify and report anomalies that may signify regulatory breaches or risks.

International Regulatory Cooperation

As financial services become more global, there is a pressing need for harmonized regulations across borders to facilitate easier cross-border financial transactions and investments.

- Standardizing Practices: Working toward more standardized international regulations could greatly reduce compliance complexity and enable smoother international operations.

- Data Privacy Concerns: Balancing the free flow of data necessary for financial innovation while ensuring privacy and protecting sensitive information is crucial.

Investment Opportunities in Modern Finance

Navigating the future of finance involves recognizing and capitalizing on new investment opportunities emerging alongside these technological and regulatory changes.

Sustainable Investing

As awareness of environmental, social, and governance (ESG) issues grows, there is an increasing interest in investments that align financial returns with societal and environmental impact.

- Green Bonds: Investments that fund energy-efficient and environmentally friendly projects are becoming increasingly popular.

- Social Impact Bonds: These bonds focus on generating positive social impact in areas such as health, education, and housing.

Cryptocurrencies and Digital Assets

Despite their volatility, cryptocurrencies and digital assets represent a burgeoning field of interest among investors looking to diversify and embrace next-generation finance.

- Cryptocurrencies: While still subject to regulatory scrutiny, mainstream acceptance of bitcoin, ethereum, and others is growing as firms explore their potential for value creation.

- Non-Fungible Tokens (NFTs): Representing ownership of unique assets in the digital world, NFTs are creating new marketplaces for digital art, music, gaming, and collectibles.

Securing the Horizon in Finance

As we draw our exploration of future trajectories in finance to a close, it’s essential to reflect on the key themes and insights we’ve unearthed along this journey. At the outset, we acknowledged the rapidly evolving landscape of finance, driven by technological innovation, shifting consumer expectations, and a globally interconnected market. Our discourse ranged across various dimensions, capturing the essence of contemporary financial dynamics and projecting them into potential futures.

Firstly, we delved into the profound impact of technology in finance. Technologies such as blockchain, artificial intelligence, and machine learning are not merely augmenting existing systems; they are redefining the business models of financial institutions. We discussed how blockchain is enhancing transparency and security across financial transactions, while AI is revolutionizing both customer services and risk management through predictive analytics. These technologies are not just trends—they are foundational elements that will continue to reshape financial ecosystems.

Moreover, we explored the rise of Fintech companies and their role in democratizing access to financial services. Fintech innovations have opened doors for underbanked populations, providing scalable solutions that traditional financial institutions were slow to address. The challenge and opportunity lie in how these fintech solutions will integrate and collaborate with established banks, fostering a more inclusive financial future.

Another critical point discussed was the concept of sustainable finance. In an era where corporate responsibility is paramount, sustainable finance methods such as green bonds and ESG (Environmental, Social, Governance) investing are gaining traction. These methods not only promise ethical dividends but also present lucrative financial returns. Investors and corporations are increasingly recognizing the long-term value proposition of aligning finance with environmental and social imperatives.

The challenges facing future finance, including regulatory constraints, cybersecurity threats, and ongoing economic uncertainties, were also a prominent part of our dialogue. In particular, regulatory bodies worldwide are grappling with how to create frameworks that adapt to innovations without stifling them. Cybersecurity remains a top concern, as the sophistication and frequency of attacks threaten the integrity of financial infrastructure. These elements underscore the imperative for robust risk management strategies and collaborative international regulatory efforts.

The narrative would be incomplete without considering how geopolitical factors influence financial markets. As we have seen, economic nationalism, trade wars, and political instability can significantly impact global financial flows and market confidence. Understanding these geopolitical dynamics is essential for businesses and investors aiming to safeguard their financial interests and exploit new opportunities.

Tying It All Back: The Road Ahead

The themes we have explored in this blog are not isolated phenomena but interconnected forces driving the transformation of finance. At the heart of this transformation is the need for agility—financial entities must be adept at navigating technological advancements, regulatory landscapes, and shifting consumer behaviours. The horizon of finance is full of promise and peril, demanding strategic foresight and resilient adaptations.

As we face forward, the synthesis of these trends suggests a finance industry that is more digital, inclusive, and sustainable. It calls for a cohort of finance professionals who are not only technically proficient but also ethically aware and globally minded. This new breed of leaders will be crucial in steering their organizations through the complexities of modern finance.

A Call to Action: Engage, Innovate, and Educate

The exploration of future trajectories in finance is not merely an academic exercise—it is a practical imperative. As such, your engagement with this topic does not end here. Whether you are a seasoned professional, an aspiring financier, or simply a curious observer, you have a role to play in shaping what’s to come.

- Engage: Keep abreast of the latest developments in financial technology and regulatory changes. Participate in dialogues, forums, and workshops that delve into these issues. By doing so, you contribute to a collective understanding and innovation in the sector.

- Innovate: Use the insights and trends discussed to challenge the status quo. Innovation is the engine of progress—be it through leveraging new technologies, creating inclusive financial products, or proposing more sustainable investment strategies. Dare to envision solutions that are not only profitable but also equitable and sustainable.

- Educate: Continuously seek knowledge and share it with others. Financial literacy is a powerful tool that can democratize access to opportunities and mitigate risks. Educate yourself and those around you on both the opportunities and responsibilities that come with financial prosperity.

The horizon of finance, with all its complexities and promises, awaits your contribution. Let us secure a future that is not only prosperous but also responsible and just. Together, through conscious effort and collaborative spirit, we can shape a financial ecosystem that fulfills its promise to all stakeholders.

Thank you for embarking on this journey with us. Keep exploring, keep questioning, and most importantly, keep shaping the future of finance.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology