Is Real Estate Investment Trusts a Good Career Path?

Is real estate investment trusts a good career path? The answer, like many things in the world of finance, depends on your individual interests and goals. REITs, or Real Estate Investment Trusts, offer a unique opportunity to invest in the real estate market without the hassle of direct property ownership. They provide investors with a diversified portfolio of properties, while also offering potential for steady income and long-term growth.

A career in the REIT industry can be exciting and rewarding, providing a chance to be involved in the development, management, and investment of real estate assets. From analyzing financial statements to overseeing property management, REIT professionals play a vital role in the success of these companies. But before diving in, it’s crucial to understand the intricacies of this specialized field and weigh the potential benefits against the challenges.

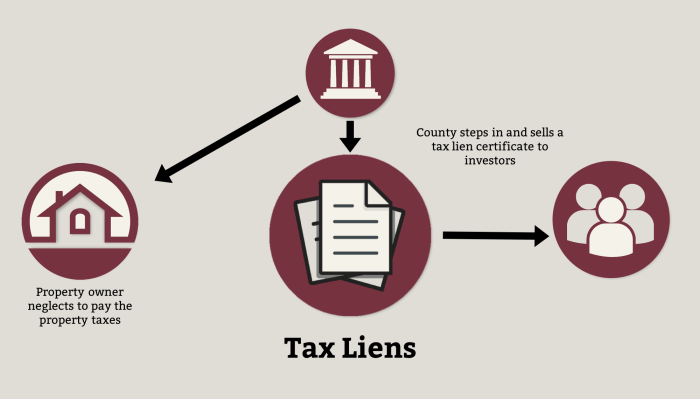

Understanding REITs

Real estate investment trusts (REITs) are companies that own, operate, or finance income-producing real estate. They offer investors a way to participate in the real estate market without directly owning properties. REITs are structured as trusts, meaning they are required to distribute a significant portion of their taxable income to shareholders in the form of dividends.

Types of REITs

REITs can be categorized based on the type of real estate they invest in. Here are some common types:

- Residential REITs: These REITs invest in properties designed for residential use, such as apartments, condominiums, and single-family homes. Examples include AvalonBay Communities (AVB) and Equity Residential (EQR).

- Commercial REITs: These REITs invest in properties used for commercial purposes, such as office buildings, retail spaces, and shopping malls. Examples include Simon Property Group (SPG) and Realty Income Corporation (O).

- Industrial REITs: These REITs invest in properties used for industrial purposes, such as warehouses, distribution centers, and manufacturing facilities. Examples include Prologis (PLD) and Duke Realty Corporation (DRE).

- Healthcare REITs: These REITs invest in properties used for healthcare purposes, such as hospitals, medical offices, and senior living facilities. Examples include Welltower Inc. (WELL) and Ventas Inc. (VTR).

- Retail REITs: These REITs invest in properties used for retail purposes, such as shopping centers, department stores, and grocery stores. Examples include Simon Property Group (SPG) and Realty Income Corporation (O).

Benefits of Investing in REITs

REITs offer several benefits to investors, including:

- Diversification: REITs allow investors to diversify their portfolios by investing in real estate, a different asset class than stocks or bonds. This can help reduce overall portfolio risk.

- High Dividend Yields: REITs are required to distribute at least 90% of their taxable income to shareholders, resulting in high dividend yields. This can provide a steady stream of income for investors.

- Professional Management: REITs are managed by experienced professionals who handle the day-to-day operations of the properties, including leasing, maintenance, and property management. This frees up investors from the complexities of direct property ownership.

- Liquidity: REITs are publicly traded on stock exchanges, providing investors with liquidity and the ability to buy or sell shares easily.

- Access to Large-Scale Investments: REITs allow investors to invest in large-scale real estate projects that they may not be able to afford on their own. This provides access to a wider range of investment opportunities.

Career Paths in the REIT Industry: Is Real Estate Investment Trusts A Good Career Path

The REIT industry offers a diverse range of career paths for individuals with various skills and interests. From finance and accounting to property management and asset management, REIT companies require a wide range of professionals to manage their real estate portfolios effectively.

Key Roles and Responsibilities in REIT Companies

REIT companies are structured similarly to other corporations, with various departments and roles working together to achieve the organization’s goals. The key roles within REIT companies can be broadly categorized into:

- Finance and Accounting: These professionals are responsible for managing the company’s financial health, including financial reporting, budgeting, and investor relations. Examples of roles in this department include:

- Financial Analyst

- Controller

- Chief Financial Officer (CFO)

- Property Management: This department focuses on the day-to-day operations of the REIT’s properties, including tenant relations, maintenance, and leasing. Some common roles include:

- Property Manager

- Leasing Agent

- Maintenance Technician

- Asset Management: Asset management professionals are responsible for acquiring, developing, and managing the REIT’s real estate portfolio. They conduct market research, analyze investment opportunities, and oversee the development and renovation of properties. Some typical roles in this department include:

- Asset Manager

- Portfolio Manager

- Real Estate Analyst

- Legal and Compliance: REITs operate in a highly regulated industry, so legal and compliance professionals are essential for ensuring the company complies with all applicable laws and regulations. These roles may include:

- General Counsel

- Compliance Officer

Skills and Qualifications for REIT Careers

A successful career in the REIT industry requires a blend of specialized skills, academic qualifications, and professional credentials. These elements equip individuals with the knowledge and expertise to thrive in this dynamic and competitive field.

Essential Skills for REIT Professionals

These skills are crucial for success in REIT roles. They encompass financial acumen, real estate expertise, and effective communication abilities.

- Financial Analysis: REIT professionals must possess strong analytical skills to evaluate financial statements, analyze investment opportunities, and assess risk. Proficiency in financial modeling, valuation techniques, and investment analysis is essential.

- Real Estate Knowledge: A deep understanding of real estate markets, property types, and investment strategies is fundamental. This includes knowledge of real estate cycles, property valuation, and legal aspects of real estate transactions.

- Communication Skills: Effective communication is vital for building relationships with investors, tenants, and other stakeholders. Strong written and verbal communication skills are essential for preparing reports, presenting proposals, and negotiating deals.

- Problem-Solving and Decision-Making: REIT professionals face complex challenges, requiring analytical thinking, critical judgment, and the ability to make sound decisions under pressure.

- Teamwork and Collaboration: REITs often operate in a team-oriented environment, demanding strong interpersonal skills, the ability to work collaboratively, and the capacity to contribute to a shared goal.

Educational Qualifications for REIT Careers

REIT employers typically seek candidates with a strong educational background in finance or real estate.

- Bachelor’s Degree: A bachelor’s degree in finance, real estate, business administration, or a related field is often a minimum requirement for entry-level positions. These programs provide a foundation in financial principles, real estate concepts, and business practices.

- Master’s Degree: A master’s degree in real estate, finance, or a related field can enhance career prospects and open doors to more senior roles. These programs offer advanced knowledge in areas such as real estate investment, property management, and financial analysis.

- Specialized Certifications: Industry-specific certifications can demonstrate specialized knowledge and enhance credibility. Examples include the Certified Commercial Investment Member (CCIM) designation, the Certified Property Manager (CPM) designation, and the Certified Financial Analyst (CFA) charter.

Industry Certifications and Licenses

Specific certifications and licenses can enhance credibility and open doors to specific career paths within the REIT industry.

- Certified Commercial Investment Member (CCIM): This designation is highly regarded in the commercial real estate industry and signifies expertise in investment analysis, market analysis, and financial analysis. It is particularly valuable for professionals involved in acquiring, managing, and selling commercial properties.

- Certified Property Manager (CPM): This designation demonstrates expertise in property management principles and practices. It is particularly relevant for professionals working in property management roles, overseeing the day-to-day operations of REIT-owned properties.

- Certified Financial Analyst (CFA): The CFA charter is a globally recognized designation that signifies expertise in investment analysis, portfolio management, and wealth management. It is particularly relevant for professionals working in investment analysis and portfolio management roles within REITs.

The Competitive Landscape

The REIT industry is a dynamic and competitive landscape, with a wide range of companies vying for investor capital and market share. Understanding the competitive dynamics within the REIT industry is crucial for anyone considering a career in this sector.

Factors Influencing Career Growth and Advancement Opportunities

Career growth and advancement opportunities within REITs are influenced by several key factors.

- Performance: Strong individual and team performance are essential for career progression. Demonstrating a track record of success in meeting or exceeding goals is a key requirement for promotions.

- Education and Certifications: While not always mandatory, pursuing relevant education and certifications, such as the Certified Commercial Investment Member (CCIM) designation or a Master of Business Administration (MBA) with a focus on real estate, can enhance career prospects and open doors to higher-level positions.

- Networking: Building strong relationships with industry professionals and peers through networking events, conferences, and professional organizations is vital for career advancement. These connections can provide valuable insights, mentorship opportunities, and potential job leads.

- Leadership Skills: REITs often seek individuals with strong leadership skills, including the ability to motivate teams, delegate tasks effectively, and make sound decisions.

- Adaptability: The REIT industry is constantly evolving, so individuals who are adaptable and able to embrace new technologies and market trends will have a competitive edge.

Current and Future Trends Impacting the REIT Industry

The REIT industry is subject to a variety of trends that can impact career opportunities and growth prospects.

- Technological Advancements: Technology is playing an increasingly important role in the REIT industry, from property management and leasing to data analytics and investment decision-making. Individuals with expertise in proptech (property technology) will be in high demand.

- Sustainability and ESG Investing: Investors are increasingly prioritizing environmental, social, and governance (ESG) factors in their investment decisions. REITs are responding by focusing on sustainable practices and reporting on ESG performance, creating new career opportunities in these areas.

- Shifting Demographics: Changes in demographics, such as an aging population and urbanization, are influencing demand for different types of real estate. REITs are adapting to these shifts, creating opportunities for professionals with expertise in specific sectors, such as senior housing or data centers.

- Interest Rate Fluctuations: Interest rate changes can impact the cost of financing for REITs and influence their investment decisions. Professionals with expertise in financial modeling and risk management will be in high demand in a fluctuating interest rate environment.

Job Market and Opportunities

The REIT industry offers a diverse range of career paths with ample opportunities for growth and development. The demand for skilled professionals in this sector remains strong, driven by the continued expansion of the REIT market and the increasing complexity of real estate investments.

Current Job Market Trends

The job market for REIT professionals is currently experiencing steady growth. According to a recent report by the National Association of Real Estate Investment Trusts (NAREIT), the number of REIT employees has been steadily increasing over the past few years. This growth is attributed to factors such as the increasing popularity of REITs as an investment vehicle, the rising demand for commercial real estate, and the ongoing need for expertise in managing complex real estate assets.

Tips for Breaking into the REIT Industry

Breaking into the REIT industry requires a strategic approach. This means networking, showcasing your skills, and preparing for interviews. Here’s a breakdown of key strategies to help you succeed.

Networking and Building Relationships

Networking is essential for landing a job in the REIT industry. Building relationships with professionals in the field can provide valuable insights, potential job leads, and mentorship opportunities.

- Attend Industry Events: Industry conferences, seminars, and networking events offer excellent opportunities to meet potential employers and learn about current trends.

- Join Professional Organizations: Organizations like the National Association of Real Estate Investment Trusts (NAREIT) provide networking opportunities, educational resources, and industry updates.

- Connect on LinkedIn: LinkedIn is a powerful tool for connecting with professionals in the REIT industry. Build a strong profile, join relevant groups, and reach out to individuals you’d like to connect with.

- Reach Out to Alumni: If you have attended a university with a strong real estate program, connect with alumni working in the REIT industry. They can offer valuable insights and guidance.

- Volunteer: Volunteering for organizations related to real estate can expose you to industry professionals and provide opportunities to gain experience.

Creating a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression on potential employers. They should showcase your relevant skills, experience, and passion for the REIT industry.

- Highlight Relevant Skills: Focus on skills that are highly sought after in the REIT industry, such as financial analysis, real estate valuation, market research, and property management.

- Quantify Your Achievements: Use numbers and data to demonstrate your impact in previous roles. For example, instead of saying “managed a portfolio of properties,” state “managed a portfolio of 10 properties, generating a 10% return on investment.”

- Tailor Your Resume and Cover Letter: Customize your resume and cover letter to each specific job you apply for. Research the company and highlight your skills and experience that align with the job requirements.

- Showcase Your Passion: Express your enthusiasm for the REIT industry and demonstrate your knowledge of the sector.

- Proofread Carefully: Errors in grammar and spelling can create a negative impression. Proofread your resume and cover letter carefully before submitting them.

Preparing for Interviews, Is real estate investment trusts a good career path

Interviews are a crucial part of the hiring process. Preparation is key to making a positive impression and showcasing your skills and experience.

- Research the Company: Learn about the company’s history, its current projects, and its investment strategy. This will help you understand the company’s culture and how your skills align with their goals.

- Practice Your Answers: Anticipate common interview questions and practice your responses. This will help you feel more confident and prepared.

- Prepare Questions: Asking thoughtful questions about the company and the role demonstrates your interest and engagement.

- Dress Professionally: First impressions matter. Dress professionally for your interview to show respect for the company and the hiring manager.

- Be Yourself: Authenticity is key. Relax, be yourself, and let your passion for the REIT industry shine through.

The world of REITs offers a diverse range of career paths, each with its own unique challenges and rewards. From financial analysis to property management, the industry demands a combination of analytical skills, business acumen, and a deep understanding of the real estate market. If you’re passionate about real estate, enjoy working with numbers, and are driven by the potential for growth, then a career in REITs could be the right fit for you. However, be prepared for a competitive environment, long hours, and the cyclical nature of the industry. By carefully considering the pros and cons, you can make an informed decision about whether a REIT career aligns with your aspirations.

Questions Often Asked

What is the average salary for a REIT professional?

Salaries for REIT professionals vary depending on experience, location, and specific role. However, entry-level positions can start around $60,000-$80,000 per year, while experienced professionals can earn upwards of $150,000 or more.

What are some of the top REIT companies to work for?

Some of the top REIT companies include: American Tower Corporation, Equity Residential, Prologis, Realty Income Corporation, and Simon Property Group. These companies are known for their strong financial performance, industry leadership, and commitment to employee development.

What are some of the challenges of working in the REIT industry?

Some of the challenges include: long hours, a competitive environment, cyclical industry trends, and the potential for high stress levels. However, these challenges are often balanced by the potential for high earnings, job security, and the opportunity to make a real impact in the real estate market.

A career in real estate investment trusts (REITs) can be rewarding, but it requires a deep understanding of the market and financial acumen. One aspect of REITs that investors often consider is the use of an LLC for property ownership, which can offer tax benefits and liability protection. If you’re thinking of investing in real estate through REITs, learning more about LLC loans for investment property can be a valuable step in your research.

This can help you navigate the complex world of REITs and make informed decisions about your investments.

A career in real estate investment trusts can be fulfilling, but it often requires significant capital. If you’re looking to get started in real estate investing without a large down payment, you might consider exploring creative financing options, such as learning about how to buy an investment property with no money down. This approach can provide a stepping stone into the world of real estate investing, which could potentially lead to a career in REITs down the line.

A career in real estate investment trusts (REITs) can be rewarding, especially with the potential for strong returns. If you’re considering a career in this field, understanding the intricacies of the real estate market is crucial. One area to explore is the booming Houston market, with its diverse range of investment properties in Houston. By analyzing trends in this market, you can gain valuable insights into the REIT industry and make informed decisions about your career path.

A career in real estate investment trusts (REITs) can be exciting and lucrative, especially if you’re interested in diversifying your portfolio. One area of focus within REITs is luxury properties investment , which can offer significant returns but also requires a deeper understanding of high-end markets and discerning clientele. Whether you’re drawn to the potential of luxury properties or prefer a broader approach to REITs, a well-rounded understanding of the real estate market is crucial for success in this competitive field.

A career in real estate investment trusts (REITs) can be rewarding, especially if you have a keen eye for identifying lucrative investment opportunities. To maximize your chances of success, it’s essential to understand the best cities for investment properties, such as those listed in this comprehensive guide best cities for investment properties. By focusing on these locations, you can leverage market trends and capitalize on strong rental demand, ultimately increasing your returns and building a successful REIT portfolio.