Car Insurance In Nyc

Car Insurance in NYC: Navigating the Concrete Jungle

Welcome to the bustling, never-sleeping metropolis of New York City, where the streets hum with the constant melody of horns, engines, and the occasional fire truck siren. In a city renowned for its iconic yellow cabs and ubiquitous traffic, owning a car here isn’t just about getting from point A to B; it’s a unique experience in itself. But, with the privilege of vehicle ownership in this fast-paced urban jungle comes the undeniable necessity of car insurance.

While many New Yorkers might rely solely on the comprehensive public transportation system, an ever-growing number of city dwellers desire the independence that comes with having their own set of wheels. Whether you’re cruising through the tree-lined avenues of Brooklyn or making your way up the bustling heart of Manhattan, understanding how to navigate car insurance in New York City becomes not only essential but a smart financial decision.

In a city characterized by its dense population, challenging driving conditions, and a dizzying blend of people, cars, and bicycles, car insurance is more than just a legal requirement. It’s your shield against the unpredictability of urban driving scenarios. But here’s the catch: procuring auto insurance in NYC can feel like a labyrinthine task if you do not know where to begin or what to prioritize. This unique setting presents its own set of challenges and opportunities, which we’ll explore in depth.

The Urban Necessity of Car Insurance

The sheer density of New York City adds layers of complexity to anything automotive. With millions of vehicles sharing tightly packed roads, accidents and fender-benders aren’t just possibilities; they’re inevitable probabilities. This makes insurance in New York City not just advisable but imperative. However, it brings forth the pressing question of what kind of coverage is best suited for the city’s unique driving environment.

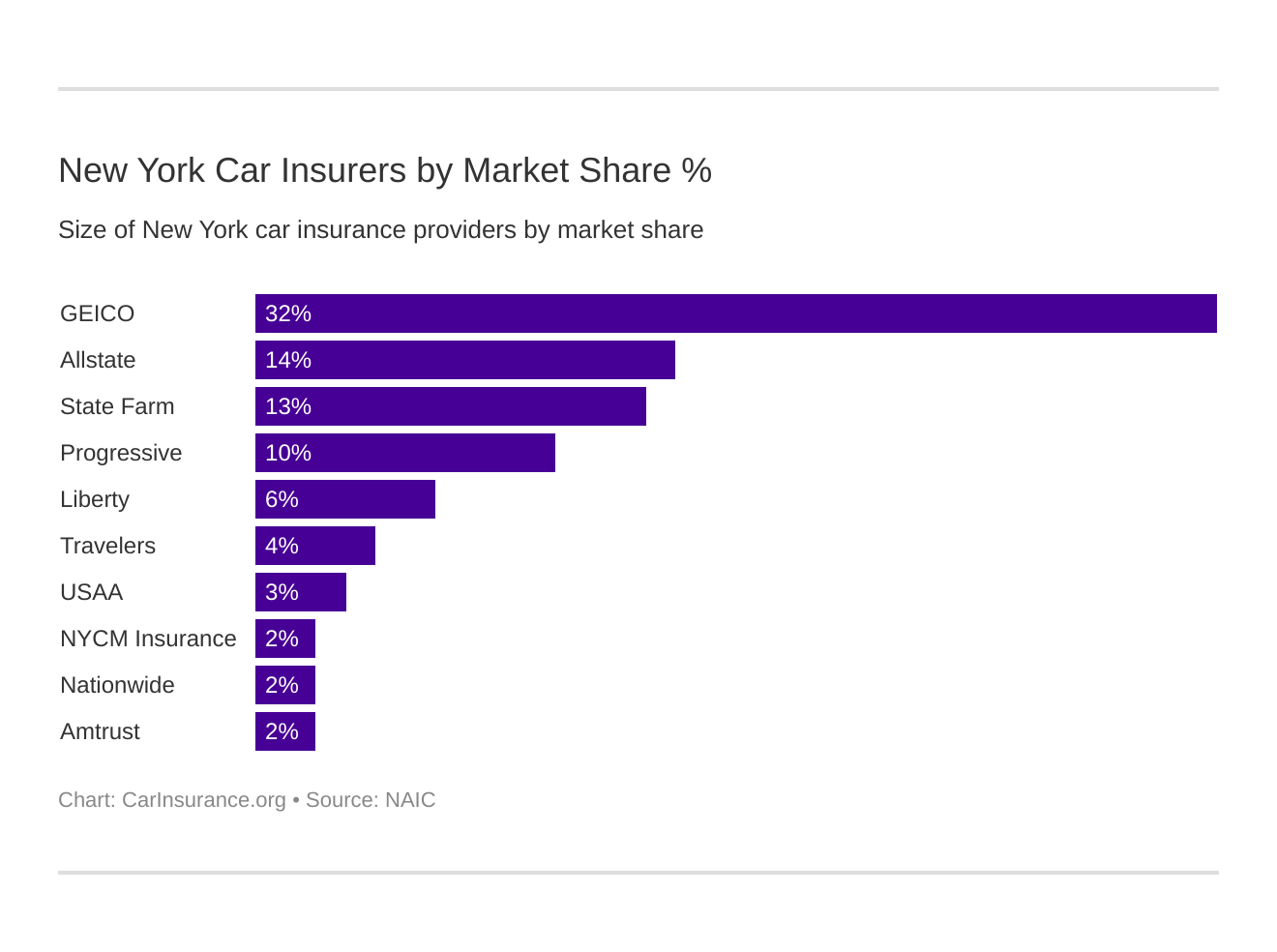

The Landscape of Insurance Providers

New Yorkers are blessed (or perhaps burdened) with a plethora of insurance providers, each promising the best coverage and rates. While it might appear overwhelming at first glance, understanding how to navigate these options is crucial for striking the right balance between coverage and cost. As we delve deeper, we’ll discuss how NYC drivers can identify the most reliable and cost-effective policies tailored to their needs.

Factors Influencing Insurance Costs

Let’s face it, car insurance isn’t cheap, especially in a metropolitan hub like New York City. Numerous factors contribute to the cost of your premium. Whether it’s your zip code, driving history, or the make and model of your car, each aspect plays a pivotal role. In the upcoming sections, we’ll break down these elements to help you understand what you are paying for and why.

Legislative Aspects and Requirements

Beyond the bustling traffic and evening skyline is the city’s strict adherence to legal frameworks, and car insurance is no exception. Navigating the mandates and legal stipulations for car insurance in NYC requires a certain level of familiarity and understanding. We’ll unravel the legal requirements you must adhere to, ensuring your insurance coverage keeps you compliant and safeguarded against higher liabilities.

Ways to Save on Car Insurance in NYC

Savvy New Yorkers know that there are ways to outsmart even the most confounding of financial challenges, and saving on car insurance is no different. Whether through discounts, comparison shopping, or optimizing coverage, there are strategies you can employ. Our guide will offer actionable tips to lower your premiums without compromising on protection.

As you read further, we’ll unfold the nuances of acquiring car insurance in NYC, demystifying the process and empowering you to make informed decisions. From exploring budget-friendly options to delving into the latest in insurance technology, our comprehensive guide is set to be your roadmap in mastering car insurance in New York City’s urban landscape. So buckle up, and prepare to traverse this critical aspect of city life.

Understanding Car Insurance Requirements in NYC

Driving in the bustling streets of New York City comes with its own set of challenges, one of which is navigating the complex world of car insurance. Given the high density of traffic and urban living conditions, understanding the requirements and acquiring the right coverage is crucial for all NYC drivers. Let’s delve into the essentials of mastering NYC car insurance, ensuring you have the right protection and peace of mind.

Mandatory Insurance Coverage

The state of New York mandates several types of auto insurance coverage that every driver must carry. Without meeting these requirements, you cannot legally register your vehicle. Here are the indispensable components:

- Liability Insurance: This insurance covers property damage and bodily injury for which you are liable. New York requires a minimum of $25,000 for bodily injury to one person, $50,000 for bodily injury to all persons in an accident, and $10,000 for property damage.

- No-Fault Insurance: Known officially as Personal Injury Protection (PIP), this covers medical expenses, lost earnings, and other reasonable expenses, regardless of who caused the accident. The minimum required is $50,000.

- Uninsured Motorist Coverage: This protects you if you’re in an accident with an at-fault driver who doesn’t have sufficient coverage. The minimum required is $25,000 per person and $50,000 per accident.

Additional Optional Coverage

While the minimum requirements ensure basic coverage, many drivers choose to purchase additional protection to cover themselves against the unpredictable nature of urban driving. Consider these options:

- Collision Coverage: This pays for damage to your vehicle resulting from a collision, helping you cover repairs or replacement costs.

- Comprehensive Coverage: This covers non-collision-related incidents such as theft, vandalism, or natural disasters.

- Gap Insurance: Especially useful for new cars, this covers the difference between your car’s value and what you owe if your car is totaled.

The Factors Affecting Car Insurance Rates in NYC

Several factors influence the cost of car insurance in NYC. By understanding these, you can make informed decisions and possibly reduce your rates:

Driving Record

Your driving history is a significant factor that insurers consider. Accidents, traffic violations, and claims can increase your premiums. Conversely, a clean record can earn you discounts.

Vehicle Type

The make, model, and year of your vehicle play a critical role in determining your insurance rates. High-end or high-performance vehicles typically cost more to insure than standard models due to increased repair costs and risks of theft.

Location and Parking

Your zip code affects your premium. Areas with higher crime rates, frequent accidents, or dense traffic often command higher insurance rates. Parking your car in a secured garage might reduce costs as opposed to street parking.

Credit Score

In New York, insurers can consider your credit score as part of your risk assessment. A better score can mean lower premiums as it often reflects your ability to manage risk and financial responsibility.

Discounts and Bundling

Most insurers offer a variety of discounts that can help reduce your premium. These might include multi-policy discounts, good student discounts, safe driver discounts, and more. Additionally, bundling your auto insurance with other policies, like homeowner’s, can lead to significant cost savings.

How to Choose the Right Insurance Provider

Finding the right insurance provider is just as crucial as choosing the correct coverage. Here are some tips to guide your decision:

Compare Quotes

Always compare quotes from different insurers. Rates can vary significantly from one company to another. Ensure like-for-like comparisons by aligning coverage levels, deductibles, and limits.

Check Financial Stability

Research insurers’ financial strength as it reflects their ability to pay claims. Trusted ratings agencies such as A.M. Best, Moody’s, and Standard & Poor’s can provide insights into an insurer’s financial health.

Read Customer Reviews

Customer feedback provides a view of what you might experience with a given provider. Look for comments on claims handling, customer service, and support effectiveness.

Consider the level of customer service

Make sure the insurer has a reputation for strong customer service. An accessible support team and efficient claims process can make a significant difference.

Value-Added Services

Some insurers offer additional services that can enhance your insurance package, such as roadside assistance, accident forgiveness programs, or flexibility in premium payments.

Understanding the Claims Process in NYC

Filing a claim in NYC can be complex, especially given the congested traffic and myriad factors involved in urban accidents. Here’s a streamlined guide to navigating the process:

- Immediate Steps: Ensure safety first by moving your car to a safe spot if possible, check for injuries, call the police to report the incident, and gather information from all parties involved, including witnesses.

- Documentation: Take photos of the accident scene, vehicles involved, and any visible injuries. This documentation will be critical for your claim.

- Report the Incident: Notify your insurance company immediately. Most insurers have a specific period within which you must report an accident.

- Claims Process: Work with your insurer’s adjuster to provide all necessary documentation and information. Be prepared to offer thorough details to support your claim.

- Follow-Up: Keep track of your claim and stay in communication with your insurer to ensure a smooth processing timeline.

Disputes and Appeals

If you disagree with the insurance company’s decision, you have the right to appeal. This typically involves providing additional evidence and possibly engaging a third-party arbitrator.

Future Trends in NYC Car Insurance

The car insurance landscape is constantly evolving. Here’s a glimpse into how technology and societal changes might shape its future:

- Telematics: Devices that track driving habits in real-time offer discounts for safe driving and are becoming more widespread.

- AI and Automation: These technologies are streamlining claims processes and improving customer service efficiency.

- Climate Change: As climate-related incidents increase, comprehensive insurance policies might see rising demands and premiums.

Mastering the Maze of Car Insurance in NYC

As we navigate the intricate world of car insurance in New York City, it becomes clear that understanding and managing these complexities are crucial for every driver. The journey through NYC’s auto insurance landscape requires more than just a basic understanding of how insurance works; it demands a strategic approach to adapting to the city’s unique environment and regulations. Let’s revisit the key points we’ve discussed and look at how you can make informed decisions to protect your financial interests while on the road.

Understanding NYC’s Insurance Landscape

In our exploration, we highlighted the unique factors that make NYC’s car insurance market distinct. The city’s high population density, massive traffic congestion, and significant levels of both vehicle theft and accidents all contribute to the higher premiums that drivers face compared to other regions. The influence of these factors cannot be underestimated when evaluating how much you’re going to pay, underscoring the importance of being well-informed and prepared.

Legal Requirements and Essential Coverage

An important aspect of our discussion was NY’s legal requirements for car insurance. We outlined the minimum coverage necessary to keep you on the right side of the law: bodily injury liability, property damage liability, personal injury protection (PIP), and uninsured motorist coverage. These set the groundwork for any insurance policy but are just the beginning of a comprehensive strategy. Determining the right coverage involves a careful examination of not only legal necessity but also your personal needs and potential risks.

Decoding Insurance Premiums

The next crucial element we examined was how premiums are determined in NYC. Factors such as your age, driving record, type of vehicle, and even your credit score can play a significant role. Armed with this knowledge, you can take proactive steps to potentially lower your costs. For instance, maintaining a clean driving record and considering the purchase of a vehicle with lower insurance rates could significantly impact your premiums. We stressed the importance of regularly reviewing policy options as personal and external factors evolve.

Navigating Discounts and Special Offers

Understanding that insurance companies offer various discounts was another pivotal part of our discussion. Safe driver discounts, multi-policy discounts, and discounts for installed safety features can all lead to savings. Being proactive in asking insurers for these discounts and regularly comparing different offers are vital steps in ensuring you’re always getting the best deal. Don’t hesitate to inquire about options that could apply specifically to you, given your driving habits and vehicle.

Choosing the Right Insurance Provider

We also discussed the importance of selecting the right insurance provider. Not all insurance companies operate equally, and choosing one that fits your specific needs is critical. Factors such as customer service, financial stability, claims processing speed, and tailored policy options should influence your decision. Investigating and comparing several providers, leveraging reviews, and consulting consumer feedback can guide you to a partner committed to supporting you effectively, especially when an accident occurs.

Leveraging Technology

The role of technology in modern insurance solutions was another crucial topic. Many companies now offer mobile apps and online portals to manage policies, file claims, and explore coverage options seamlessly. These digital tools allow for more control and better insight into your policy’s specifics, thus empowering you to make adjustments as needed. Familiarizing yourself with technological resources maximizes convenience and transparency in managing your car insurance.

A Call to Action: Equip Yourself for the Road Ahead

As we bring this comprehensive guide to a close, it’s evident that the complexities of car insurance in NYC can be overwhelming but are manageable with the right knowledge and approach. We’ve provided you with a roadmap to navigate this intricate terrain, but the journey doesn’t end here. Stay informed, continually evaluate your insurance needs, and advocate for your best interests.

We encourage you to take immediate steps in applying these insights. Review your current policy, compare new insurer offerings, and reach out to your agent to discuss possible savings opportunities. Stay engaged with ongoing changes in NYC’s insurance landscape and adapt your strategy accordingly. For further enrichment, consider subscribing to our newsletter for updates and expert insights, and connect with us on social media where more discussions take place. Visit our blog regularly to delve into deeper analyses and stay ahead in the ever-evolving world of auto insurance.

Your proactive engagement and informed decision-making will ensure not only compliance but also the financial protection you deserve. Navigate with confidence, knowing that each decision is a step toward mastering the complexities of car insurance in NYC, securing peace of mind on every drive through the bustling streets of this dynamic city.

Continue the conversation: Share your experiences with NYC car insurance, ask questions, or start a discussion in the comments section below. Your insights and inquiries could help fellow drivers and contribute to a more informed community.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology