Jim Cramer Investment Club A Deep Dive

Jim Cramer Investment Club offers a unique perspective on the world of investing, blending the high-energy personality of the “Mad Money” host with practical investment advice. The club provides access to Cramer’s insights, strategies, and recommendations, aiming to empower investors of all levels.

This exploration delves into the core principles behind Jim Cramer’s investment philosophy, examining his approach to market analysis, stock selection, and risk management. We’ll also analyze the impact of his popular “Mad Money” show on retail investors and explore the structure and benefits of joining the Jim Cramer Investment Club.

Jim Cramer’s Investment Philosophy: Jim Cramer Investment Club

Jim Cramer, a renowned figure in the world of finance, is known for his energetic and often unconventional approach to investing. He is the host of CNBC’s “Mad Money” and has authored several books on investing, including “Get Rich Carefully” and “Stay Mad for Life.” Cramer’s investment philosophy is rooted in a blend of fundamental analysis, technical analysis, and a strong emphasis on market psychology.

Market Analysis and Stock Selection

Cramer’s approach to market analysis is characterized by a deep understanding of various sectors and industries. He believes in identifying trends and analyzing company fundamentals to find undervalued stocks with growth potential. Cramer emphasizes the importance of understanding a company’s earnings, revenue growth, and competitive landscape. He often uses a combination of fundamental analysis and technical analysis to identify potential investment opportunities. Cramer’s preferred sectors include technology, healthcare, and consumer discretionary, which he believes offer long-term growth prospects.

Investment Strategies

Cramer’s investment strategies are diverse and reflect his belief in adapting to changing market conditions. He advocates for a mix of long-term and short-term strategies, emphasizing the importance of having a diversified portfolio.

- Growth Investing: Cramer believes in investing in companies with strong earnings growth potential. He often looks for companies with innovative products or services, a strong market position, and a history of consistent earnings growth.

- Value Investing: Cramer also employs value investing strategies, focusing on finding undervalued stocks with the potential to appreciate in value. He looks for companies with strong fundamentals but may be trading at a discount to their intrinsic value.

- Momentum Investing: Cramer acknowledges the importance of momentum in the market and often invests in stocks that are experiencing strong price gains. He believes that momentum can be a powerful indicator of future price appreciation.

- Short Selling: Cramer is known for his willingness to short sell stocks he believes are overvalued or are experiencing negative fundamental changes. Short selling involves borrowing shares and selling them, hoping to buy them back at a lower price and profit from the difference.

Risk Management and Portfolio Diversification

Cramer emphasizes the importance of risk management and portfolio diversification. He believes that investors should carefully consider their risk tolerance and invest in a diversified portfolio of assets. Cramer recommends spreading investments across different asset classes, sectors, and geographies to reduce overall portfolio risk. He also encourages investors to have a long-term investment horizon and to avoid making emotional decisions based on short-term market fluctuations.

“The most important thing is to have a plan and stick to it. Don’t let the market dictate your emotions.” – Jim Cramer

The Jim Cramer Investment Club

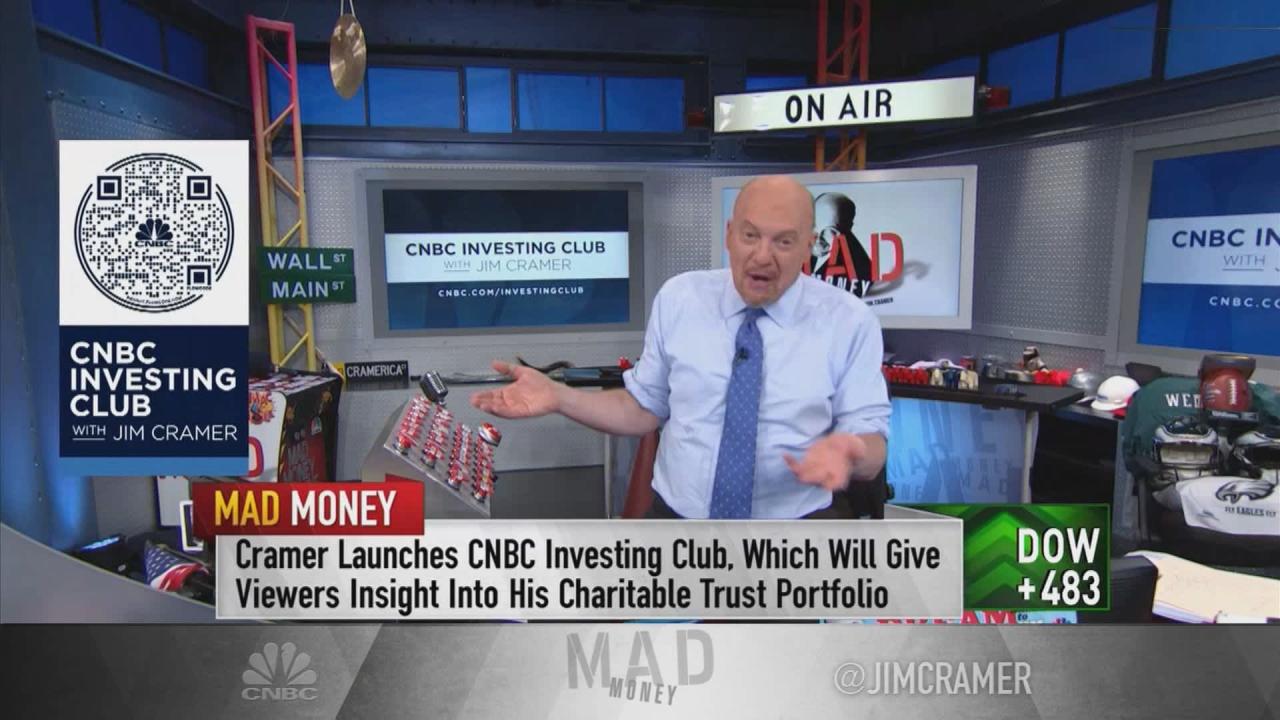

The Jim Cramer Investment Club, launched in 2021, is a subscription-based investment community that offers exclusive access to Jim Cramer’s investment insights and strategies. The club is designed to provide investors of all experience levels with guidance and tools to navigate the complex world of stock market investing.

Target Audience and Membership Requirements

The Jim Cramer Investment Club targets individuals seeking to enhance their investment knowledge and potentially improve their returns. While the club welcomes investors of all levels, it particularly appeals to those who are:

- New to investing and seeking guidance to get started.

- Experienced investors who want to learn from Jim Cramer’s insights and perspective.

- Individuals interested in a community-driven approach to investing.

Membership in the club typically requires a monthly subscription fee, providing access to various resources and features.

Benefits and Drawbacks of Joining the Club

The Jim Cramer Investment Club offers a range of benefits, including:

- Exclusive access to Jim Cramer’s insights: Members receive regular updates and recommendations directly from Jim Cramer, leveraging his decades of experience in the financial markets.

- Investment research and analysis: The club provides in-depth research and analysis on various investment opportunities, helping members make informed decisions.

- Community forum and interaction: Members can engage with other investors in a dedicated forum, exchanging ideas, strategies, and experiences.

However, it’s essential to acknowledge potential drawbacks associated with joining the club:

- Potential bias: Jim Cramer’s investment philosophy and recommendations may not align with every investor’s risk tolerance and investment goals.

- Cost of membership: The monthly subscription fee can be a significant expense for some investors, especially those with limited budgets.

- No guarantee of returns: Past performance is not indicative of future results, and the club’s recommendations do not guarantee profits.

Comparison with Other Investment Communities and Platforms

The Jim Cramer Investment Club distinguishes itself from other investment communities and platforms in several ways:

- Celebrity endorsement: Jim Cramer’s recognizable name and reputation provide a significant advantage in attracting members.

- Focus on active trading: The club emphasizes active trading strategies, potentially appealing to investors seeking short-term gains.

- Community engagement: The club fosters a strong sense of community through its forum and interactive features.

However, it’s important to consider other platforms that offer alternative investment approaches, such as robo-advisors, which utilize algorithms and automated portfolio management, or passive investment strategies, which emphasize long-term growth through index funds.

Case Studies of Jim Cramer’s Investment Recommendations

Jim Cramer, the boisterous host of Mad Money, has become a prominent figure in the world of finance. His passionate, often flamboyant style has earned him both ardent fans and detractors. Many investors are curious about his investment recommendations and their track records. Examining several of his most notable recommendations, both successful and unsuccessful, can provide valuable insights into the potential risks and rewards associated with following his advice.

The Rise and Fall of Tesla, Jim cramer investment club

In 2013, Cramer was a vocal supporter of Tesla, calling it a “game changer” and predicting it would be a “multi-bagger” (meaning it would increase in value several times over). This bullish stance was fueled by Tesla’s innovative electric vehicles and its potential to disrupt the traditional automotive industry.

- Cramer’s early support for Tesla proved to be a successful call. Tesla’s stock price surged from around $30 in 2013 to over $1,000 in 2021, making it one of the most valuable companies in the world.

- However, Tesla’s meteoric rise was not without its challenges. In recent years, the company has faced scrutiny over its production issues, safety concerns, and CEO Elon Musk’s volatile behavior. This has led to significant fluctuations in Tesla’s stock price.

- In 2022, Cramer became more cautious about Tesla, citing its high valuation and the increasing competition in the electric vehicle market. He even suggested investors consider selling some of their Tesla shares.

Tesla’s journey demonstrates the potential for both substantial gains and significant losses when investing in a company with high growth potential but also facing numerous challenges.

The Uncertain Future of Peloton

In 2020, during the COVID-19 pandemic, Cramer was a strong proponent of Peloton, a company that provides interactive fitness classes through its stationary bikes and treadmills. He saw the company’s business model as a winner in a world where people were increasingly working out from home.

- Peloton’s stock price soared during the early stages of the pandemic, fueled by strong demand for its products. Cramer’s early support for the company was well-timed and profitable for many investors.

- However, as the pandemic subsided and people returned to gyms and fitness studios, Peloton’s growth slowed down significantly. The company faced challenges with its high costs, saturated market, and declining demand for its products.

- Cramer’s enthusiasm for Peloton cooled as the company’s stock price began to decline. In 2022, he suggested that investors consider selling their shares, citing the company’s declining growth prospects and the need for a turnaround strategy.

Peloton’s story highlights the importance of considering the long-term sustainability of a company’s business model and the impact of macroeconomic factors on its performance.

The Importance of Market Conditions

Cramer’s investment recommendations are often influenced by the prevailing market conditions. During periods of economic uncertainty, he tends to favor defensive stocks that are less likely to be affected by market volatility. In bull markets, he often recommends growth stocks with high potential for appreciation.

- For example, during the 2008 financial crisis, Cramer advised investors to focus on companies with strong balance sheets and low debt levels. He believed these companies were better positioned to weather the economic storm.

- In contrast, during the bull market of the late 2010s, Cramer frequently recommended growth stocks in sectors such as technology and healthcare. He believed these sectors were poised for strong growth in the years ahead.

Understanding the market cycle and its potential impact on specific industries and companies is crucial for making informed investment decisions.

The Role of Emotion and Psychology in Investment Decisions

The world of finance is often painted as a realm of cold, hard logic, where decisions are driven by data and analysis. However, the reality is far more nuanced, with human emotions playing a significant role in shaping investment choices. Fear and greed, two powerful emotions, can exert a profound influence on investor behavior, leading to both opportunities and pitfalls.

The Influence of Fear and Greed

Fear and greed are often referred to as the two primary drivers of market volatility. Fear can lead investors to sell assets during market downturns, amplifying the decline and creating a self-fulfilling prophecy. Conversely, greed can drive investors to chase high-flying stocks, often leading to overvaluation and subsequent market corrections.

- Fear: When markets experience a downturn, investors may be gripped by fear, leading them to panic-sell their holdings. This can create a downward spiral, as more investors sell, further depressing prices. For example, during the 2008 financial crisis, many investors, overwhelmed by fear, sold their stocks, contributing to the market’s sharp decline.

- Greed: Greed can lead investors to chase high returns, often overlooking fundamental analysis and taking excessive risks. This can lead to bubbles, where asset prices become inflated beyond their intrinsic value. The dot-com bubble of the late 1990s is a classic example of how greed can drive market excesses.

Maintaining a Rational and Disciplined Approach

In the face of market volatility and emotional pressures, maintaining a rational and disciplined approach is crucial for long-term investment success. This involves developing a well-defined investment strategy, sticking to it, and avoiding emotional reactions to market fluctuations.

- Diversification: Diversifying your portfolio across different asset classes, sectors, and geographies can help mitigate risk and reduce the impact of market volatility.

- Long-term Perspective: Investing should be viewed as a long-term endeavor, not a get-rich-quick scheme. Avoid making impulsive decisions based on short-term market movements.

- Emotional Intelligence: Recognizing and managing your own emotions is crucial to making sound investment decisions. Be aware of your biases and how they might influence your judgment.

Managing Emotional Biases

Emotional biases can cloud our judgment and lead to poor investment decisions. Recognizing and managing these biases is essential for making informed choices.

- Confirmation Bias: This bias leads us to seek out information that confirms our existing beliefs, while ignoring evidence that contradicts them.

- Anchoring Bias: We tend to overemphasize the first piece of information we receive, even if it is irrelevant.

- Herd Mentality: We often follow the crowd, assuming that if others are doing something, it must be the right thing to do.

Ultimately, understanding Jim Cramer’s investment philosophy and the nuances of his club requires a balanced perspective. While his energetic approach and bold recommendations can be captivating, it’s crucial to remember that investing involves inherent risks. By carefully considering Cramer’s advice alongside independent research and a well-defined investment strategy, investors can make informed decisions that align with their individual financial goals.

Helpful Answers

How much does it cost to join the Jim Cramer Investment Club?

The cost of membership varies depending on the specific club or platform. It’s best to check their website for current pricing details.

Is Jim Cramer Investment Club suitable for beginners?

While the club can provide valuable insights, it’s essential to have a basic understanding of investing principles before joining. Beginners should consider additional resources and guidance alongside the club’s recommendations.

What are some of the potential drawbacks of joining the Jim Cramer Investment Club?

As with any investment advice, it’s important to be aware of potential biases and the inherent risks involved. Cramer’s recommendations may not always align with individual investment goals, and market conditions can significantly impact outcomes.

Jim Cramer’s investment club often emphasizes the importance of diversification, and that includes exploring different types of real estate investments. If you’re considering purchasing an investment property, you might want to learn more about securing financing through a conventional loan for investment property , which can offer competitive rates and flexible terms. Ultimately, understanding the different financing options available can help you make informed decisions about your investment strategy, just as Jim Cramer would advise.

Jim Cramer’s investment club, known for its fast-paced, often high-risk strategies, might not typically recommend venturing into the world of luxury properties investment , which is generally considered a more conservative, long-term play. However, with the right research and a solid understanding of the market, even the most ardent day trader could find value in this type of investment.

Jim Cramer’s investment club often focuses on the stock market, but savvy investors know that real estate can be a lucrative avenue as well. If you’re considering diversifying your portfolio, you might want to explore the potential of Florida investment properties , which offer a blend of strong rental demand and potential for appreciation. While Cramer’s club might not be directly involved in real estate, the principles of smart investing remain the same – research, due diligence, and a long-term perspective are key.

Jim Cramer’s investment club often provides insights on various market sectors, and real estate is no exception. A question that often arises is whether you can use a VA loan for an investment property, which can be a valuable tool for veterans looking to diversify their portfolio. You can find more information about the specifics of using a VA loan for investment properties here.

Understanding the nuances of such loans is essential, especially for those seeking to build wealth through real estate investments, as Jim Cramer’s club frequently emphasizes.

Jim Cramer’s investment club might advise against using a VA loan for an investment property, as the program is primarily designed for primary residences. However, if you’re considering an investment property, you might want to explore the details of VA loan eligibility, especially if you’re a veteran, by checking out this resource: can you use a va loan for an investment property.

Ultimately, the best approach is to consult with a financial advisor to determine the most suitable financing option for your investment strategy.