How To Buy An Investment Property With No Money

How To Buy An Investment Property With No Money

In the world of real estate investment, there’s something undeniably alluring about the idea of acquiring property using other people’s money. Imagine getting the keys to your very own investment property without ever dipping into your own bank account. Sounds like a dream, right? But what if I told you it’s not only possible, but there are multiple pathways to achieving it? Welcome to the fascinating realm of property investment using creative financing strategies.

As the housing market continues to evolve, so do the strategies for acquiring investment properties. Gone are the days when an enthusiastic real estate investor was required to have a hefty sum of money stashed away. Today, the savvy investor can gain access to lucrative real estate assets through innovative and unconventional means. These methods often break the traditional mold of financing, paving the way for a broader array of opportunities that were once out of reach for many.

Perhaps you’re thinking, “Isn’t buying property without money a risky gamble?” That’s a legitimate concern. However, with the right knowledge and tools at your disposal, you can mitigate these risks and turn this dream into a reality. From partnering with seasoned investors to utilizing seller financing, there are numerous approaches designed to fit various scenarios and investor profiles. This blog post is your gateway into the strategies you can employ to step into the real estate game without a significant monetary commitment.

Let’s take a moment to consider the current economic climate, where rising property prices often seem a barrier too high for many aspiring investors. Yet within every challenge lies an opportunity. In fact, the very difficulty in acquiring traditional financing can act as a catalyst for innovation amongst those determined to succeed. This introduction will give you a taste of how you can leverage these circumstances to your advantage, paving the way for financial freedom and security.

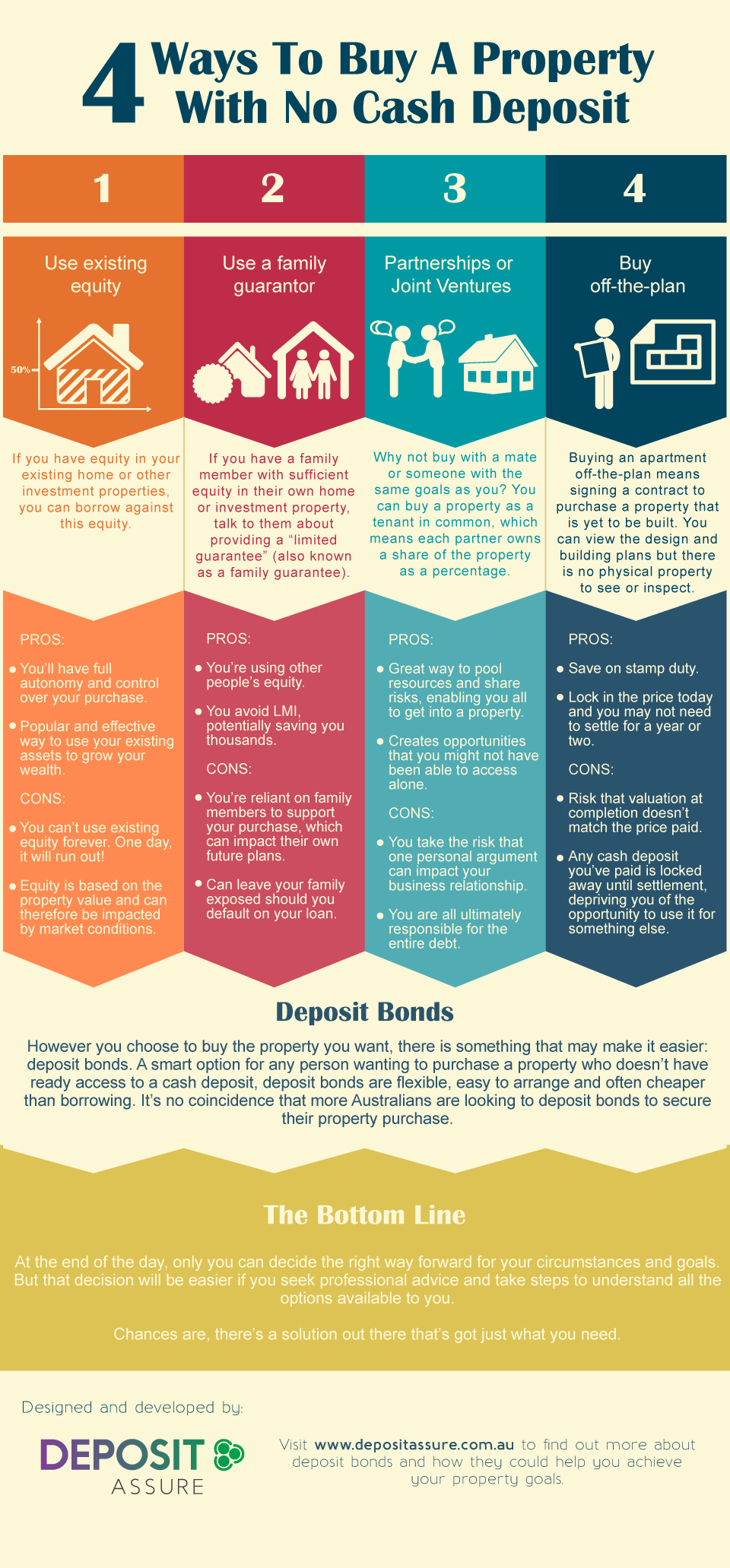

- Leverage Existing Properties: We’ll explore how those who already own a property can potentially utilize it as a springboard to acquire more. You might be sitting on a goldmine if you deploy clever tactics such as refinancing or taking out a home equity line of credit.

- Partnerships and Syndicates: Joining forces with like-minded investors can significantly reduce your financial burden. We’ll look at the structure of real estate partnerships and how to find the right people to share the journey.

- Seller Financing: Often overlooked, seller financing can be an excellent way to bypass the traditional banking system, giving both the buyer and the seller flexibility unavailable elsewhere. This approach allows you to negotiate terms that suit your financial situation without the stringent requirements of conventional loans.

- Real Estate Wholesaling: This strategy involves locking down properties at a discount and assigning contracts to buyers, allowing you to profit without owning the property directly. It’s a method that requires savvy negotiation skills and an eye for deals, but it’s entirely possible without upfront capital.

- Lease Options and Rent-to-Own: These methods provide an opportunity to control a property and even purchase it down the line while paying rent, creating a bridge to ownership without an initial purchase.

These methods aren’t just hypothetical; they’re real-world strategies used by investors to gradually build portfolios without upfront cash investments. Over the course of this blog post, we’ll delve deeper into each of these strategies and give you the tools needed to tap into the potential that lies within the real estate market without money constraints.

So, whether you’re a novice investor ready to make your first move or a seasoned veteran looking for new strategies, this guide will illuminate the path to property acquisition through innovative financial solutions. Are you ready to unlock the doors to property investment without pulling out your wallet? Let’s embark on this journey together and explore the myriad of possibilities that await.

1. Leverage Seller Financing

Seller financing occurs when the property owner provides direct financing to the buyer, making it an excellent option for real estate investors without substantial capital. This arrangement bypasses traditional mortgages, as you and the seller agree on the interest rate, monthly payments, and repayment period.

How to Approach Seller Financing

- Build Rapport: Start by building a positive relationship with the seller to establish trust and open lines of communication. Demonstrating reliability and a proactive approach can make the seller more inclined to offer favorable terms.

- Negotiate Terms: Aim for terms that benefit both parties. This might include negotiating a down payment, interest rate, and duration that fit your financial situation.

- Draft a Formal Agreement: It’s essential to document the terms clearly with a legally binding contract to protect both you and the seller.

2. Partner with Investors

Teaming up with partner investors is a strategic way to acquire property without a down payment. These partnerships can involve family, friends, or other real estate investors who can provide the necessary capital in exchange for a share of the property’s profits.

Steps to Form an Investment Partnership

- Identify Potential Partners: Look for individuals who have the financial capacity and interest in real estate investing. Networking at real estate seminars and investment forums can be highly beneficial.

- Define Roles and Responsibilities: Clearly articulate the role each partner will play, as well as how profits and losses will be shared. This ensures accountability and reduces conflicts.

- Create a Partnership Agreement: Draft a formal agreement detailing the terms of the partnership, including investment amounts, ownership percentages, and decision-making authority.

3. Utilize Lease Options

Lease options allow you to control a property with minimal upfront costs. Under this scenario, you lease the property with the option to purchase it after a certain period. A portion of your lease payment may even be applied toward the eventual purchase price.

Implementing Lease Option Strategies

- Select Suitable Properties: Look for properties where the owner is interested in selling but is open to leasing for a certain period. These properties are often easier to negotiate a lease option on.

- Negotiate Favorable Terms: A well-negotiated lease option will have a clear agreement on the purchase price upfront, a portion of rent credited toward the purchase, and a flexible timespan.

- Exercise Your Option Wisely: During the lease period, either save up or arrange financing to purchase the property at the end of the lease.

4. Explore Hard Money Lenders

Hard money lenders offer short-term loans based on the property value rather than the buyer’s creditworthiness. These loans can be a quick way to secure a property purchase without a sizable initial investment.

Understanding Hard Money Loans

- Short-Term Financing Solution: Hard money loans are typically used for quick property flips or short-term investment holds due to high interest rates.

- Simple Application Process: Because these loans are asset-based, they require less paperwork and are faster to obtain compared to traditional loans.

- Work with Reputable Lenders: Ensure that you are working with a legitimate and well-reputed lender to avoid predatory terms and rates.

5. Seek Real Estate Crowdfunding

Crowdfunding for real estate investments has gained popularity, allowing you to pool funds from multiple investors to purchase a property. This democratizes property ownership, enabling participation from those without extensive resources.

The Process of Real Estate Crowdfunding

- Research Platforms: Use reputable crowdfunding websites and platforms to find investment opportunities that suit your financial goals.

- Diversify Your Investments: Instead of putting all your resources in one property, consider spreading your investments across multiple ventures to reduce risk.

- Review Project Details: Thoroughly analyze each deal’s terms, expected returns, and associated risks before investing.

6. Look for Wholesaling Opportunities

Wholesaling involves finding a property, getting it under contract, and then selling that contract to another buyer for a profit. This requires no money down from your end, just strong negotiation skills and a solid buyer network.

Wholesaling Processes

- Identify Potential Deals: Actively search for properties being sold below market value, often by distressed sellers.

- Negotiate Contracts that Favor Assignment: Ensure your contracts include a clause that allows you to assign the contract to a new buyer.

- Build a Buyer’s List: Network to find a reliable list of potential buy-and-hold investors or house flippers interested in purchasing properties quickly.

7. Consider Rent-to-Own Agreements

Similar to lease options, rent-to-own agreements allow potential property investors to secure properties by renting first with an agreement to purchase at a later date. Unlike traditional purchases, these agreements usually require little to no upfront cost.

Key Considerations for Rent-to-Own

- Agree on a Purchase Price: As part of the initial agreement, set a fixed price for which you can purchase the property at the end of the rental term.

- Understand the Terms: Clarify who covers property maintenance, insurance, and taxes during the rental period.

- Secure Financing Options: Prepare for eventual purchase by improving creditworthiness and exploring financing options early.

8. Optimize Home Equity

If you own a home, using your existing home equity can fund an investment property. Home equity lines of credit (HELOC) allow you to borrow against your current property’s equity, providing a down payment for a new investment.

Steps to Use Home Equity

- Assess Your Equity: Review your home’s current market value against remaining mortgage balances to determine available equity.

- Obtain a HELOC: Work with a financial institution to secure a HELOC, ensuring that you understand the fees, interest rates, and repayment terms.

- Invest Strategically: Utilize the borrowed funds wisely for profitable investment opportunities that offer good returns.

Unleashing Creative Financial Ingenuity in Real Estate Investment

In the ever-evolving landscape of real estate investment, purchasing a property without depleting your savings might once have seemed like a distant dream. However, as we delved into throughout this post, the astute investor can leverage a plethora of inventive strategies to make this aspiration a reality. By deftly blending knowledge, creativity, and strategic action, you can embark on your journey towards real estate investment without the traditional financial groundwork.

The discussion began with an essential premise: the necessity of acquiring property even when upfront capital seems elusive. Real estate remains one of the most reliable wealth-building vehicles available, yet the conventional wisdom often suggests that significant funds are prerequisites. Breaking this preconceived notion was pivotal, illustrating that with determination and the right approach, barriers become opportunities.

Exploring Innovative Strategies

We explored several alternative methods to fund property investment that highlight the importance of resourcefulness and negotiation skill:

- Partnerships and Joint Ventures: Collaborating with partners allows you to pool resources, share risks, and capitalize on each participant’s strengths. This tactic not only alleviates financial burden but also enriches your investment experience through shared expertise.

- Seller Financing: Engaging the property seller in financing the purchase directly opens new avenues, where traditional lenders are bypassed, fostering agreements beneficial to both buyer and seller.

- Lease Options: Opting for lease-to-own agreements enables you to control a property with nominal initial outlay, providing time to improve credit, build equity, or organize finances for eventual purchase.

- Utilizing Other People’s Money (OPM): Tapping into funds from private lenders or family can result in acquisition without direct personal investment, provided there is alignment of interests and terms.

- Employing ‘House Hacking’: By purchasing a multi-family home and living in one part while renting out others, you can cover costs and potentially generate additional income, decreasing your financial input significantly.

Each of these methods revolves around a core principle: leveraging existing assets, relationships, and innovative financial structures. Each strategy reflects the essence of modern real estate entrepreneurship, where adaptability and creativity outweigh mere financial muscle.

Bringing the Dream Within Reach

As the world of real estate continues to expand and evolve, so too do the opportunities for those willing to think outside the traditional mold. We emphasized the crucial takeaway: real estate investment without significant initial capital investment is plausible with the right mindset and strategy. Removing the financial roadblocks converts an investment endeavor from a distant dream into an attainable objective. This transformation is fueled by the principles of strategic alliances, negotiation expertise, and a firm grasp of finance-driven creativity.

Success in this domain requires a shift from linear, conventional methods to a dynamic embrace of more collaborative, innovative approaches.

A Call to Action: Empower Your Investment Future

In this exciting venture of investment property acquisition with minimal capital, I implore you to take proactive steps towards making your real estate goals a reality. Here’s how you can empower yourself further:

- Engage in online forums and community groups focused on real estate investment to learn from other investors’ experiences.

- Attend workshops/webinars that focus on creative financing methods in real estate.

- Network with seasoned real estate investors to gather insights and potential partnership opportunities.

- Simulate negotiations or leasing scenarios to enhance your negotiation skills and understanding of various investment models.

Remember, each step you take not only widens your network and knowledge but also increases your chances of successful ventures. Knowledge, after all, is as crucial as capital, and in this knowledge, lies your power to effect transformative financial achievement.

To deepen your understanding and refine your strategy, I encourage you to explore our other resources. Connect with fellow investors on our discussion forum, download our comprehensive e-book on creative real estate financing, or take part in one of our upcoming webinars that dive deeper into each strategy mentioned.

Your journey into real estate investment can be as unconventional and rewarding as you make it. Begin today, broaden your understanding, extend your networks, and turn possibilities into reality.

Thank you for joining this exploration of non-traditional real estate investment strategies. Continue to visit our blog for the latest insights and updates, and remember—your next investment property purchase could be right around the corner, requiring little more than your ingenuity and determination.

Good luck, and happy investing!

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology