Car Insurance California A Comprehensive Guide

Car insurance California is a vital component of responsible driving in the Golden State. Navigating the complexities of insurance requirements, coverage options, and cost factors can feel overwhelming. This guide provides a comprehensive overview of car insurance in California, covering everything from mandatory insurance requirements to safe driving practices and managing your policy.

Understanding the intricacies of car insurance in California can be challenging. This guide aims to simplify the process by providing clear explanations of key concepts and offering practical advice for choosing the right policy, driving safely, and managing your insurance needs effectively.

Understanding California Car Insurance

Navigating the world of car insurance in California can feel overwhelming, especially with the various requirements and options available. This guide aims to demystify the process, providing you with the knowledge you need to make informed decisions about your car insurance.

Mandatory Insurance Requirements in California

California law mandates that all vehicle owners carry a minimum amount of liability insurance to protect themselves and others from financial losses in case of an accident. This insurance is referred to as “Financial Responsibility” and covers bodily injury and property damage caused by an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other party if you are at fault in an accident. The minimum requirement is $15,000 per person and $30,000 per accident.

- Property Damage Liability: This coverage pays for damages to the other party’s vehicle or property if you are at fault in an accident. The minimum requirement is $5,000.

It is important to note that these are only minimum requirements, and you may want to consider purchasing higher limits to protect yourself from potentially significant financial liabilities.

Types of Car Insurance Coverage in California

Beyond the mandatory liability insurance, several other types of coverage are available to address various scenarios.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. It covers damage caused by hitting another vehicle, an object, or even a pothole. This coverage is typically optional but can be beneficial if your vehicle is relatively new or has a high value.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by non-collision events such as theft, vandalism, fire, hail, or natural disasters. It is optional but can be valuable, especially if your vehicle is financed or leased.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you and your passengers if you are involved in an accident with an uninsured or underinsured driver. It helps pay for medical expenses, lost wages, and other damages. It is typically optional but highly recommended as it provides an extra layer of protection.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of fault, if you are injured in an accident. It is optional and can be useful for covering out-of-pocket medical costs that your health insurance may not cover.

Factors Influencing Car Insurance Premiums in California

Several factors determine the cost of your car insurance premium. Understanding these factors can help you make informed decisions to potentially reduce your premium.

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your premium. A clean driving record typically translates to lower premiums.

- Age and Gender: Younger drivers generally pay higher premiums due to their higher risk of accidents. Gender can also play a role, with males generally paying higher premiums than females.

- Vehicle Type: The make, model, year, and value of your vehicle can influence your premium. Higher-performance or luxury vehicles tend to have higher premiums due to their higher repair costs and potential for higher claims.

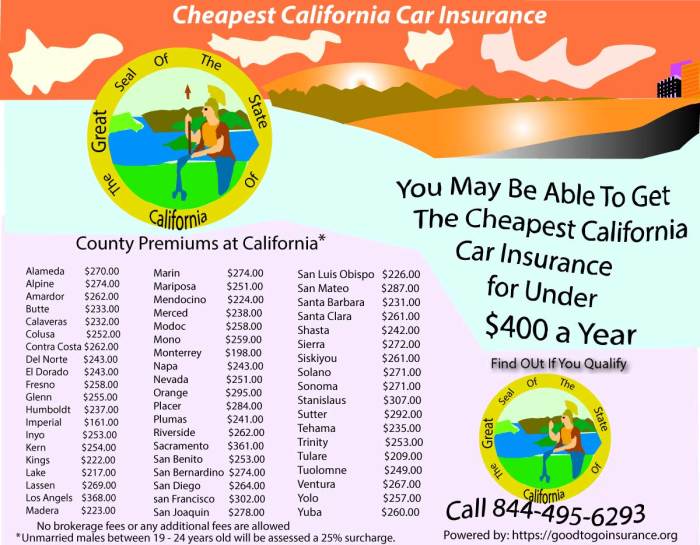

- Location: Your zip code can impact your premium due to factors such as traffic density, accident rates, and theft rates in your area. Areas with higher risk factors typically have higher premiums.

- Credit Score: In some states, including California, insurance companies can use your credit score as a factor in determining your premium. A higher credit score can indicate a lower risk profile, potentially leading to lower premiums.

- Coverage Levels: The amount of coverage you choose, such as higher liability limits or additional coverage options, will naturally impact your premium. More coverage generally translates to a higher premium.

- Deductibles: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but you will need to pay more out-of-pocket in case of a claim.

Common Insurance Add-ons in California

In addition to the standard coverage options, several add-ons can enhance your car insurance policy.

- Roadside Assistance: This coverage provides assistance in case of a breakdown, flat tire, or other roadside emergencies. It can include services such as towing, jump starts, and tire changes.

- Rental Car Reimbursement: This coverage pays for a rental car while your vehicle is being repaired after an accident. It can be beneficial if you rely on your vehicle for daily transportation.

- Gap Insurance: This coverage pays the difference between your vehicle’s actual cash value and the amount you owe on your loan or lease if your vehicle is totaled in an accident. It can be valuable if you have a new vehicle or a high loan balance.

Choosing the Right Car Insurance in California: Car Insurance California

Finding the right car insurance in California can feel like navigating a maze. With so many options available, it’s crucial to understand the factors that matter most and make informed decisions. This section will guide you through the process of selecting the best car insurance policy for your needs.

Comparing Car Insurance Providers in California

Choosing the right car insurance provider involves comparing different companies based on factors like coverage, pricing, customer service, and financial stability. Here’s a breakdown of key aspects to consider:

- Coverage Options: Every insurance company offers various coverage options, each with its own benefits and costs. It’s important to compare the types of coverage offered by different providers and ensure they meet your specific needs. For instance, if you have a high-value car, you might need comprehensive and collision coverage.

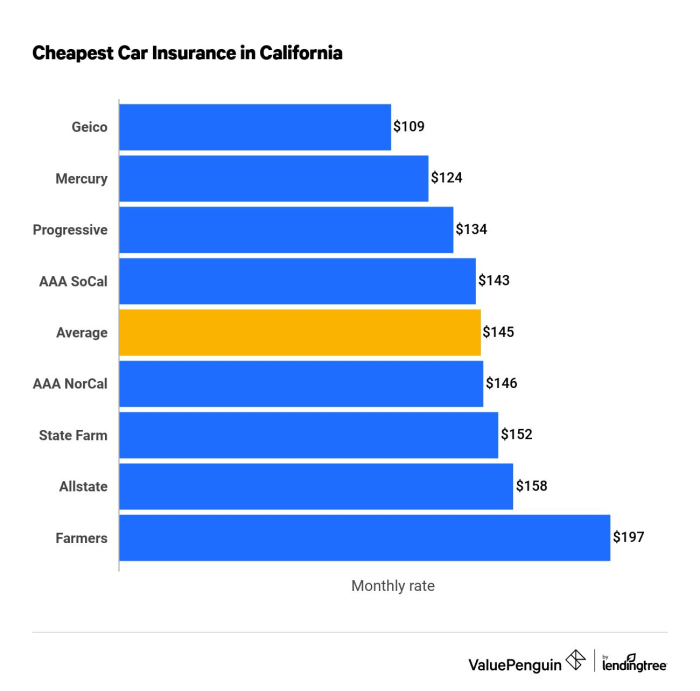

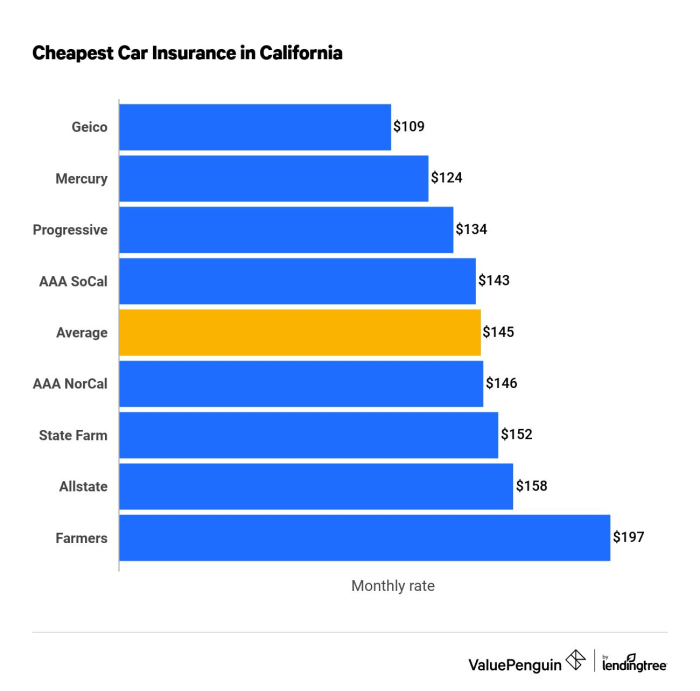

- Pricing: Car insurance premiums can vary significantly across providers. It’s essential to get quotes from multiple companies to compare prices and find the most affordable option without compromising coverage. Factors like your driving history, vehicle type, and location influence premium costs.

- Customer Service: Good customer service is crucial, especially when dealing with claims or policy changes. Look for providers with a strong reputation for responsiveness, accessibility, and helpfulness. Consider reading customer reviews or contacting the California Department of Insurance to check for any complaints against specific providers.

- Financial Stability: Choose a financially stable company with a good track record of paying claims promptly and fairly. You can assess a provider’s financial health by checking their ratings from organizations like AM Best or Standard & Poor’s.

Key Features to Consider

Beyond comparing providers, it’s crucial to understand the key features of a car insurance policy and how they impact your coverage and costs. Here are some essential aspects to consider:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It typically covers medical expenses, lost wages, and property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This coverage protects you from damages caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually results in lower premiums, but you’ll have to pay more if you file a claim.

- Premium Payment Options: Most insurers offer various payment options, such as monthly, quarterly, or annual payments. Choose an option that fits your budget and financial planning.

Importance of Getting Multiple Quotes

Obtaining quotes from several car insurance providers is essential for finding the best deal. Each company uses different algorithms to calculate premiums, so you might find significant variations in pricing.

“Never settle for the first quote you receive. Take the time to compare quotes from multiple companies to ensure you’re getting the best value for your money.”

Role of Discounts and Promotions

Car insurance companies often offer discounts and promotions to attract new customers and retain existing ones. These discounts can significantly reduce your premium costs. Here are some common discounts:

- Good Driver Discount: This discount is typically offered to drivers with a clean driving record and no accidents or traffic violations.

- Safe Driver Discount: Some companies offer discounts to drivers who have completed defensive driving courses or have installed safety features in their vehicles.

- Multi-Car Discount: You may receive a discount if you insure multiple vehicles with the same company.

- Multi-Policy Discount: Insurers often offer discounts if you bundle your car insurance with other types of insurance, such as homeowners or renters insurance.

- Loyalty Discount: Some companies reward long-term customers with discounts for their continued business.

Driving Safely in California

California is renowned for its diverse landscapes and bustling cities, making it a popular destination for driving. However, the state’s unique driving conditions and high traffic volume necessitate a commitment to safe driving practices.

Safe Driving Practices

Adopting safe driving practices is essential for minimizing the risk of accidents and ensuring the safety of yourself and others on the road. Here are some crucial practices to follow:

- Obey the Speed Limit: Speeding is a leading cause of accidents. Adhering to the posted speed limit is crucial for maintaining control of your vehicle and reacting to unexpected situations.

- Avoid Distracted Driving: Distracted driving, such as texting, talking on the phone, or eating while driving, significantly increases the risk of accidents. Focus your attention on the road at all times.

- Maintain a Safe Following Distance: Allowing ample space between your vehicle and the car in front of you provides you with the time and distance needed to brake safely in case of sudden stops.

- Be Aware of Your Surroundings: Stay alert and observant of your surroundings, including other vehicles, pedestrians, cyclists, and road conditions. Be prepared to react to potential hazards.

- Avoid Aggressive Driving: Aggressive driving behaviors, such as tailgating, speeding, and weaving in and out of traffic, increase the likelihood of accidents. Maintain a calm and defensive driving approach.

- Use Turn Signals: Signaling your intentions clearly with turn signals helps other drivers anticipate your movements and avoid collisions.

- Be Cautious at Intersections: Intersections are common accident locations. Be extra cautious and yield to pedestrians and oncoming traffic.

- Drive Defensively: Anticipate the actions of other drivers and be prepared to react accordingly. Assume other drivers may make mistakes and adjust your driving accordingly.

- Avoid Driving Under the Influence: Driving under the influence of alcohol or drugs is illegal and extremely dangerous. Always choose a designated driver or use a ride-sharing service if you plan to consume alcohol.

Common Traffic Violations and Penalties

Traffic violations are common occurrences in California, and it’s essential to understand the associated penalties to avoid fines, points on your driving record, and potential license suspension.

| Violation | Penalty |

|---|---|

| Speeding | Fines ranging from $238 to $490, plus court fees and potential points on your driving record. |

| Driving Under the Influence (DUI) | Fines, jail time, license suspension, and potential vehicle impoundment. |

| Running a Red Light | Fines of $490, plus court fees and potential points on your driving record. |

| Driving Without Insurance | Fines of up to $1,000, plus court fees and potential license suspension. |

| Texting While Driving | Fines of $162, plus court fees and potential points on your driving record. |

| Failing to Yield to Pedestrians | Fines of $238, plus court fees and potential points on your driving record. |

Navigating California’s Unique Driving Conditions

California’s diverse geography presents unique driving challenges, from mountainous roads to dense urban traffic. Understanding these conditions and adapting your driving accordingly is crucial for safety.

- Mountain Driving: Be prepared for steep grades, winding roads, and potential hazards like rockfalls and snow. Drive slowly, use lower gears, and avoid passing on curves.

- Urban Driving: Expect heavy traffic, congested streets, and aggressive drivers. Be patient, use defensive driving techniques, and be aware of your surroundings.

- Coastal Driving: Coastal roads can be scenic but can also be prone to fog, strong winds, and potential hazards like wildlife crossings. Be cautious, reduce speed, and use headlights in foggy conditions.

- Desert Driving: Desert roads can be long and desolate, with limited services and potential for extreme temperatures. Plan your route, check your vehicle, and carry plenty of water and supplies.

Defensive Driving Techniques, Car insurance california

Defensive driving techniques are essential for anticipating potential hazards and reacting safely in challenging driving situations. These techniques help you stay alert, maintain control, and avoid accidents.

- Maintain a Safe Following Distance: Always leave enough space between your vehicle and the car in front of you to react safely to sudden stops or changes in traffic.

- Scan the Road Ahead: Look far ahead to anticipate potential hazards, such as stopped vehicles, pedestrians, or road debris.

- Check Your Mirrors Regularly: Be aware of vehicles around you and be prepared to react to their movements.

- Use Your Turn Signals: Signaling your intentions clearly with turn signals helps other drivers anticipate your movements and avoid collisions.

- Be Patient: Avoid aggressive driving behaviors and maintain a calm and collected approach.

- Avoid Distractions: Put away your phone, avoid eating while driving, and focus your attention on the road.

- Be Prepared for the Unexpected: Assume other drivers may make mistakes and be prepared to react accordingly.

Managing Your Car Insurance Policy

Having car insurance in California is essential, and understanding how to manage your policy effectively is crucial. This includes knowing how to file a claim, protecting yourself from scams, updating your policy, and ensuring your contact information is accurate.

Filing a Claim

If you’re involved in an accident, you’ll need to file a claim with your car insurance provider. This process typically involves contacting your insurer, providing details about the accident, and submitting supporting documentation.

- Contact your insurer: Immediately after the accident, contact your insurance company. They will provide you with instructions on how to file a claim and the necessary documentation you need.

- Provide details of the accident: Include the date, time, location, and description of the accident. Also, list the names and contact information of all parties involved, including witnesses.

- Submit supporting documentation: Gather any relevant documents, such as a police report, photos of the damage, and medical records.

Avoiding Car Insurance Scams

Car insurance scams can be a serious issue. Being aware of common scams can help you protect yourself from financial losses.

- Staged accidents: Be cautious of individuals who deliberately cause accidents to file fraudulent claims.

- Fake injury claims: Be aware of individuals who exaggerate or fabricate injuries to receive higher payouts.

- Stolen vehicle claims: Be vigilant about protecting your car from theft and report any suspicious activity to the authorities.

Updating Your Car Insurance Policy

Your car insurance policy should be updated regularly to reflect changes in your situation.

- Changes in vehicle ownership: If you buy or sell a car, update your policy to reflect the new ownership.

- Changes in driving habits: If you start driving less or more frequently, or change your driving habits, update your policy accordingly.

- Changes in your personal information: Ensure your address, phone number, and email address are up-to-date with your insurer.

Maintaining Accurate Contact Information

Keeping your contact information updated with your insurer is essential for timely communication.

- Prompt claim processing: Accurate contact information allows your insurer to reach you quickly in case of an accident, speeding up the claim process.

- Policy updates and notifications: Your insurer can send important policy updates, renewal notices, and other notifications directly to you.

- Avoid delays and misunderstandings: Maintaining updated contact information helps prevent delays and misunderstandings that can arise from missed communications.

Additional Resources for California Drivers

Navigating the world of car insurance in California can be overwhelming, but there are numerous resources available to help you make informed decisions. These resources provide valuable information, support, and guidance to ensure you understand your rights and obligations as a California driver.

Websites and Organizations

These websites and organizations offer a wealth of information on car insurance in California, including regulations, consumer tips, and resources for finding the right coverage:

- California Department of Insurance (CDI): The CDI is the primary regulatory body for insurance in California. Their website provides comprehensive information on car insurance laws, consumer rights, and complaint filing procedures. You can also find a directory of licensed insurance companies and agents.

Website: https://www.insurance.ca.gov/ - California Department of Motor Vehicles (DMV): The DMV handles vehicle registration, driver’s licenses, and other vehicle-related matters. Their website provides information on required insurance coverage, financial responsibility laws, and other important topics related to driving in California.

Website: https://www.dmv.ca.gov/ - National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that promotes uniformity in insurance regulations across states. Their website offers resources for consumers, including information on insurance products, consumer protection, and industry trends.

Website: https://www.naic.org/ - Consumer Reports: Consumer Reports provides independent ratings and reviews of insurance companies, helping you compare quotes and find the best value for your needs.

Website: https://www.consumerreports.org/ - Insurance Information Institute (III): The III is a non-profit organization that provides information and resources on insurance issues. Their website offers articles, statistics, and tools to help you understand car insurance and make informed decisions.

Website: https://www.iii.org/

Contact Information for the California Department of Motor Vehicles (DMV)

The DMV offers a variety of services and resources for California drivers, including information on car insurance requirements. You can contact the DMV by phone, email, or mail.

- Phone: 1-800-777-0133

- Email: [email protected]

- Mail: California Department of Motor Vehicles, P.O. Box 942840, Sacramento, CA 94242-8400

Car Insurance Resources for Specific Demographics

Understanding your specific needs and circumstances is crucial when choosing car insurance. Here is a table highlighting resources for different demographics:

| Demographic | Resources |

|---|---|

| Seniors (65+ years old) |

|

| Young Drivers (Under 25 years old) |

|

Understanding California’s Insurance Regulations

California has a comprehensive set of insurance regulations designed to protect drivers and ensure fair practices. It is important to understand these regulations to make informed decisions about your car insurance.

- Financial Responsibility Law: This law requires all drivers to have financial responsibility, typically through car insurance, to cover damages caused by accidents.

Minimum coverage requirements: $15,000 for injury or death to one person, $30,000 for injury or death to multiple people, and $5,000 for property damage.

- Uninsured Motorist Coverage (UM): This coverage protects you if you are injured in an accident caused by an uninsured or underinsured driver. It is required in California, and you can choose to purchase higher limits than the minimum required.

- Underinsured Motorist Coverage (UIM): This coverage helps cover your losses if the other driver’s insurance policy is not enough to cover your damages.

- California’s “No-Fault” System: California operates under a “no-fault” system for personal injury protection (PIP) coverage, which is part of your car insurance policy. This means that you can file a claim with your own insurer for medical expenses and lost wages regardless of who caused the accident.

Driving in California requires understanding the state’s unique driving conditions and adhering to its traffic laws. By equipping yourself with knowledge about car insurance, safe driving practices, and effective policy management, you can navigate the roads with confidence and peace of mind. Remember, car insurance is not just a legal requirement but a crucial investment in your safety and financial security.

FAQ Corner

How much does car insurance cost in California?

Car insurance costs in California vary based on factors such as your driving record, age, vehicle type, and location. It’s recommended to get quotes from multiple providers to compare rates.

What happens if I get into an accident without car insurance in California?

Driving without car insurance in California is illegal and can result in fines, license suspension, and even jail time. Additionally, you may be held financially responsible for any damages or injuries caused in an accident.

What are the different types of car insurance discounts available in California?

Common car insurance discounts in California include good driver discounts, safe driver discounts, multi-car discounts, and discounts for safety features like anti-theft devices.