Property Investment Websites: Unlocking the Digital Gateway to Real Estate Success

In today’s ever-evolving digital era, technological innovation has permeated every conceivable sector, each leveraging its capabilities in unprecedented ways. The realm of real estate and property investment, an area traditionally rooted in physical showings and face-to-face negotiations, is no exception. As the world becomes increasingly interconnected, property investment websites are emerging as pivotal platforms reshaping the landscape of real estate. These websites, teeming with data, tools, and resources, have undeniably revolutionized how investors approach and manage property investments.

Picture this: you’re a budding investor eager to delve into the dynamic world of real estate. However, numerous questions swirl in your mind – where to begin? Which markets offer the best opportunities? How can you assess property values accurately? The traditional methods would have required laborious research and perhaps a bit of luck to find answers. Enter property investment websites, your digital allies in navigating this complex domain. With just a few clicks, they offer a trove of information that is crucial for making informed and strategic decisions.

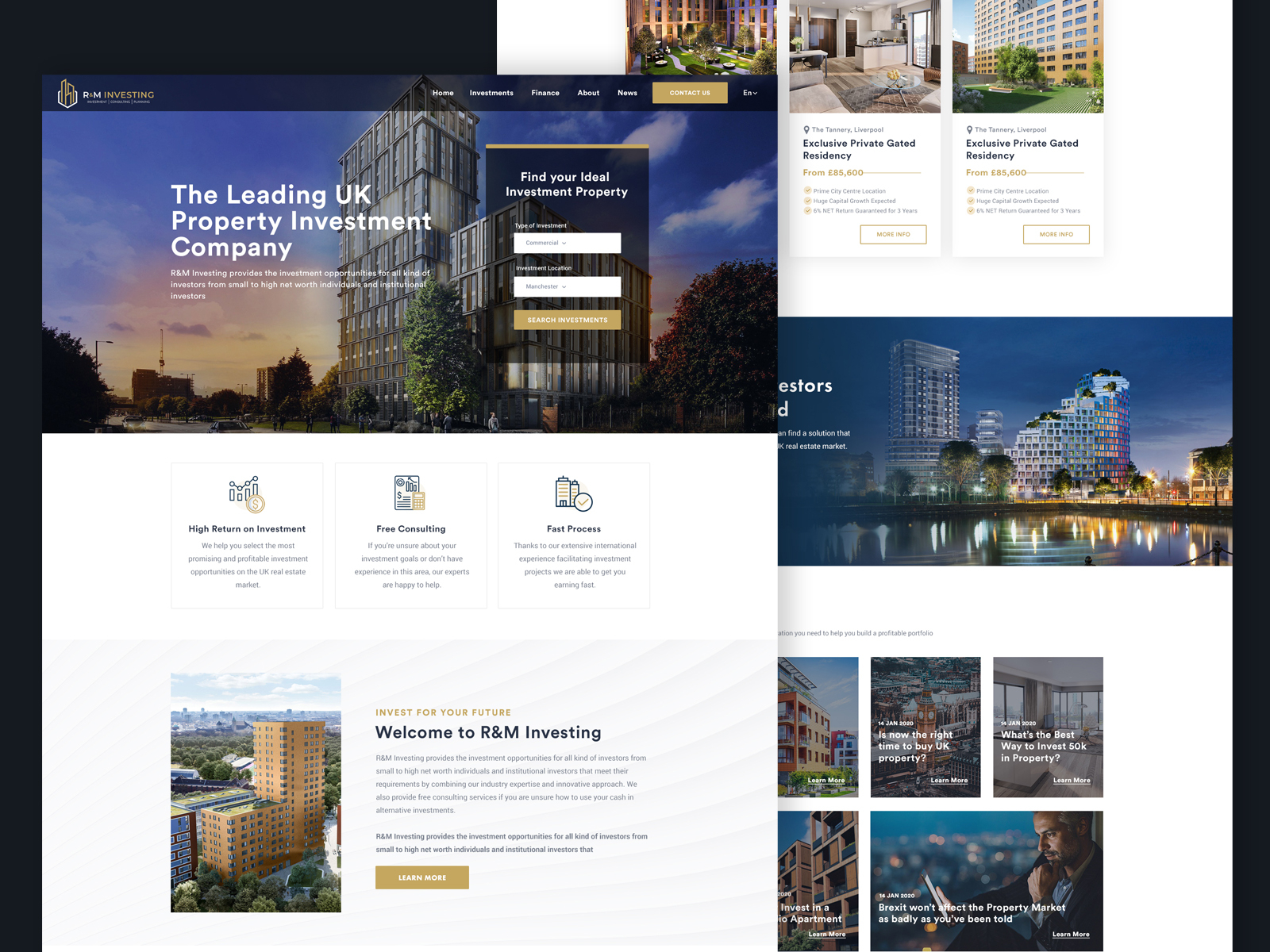

Property investment websites are not merely repository platforms for listings; they have dramatically enhanced the transparency and availability of information in the market. Now, buyers, sellers, and investors can access detailed property information, market analytics, mortgage calculators, and even virtual tours, all from the comfort of their own homes. These websites are democratizing access to data that was once the exclusive domain of real estate insiders, leveling the playing field for seasoned investors and newcomers alike.

The convenience offered by these platforms cannot be overstated. Investors can explore numerous properties across different locales without setting foot outside, compare prices and trends, and even engage in bidding wars, all thanks to sophisticated digital tools. This surge in accessibility and ease has transformed the real estate market from a labyrinthine space into a more navigable one, fostering informed investment choices and mitigating risks.

However, as with any significant shift, the proliferation of property investment websites presents a dual-edged sword. While these platforms streamline processes and open new doors, they also introduce layers of complexity that potential investors must navigate. For instance, the sheer volume of data can be overwhelming, and deciphering what information is truly valuable requires a keen eye and strategic mindset. Moreover, the rise of these platforms has also given way to heightened competition, demanding sharper analytical skills and faster decision-making from investors.

In this blog post, we will delve deeper into the transformative role of property investment websites in the real estate sector. We will examine their benefits, outline the various types of platforms available, and offer practical strategies to optimize their use for successful investments. From understanding the tools that facilitate market research to leveraging resources for securing deals, our discussion aims to equip readers with the knowledge needed to harness the full potential of these digital platforms.

We will also address the challenges associated with property investment websites, such as information overload and data reliability. In navigating these platforms effectively, savvy investors will not only enhance their property portfolios but also sharpen their competitive advantage. So, whether you’re a seasoned property mogul or an aspiring investor taking your first steps into the market, this blog is your guide to mastering the digital gateway of property investment.

Prepare to embark on a journey where we unlock the secrets of these virtual platforms, unravel best practices, and empower your real estate ventures with the right digital tools. Let’s dive in and explore how you can harness the power of property investment websites to transform your investments and achieve real estate success.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology