Find the Best Car Insurance in NY

Navigating the world of car insurance in New York can be a daunting task. Finding the best car insurance in NY involves understanding the unique factors that influence rates, from mandatory coverages to individual risk profiles. This guide aims to demystify the process, equipping you with the knowledge to make informed decisions and secure the best coverage for your needs.

New York’s car insurance landscape is shaped by a variety of factors, including mandatory coverages, driving history, vehicle type, and even your credit score. Understanding these factors is crucial for determining your individual insurance premiums and finding the most competitive rates.

Understanding New York’s Car Insurance Landscape

Navigating the world of car insurance in New York can feel overwhelming, especially with the unique factors that influence rates and the specific requirements for coverage. This guide aims to demystify the process, providing a clear understanding of the New York car insurance landscape.

Factors Influencing Car Insurance Rates

New York’s car insurance rates are determined by a complex interplay of factors. Understanding these factors can help you make informed decisions and potentially save money on your premiums.

- Driving History: Your driving record, including accidents, traffic violations, and even the number of years you’ve been driving, significantly impacts your rates. A clean record generally leads to lower premiums.

- Vehicle Type: The make, model, and year of your vehicle play a crucial role. Certain car models are considered riskier to insure due to factors like theft susceptibility, repair costs, and safety features.

- Location: Your zip code and the surrounding area influence your rates. Areas with higher crime rates, traffic congestion, or a history of accidents tend to have higher premiums.

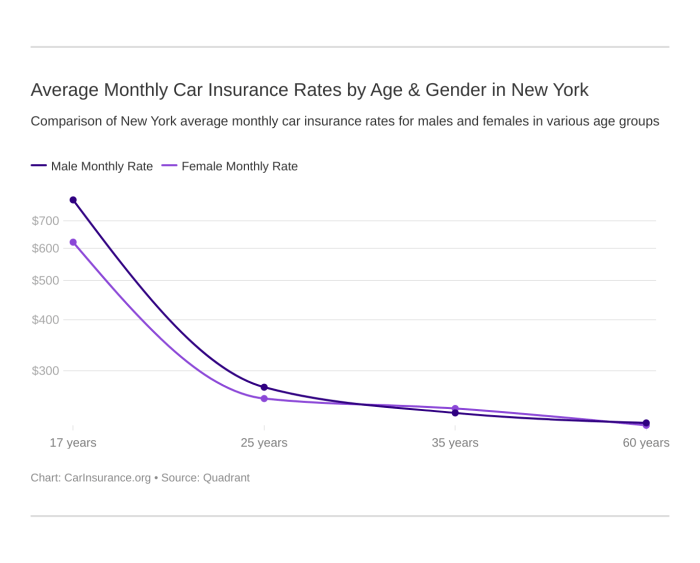

- Age and Gender: Statistically, younger and less experienced drivers tend to have higher insurance rates due to a higher risk of accidents. Gender can also play a role, although this is becoming less of a factor in many states.

- Credit Score: In New York, insurance companies can use your credit score to assess your risk. A good credit score can often translate to lower premiums, while a poor score may result in higher rates.

- Coverage Levels: The amount of coverage you choose, such as liability limits and comprehensive/collision coverage, will directly affect your premium. Higher coverage levels generally mean higher premiums.

Mandatory Insurance Coverages, Best car insurance in ny

New York State mandates specific car insurance coverages to protect both drivers and the public. These coverages are essential and must be maintained at all times.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers the costs of medical bills, lost wages, and property repairs up to the policy limits.

- Personal Injury Protection (PIP): This coverage covers medical expenses and lost wages for you and your passengers, regardless of who caused the accident. It’s also known as “no-fault” insurance because it pays regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

Types of Car Insurance in New York

New York offers various types of car insurance to meet different needs and budgets. Understanding these options can help you choose the coverage that best suits your situation.

- Liability Coverage: This is the most basic type of insurance, providing financial protection for injuries and property damage caused to others. It’s required by law in New York.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s optional but highly recommended.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, or natural disasters. It’s also optional but can be beneficial.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. It’s required by law in New York.

- Personal Injury Protection (PIP): This coverage covers medical expenses and lost wages for you and your passengers, regardless of who caused the accident. It’s required by law in New York.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault. It’s optional and can supplement PIP coverage.

- Rental Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged and needs repairs.

- Roadside Assistance: This coverage provides assistance with services like towing, flat tire changes, and jump starts.

Choosing the Best Car Insurance Provider

Choosing the right car insurance provider in New York is crucial, as it can significantly impact your financial well-being in case of an accident. You’ll need to consider factors like price, coverage options, customer service, and claims processing to find the best fit for your needs.

Reputable Car Insurance Providers in New York

A wide range of reputable car insurance companies operate in New York, offering various coverage options and pricing structures.

- Geico: Known for its competitive pricing and straightforward online experience, Geico offers a range of discounts and excellent customer service. However, their coverage options might not be as extensive as some other providers.

- State Farm: State Farm is a well-established insurer with a strong reputation for customer satisfaction and a wide network of agents. They offer a variety of coverage options and discounts, but their premiums can be higher than some competitors.

- Progressive: Progressive is known for its innovative approach to car insurance, including its popular “Name Your Price” tool. They offer a wide range of coverage options and discounts, and their customer service is generally well-regarded. However, some customers have reported issues with claims processing.

- Allstate: Allstate offers a comprehensive range of coverage options and discounts, including accident forgiveness and ride-sharing coverage. They also have a strong reputation for customer service and claims processing. However, their premiums can be higher than some competitors.

- Liberty Mutual: Liberty Mutual offers a variety of coverage options and discounts, including accident forgiveness and new car replacement. They also have a strong reputation for customer service and claims processing. However, their premiums can be higher than some competitors.

Comparing Key Features and Pricing

The following table compares key features and pricing of top-rated car insurance providers in New York. It’s important to note that these prices are estimates and can vary based on individual factors like driving history, vehicle type, and location.

| Provider | Average Annual Premium | Customer Service Rating | Claims Processing Rating | Discounts |

|---|---|---|---|---|

| Geico | $1,200 | 4.5/5 | 4/5 | Good Driver, Multi-Car, Safe Driver, etc. |

| State Farm | $1,350 | 4.7/5 | 4.2/5 | Good Driver, Multi-Car, Safe Driver, etc. |

| Progressive | $1,150 | 4.3/5 | 3.8/5 | Good Driver, Multi-Car, Safe Driver, etc. |

| Allstate | $1,400 | 4.6/5 | 4.1/5 | Good Driver, Multi-Car, Safe Driver, etc. |

| Liberty Mutual | $1,300 | 4.4/5 | 4/5 | Good Driver, Multi-Car, Safe Driver, etc. |

Navigating the Claims Process: Best Car Insurance In Ny

In the event of an accident, navigating the claims process is crucial. Knowing the steps involved and understanding your rights can make the process smoother and ensure you receive the compensation you deserve.

Filing a Car Insurance Claim in New York

Once you’ve been involved in an accident, the first step is to file a claim with your insurance company. This involves reporting the accident and providing details about the incident.

- Report the Accident: Contact your insurance company as soon as possible after the accident. They will guide you through the reporting process and provide instructions on what to do next.

- Provide Accident Details: Be prepared to provide information such as the date, time, location of the accident, the names and contact information of all parties involved, and the details of any injuries sustained.

- File a Claim: Your insurance company will guide you through the process of filing a claim, which typically involves completing a claim form and providing supporting documentation.

Documenting Accidents and Communicating with the Insurance Company

Thorough documentation is essential for a successful claims process. This includes taking photos of the accident scene, collecting contact information from witnesses, and obtaining a copy of the police report.

- Take Photos and Videos: Document the damage to your vehicle, the accident scene, and any injuries sustained. This visual evidence can be crucial in supporting your claim.

- Gather Witness Information: Collect contact information from anyone who witnessed the accident. Their statements can provide valuable insights into the events leading up to the accident.

- Obtain a Police Report: If the accident involved injuries or property damage exceeding a certain threshold, a police report will be required. Request a copy of the report from the police department.

- Communicate Clearly and Promptly: Maintain open and clear communication with your insurance company throughout the claims process. Respond to their requests for information promptly and provide accurate details.

Handling Disputes or Challenges

Disputes or challenges can arise during the claims process. It’s important to understand your rights and options in such situations.

- Review the Policy: Carefully review your insurance policy to understand your coverage and the process for handling disputes.

- Negotiate with the Insurance Company: If you disagree with the insurance company’s assessment or decision, attempt to negotiate a fair settlement. Be prepared to provide supporting documentation and evidence to justify your position.

- Consult with an Attorney: If you’re unable to reach a satisfactory agreement with the insurance company, consider consulting with an attorney specializing in insurance law. They can advise you on your rights and options and represent you in negotiations or legal proceedings.

Ultimately, finding the best car insurance in NY requires a personalized approach. By considering your individual needs, driving habits, and financial situation, you can compare quotes from reputable providers and secure the coverage that best fits your circumstances. Remember, taking the time to research and compare options can save you money and ensure you have the protection you need on the road.

Helpful Answers

What are the mandatory car insurance coverages in New York?

New York requires all drivers to carry liability insurance, which covers damage to other vehicles or injuries to other people in an accident you cause. You must also have personal injury protection (PIP) to cover medical expenses for yourself and passengers in your car.

How can I get a discount on my car insurance?

Many insurance companies offer discounts for good driving records, safe driving courses, bundling multiple insurance policies, and having safety features in your vehicle. You can also ask about discounts for being a member of certain organizations or having a good credit score.

What should I do if I get into an accident?

If you’re involved in an accident, it’s important to stay calm and prioritize safety. Exchange information with the other driver(s), call the police if necessary, and take pictures of the scene. Contact your insurance company as soon as possible to report the accident and begin the claims process.