Car Insurance in New York A Comprehensive Guide

Car insurance new york – Car insurance in New York is a crucial aspect of responsible driving, protecting you and others on the road. Understanding the intricacies of coverage, rates, and claims processes is essential for every driver in the state.

New York State mandates specific car insurance coverage, including liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. These requirements are designed to ensure financial protection for drivers and passengers involved in accidents.

Filing a Car Insurance Claim in New York: Car Insurance New York

Filing a car insurance claim in New York can be a stressful process, but understanding the steps involved can help you navigate it more smoothly. This guide will walk you through the process, providing information on how to gather necessary documentation and the role of the insurance adjuster.

The Process of Filing a Claim

Following an accident, you should contact your insurance company as soon as possible. You’ll need to provide details about the accident, including the date, time, location, and the other parties involved. The insurance company will then assign an adjuster to your claim.

Gathering Necessary Documentation, Car insurance new york

The following documentation is typically required for a car insurance claim in New York:

- Police report: If the accident involved injuries or property damage exceeding $1,000, you must file a police report. This report will document the details of the accident, including the names and contact information of all parties involved.

- Photographs of the damage: Take clear photos of the damage to your vehicle, including any injuries or damage to other vehicles or property.

- Medical records: If you sustained injuries, provide your insurance company with medical records documenting your treatment and expenses.

- Repair estimates: Obtain repair estimates from qualified mechanics for the damage to your vehicle.

- Proof of ownership: Provide your insurance company with your vehicle registration and title.

- Driver’s license: Ensure your driver’s license is valid and up-to-date.

The Role of the Insurance Adjuster

The insurance adjuster is responsible for investigating your claim and determining the extent of your coverage. They will review the documentation you provide and may conduct an inspection of your vehicle. The adjuster will then make a decision on whether to approve or deny your claim.

Car Insurance for High-Risk Drivers in New York

Securing car insurance in New York can be challenging for high-risk drivers. Insurance companies view these drivers as posing a greater risk of accidents and therefore charge higher premiums. This can make it difficult for high-risk drivers to find affordable insurance options.

Insurance Options for High-Risk Drivers

Drivers with poor driving records may have limited insurance options. However, several insurers specialize in providing coverage for high-risk drivers. These companies typically have higher premiums than standard insurers, but they offer more flexibility and may be willing to insure drivers with a history of accidents, violations, or DUI convictions.

- Non-Standard Insurers: These insurers specialize in insuring drivers with poor driving records. They may have higher premiums, but they offer more flexibility and may be willing to insure drivers who have been denied by other companies.

- State-Funded Programs: New York offers several state-funded programs that provide insurance for drivers who cannot afford it. These programs may have restrictions on coverage and premiums may still be higher than standard insurers.

- Comparison Websites: Using online comparison websites can help you find the best rates from different insurers. These websites allow you to compare quotes from multiple companies at once, which can save you time and money.

Impact of SR-22 Requirements on Insurance Premiums

An SR-22 is a certificate of financial responsibility that is required by the state of New York for drivers who have been convicted of certain offenses, such as driving without insurance or DUI. This certificate ensures that the driver has enough insurance coverage to pay for any damages they cause.

SR-22 requirements can significantly increase insurance premiums.

Insurers charge higher premiums for drivers who require an SR-22 because they are considered a higher risk. The cost of an SR-22 can vary depending on the insurer and the driver’s driving history.

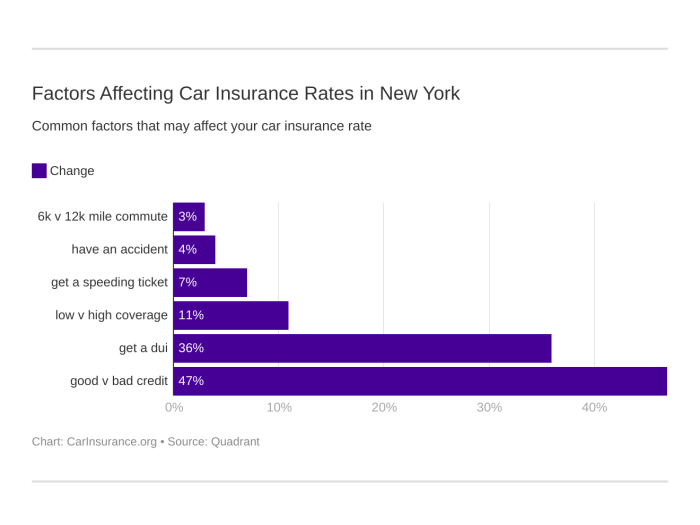

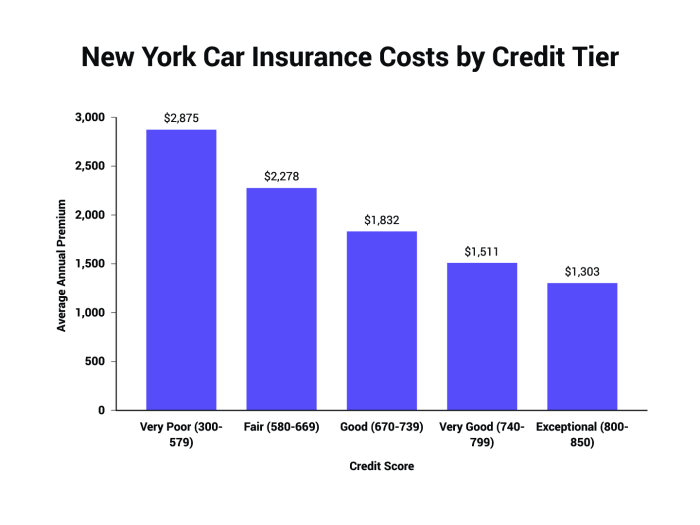

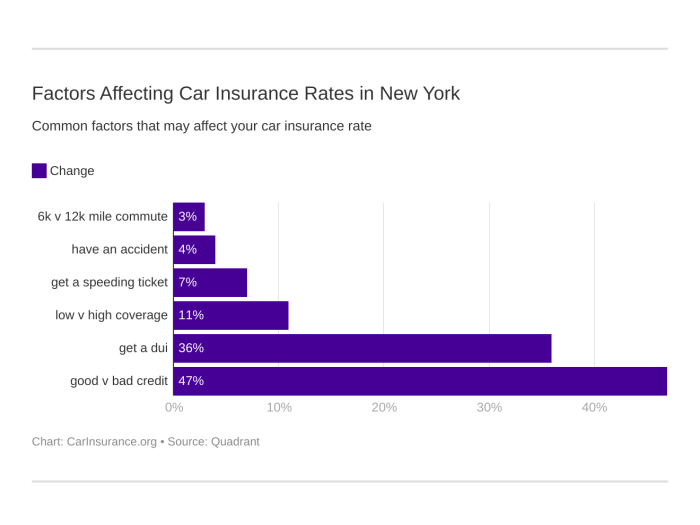

Navigating the world of car insurance in New York can be complex, but with careful planning and research, drivers can find the best coverage at a competitive price. By understanding the factors that influence rates, comparing quotes from different providers, and taking advantage of available discounts, you can secure the protection you need while minimizing your insurance costs.

Frequently Asked Questions

How much does car insurance cost in New York?

Car insurance costs in New York vary greatly depending on factors such as your driving history, age, vehicle type, and location. It’s best to obtain quotes from multiple insurance providers to compare prices.

What happens if I get into an accident without car insurance in New York?

Driving without car insurance in New York is illegal and can result in fines, license suspension, and even jail time. It’s crucial to have adequate insurance coverage to protect yourself financially in case of an accident.

Can I get car insurance if I have a poor driving record?

Yes, but you may face higher premiums. Some insurance companies specialize in providing coverage for high-risk drivers. It’s important to be honest about your driving history when applying for insurance.