LLC Loans for Investment Property A Guide to Funding Your Real Estate Ventures

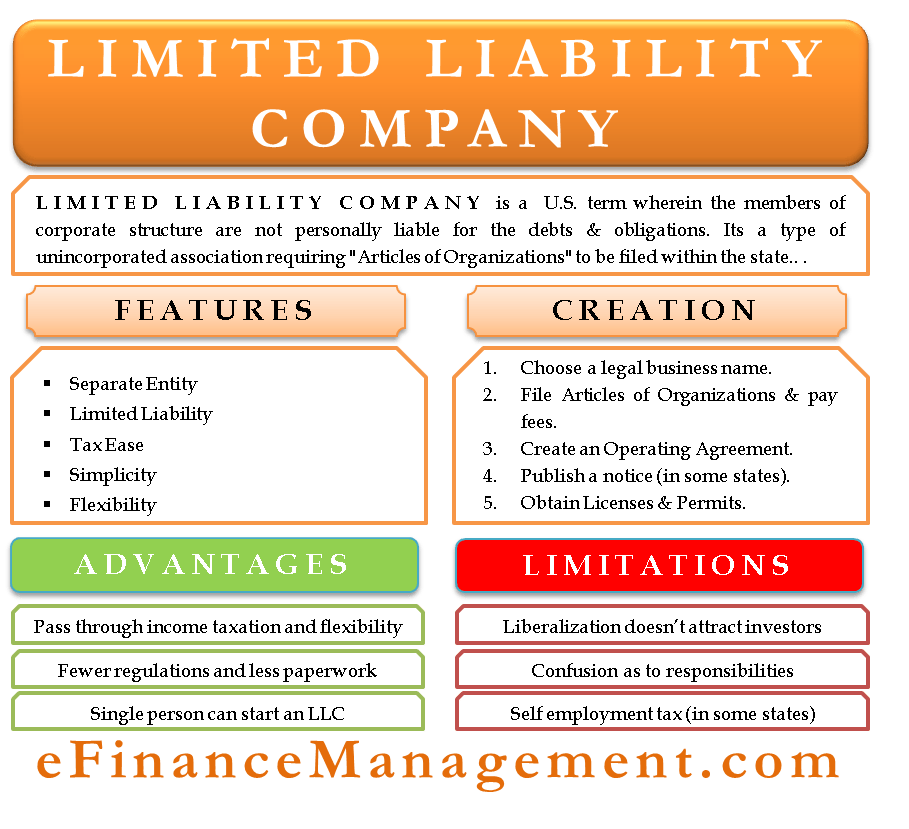

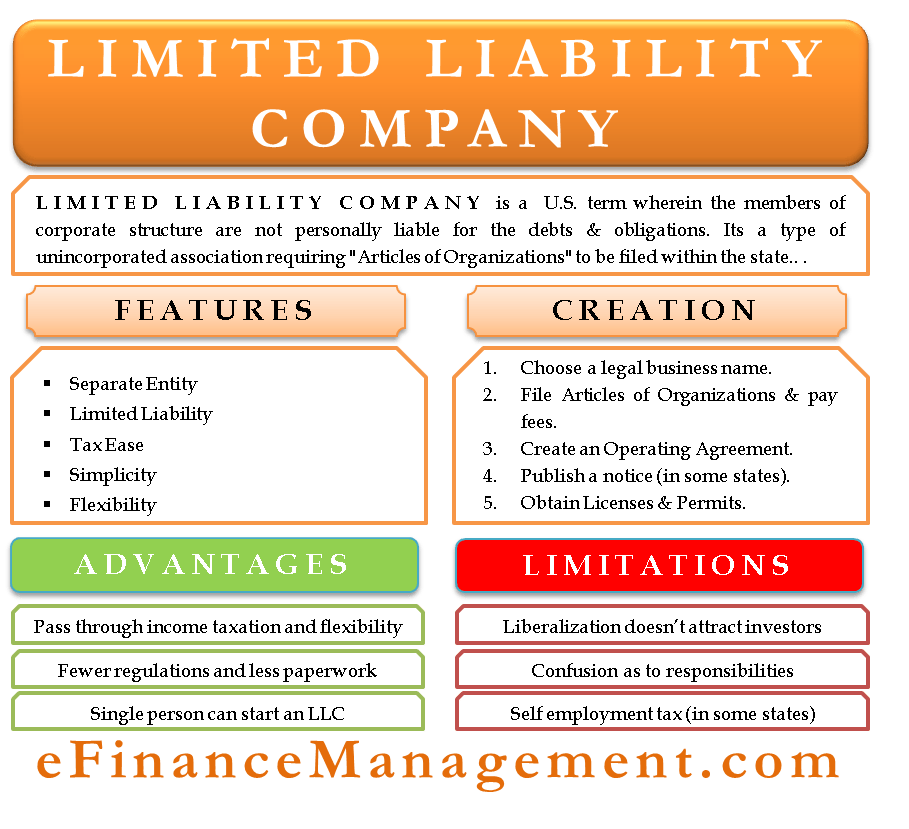

Llc loan for investment property – LLC Loans for Investment Property offer a unique path to real estate ownership, allowing investors to leverage the benefits of limited liability protection and potential tax advantages while securing funding for their ventures. This guide delves into the intricacies of LLC loans, exploring eligibility criteria, available loan types, and strategies for finding the right lender.

From understanding the nuances of LLC loans compared to traditional mortgages to navigating the application and closing processes, this comprehensive resource provides valuable insights for aspiring and seasoned real estate investors alike.

Understanding LLC Loans for Investment Properties

Securing financing for an investment property can be a crucial step in building your real estate portfolio. While traditional mortgages are a common option, an LLC loan can offer unique advantages, particularly for those seeking greater flexibility and potential tax benefits.

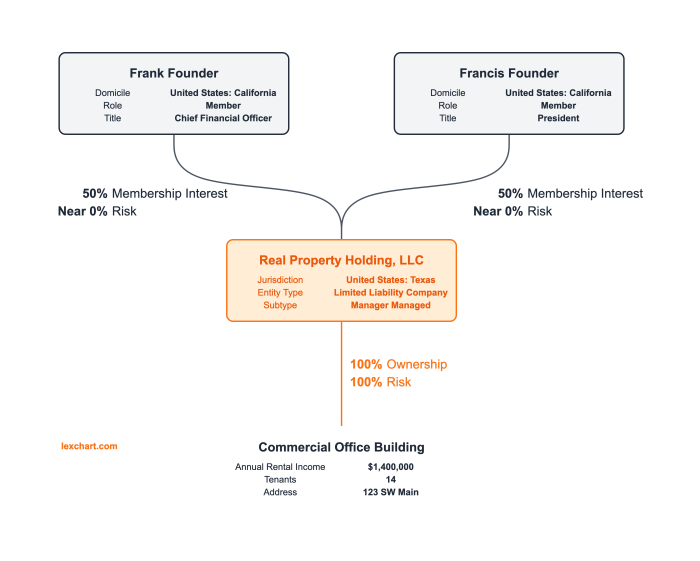

An LLC loan is a type of commercial loan specifically designed for businesses, including those structured as Limited Liability Companies (LLCs). These loans are used to finance the acquisition of investment properties, offering a distinct alternative to traditional mortgages.

Benefits of Using an LLC for Investment Properties

Using an LLC to purchase an investment property can provide several advantages, including:

- Liability Protection: An LLC acts as a separate legal entity, shielding your personal assets from business liabilities. This means that if your investment property faces legal issues or financial difficulties, your personal assets, such as your home, savings, and other investments, are protected from potential lawsuits or creditors. This is a crucial benefit for real estate investors, as it minimizes the risk of losing personal assets due to business-related issues.

- Tax Advantages: Depending on your business structure and tax strategy, an LLC can offer tax advantages. You may be able to deduct business expenses related to the property, such as mortgage interest, property taxes, and insurance premiums, from your business income, potentially reducing your overall tax liability. This can be a significant benefit for investors seeking to maximize their returns and minimize their tax burden.

Comparison of LLC Loans and Traditional Mortgages, Llc loan for investment property

While both LLC loans and traditional mortgages can be used to finance investment properties, there are key differences in terms of requirements, interest rates, and loan terms:

Requirements

- LLC Loans: Lenders typically require a well-established LLC with a strong financial history, including a track record of generating revenue and managing finances responsibly. They may also assess the creditworthiness of the LLC’s members or owners. Additionally, lenders may require a higher down payment for LLC loans compared to traditional mortgages.

- Traditional Mortgages: Lenders typically focus on the borrower’s individual credit score, income, and debt-to-income ratio when evaluating mortgage applications. They may also require a down payment, but the requirements can vary depending on the loan program and the borrower’s financial profile.

Interest Rates

- LLC Loans: Interest rates for LLC loans can be higher than those for traditional mortgages. This is because lenders consider LLC loans as commercial loans, which generally carry a higher risk compared to residential mortgages.

- Traditional Mortgages: Interest rates for traditional mortgages are often lower than those for LLC loans, reflecting the lower risk associated with residential mortgages.

Loan Terms

- LLC Loans: Loan terms for LLC loans can be shorter than those for traditional mortgages. This means that you may have to make larger monthly payments to repay the loan within a shorter timeframe. However, some lenders may offer longer terms for LLC loans, depending on the specific circumstances.

- Traditional Mortgages: Traditional mortgages typically offer longer loan terms, such as 15 or 30 years, allowing for smaller monthly payments but potentially leading to higher overall interest costs.

Eligibility and Loan Requirements: Llc Loan For Investment Property

Securing an LLC loan for an investment property requires meeting specific eligibility criteria and providing the necessary documentation. Lenders assess various factors to determine the borrower’s financial health and the property’s value before approving a loan.

Loan Eligibility Criteria

Lenders evaluate several factors to assess your eligibility for an LLC loan. These criteria ensure the lender’s confidence in your ability to repay the loan.

- Credit Score: A good credit score is crucial for obtaining an LLC loan. Lenders generally prefer borrowers with a credit score of at least 680, though this may vary depending on the lender and loan type. A higher credit score indicates a lower risk to the lender, potentially resulting in better interest rates.

- Debt-to-Income Ratio (DTI): Your DTI is the percentage of your monthly income that goes towards debt payments. Lenders typically prefer a DTI below 43%, though this can vary. A lower DTI signifies your ability to manage your existing debt obligations while comfortably making loan payments.

- LLC Financial History: Lenders examine the financial history of your LLC, including its revenue, expenses, and cash flow. A strong financial track record demonstrates your LLC’s ability to generate income and meet its financial obligations.

- Investment Property Value: The value of the investment property is a key factor in loan eligibility. Lenders assess the property’s condition, location, and potential for appreciation to determine its market value.

- Down Payment: Lenders usually require a down payment for investment property loans, typically ranging from 15% to 25% of the purchase price. A larger down payment can demonstrate your financial commitment and reduce the loan amount, potentially leading to lower interest rates.

- Loan Purpose: Lenders may have specific requirements based on the purpose of the loan. For example, a loan for a rental property might have different requirements than a loan for a fix-and-flip project.

Required Documentation

Lenders require specific documentation to verify your identity, financial standing, and the investment property details. This information helps them assess your loan application and make an informed decision.

- LLC Formation Documents: Provide copies of your LLC’s articles of incorporation, operating agreement, and any other relevant legal documents. This verifies the legitimacy of your business entity.

- Personal Financial Statements: Lenders may require personal financial statements, including your personal tax returns, bank statements, and credit reports. This helps them evaluate your overall financial situation.

- LLC Financial Statements: Provide your LLC’s financial statements, including profit and loss statements, balance sheets, and cash flow statements. These documents demonstrate your LLC’s financial health and ability to repay the loan.

- Investment Property Documents: Lenders require documentation related to the investment property, including a property appraisal, purchase agreement, and insurance policy. This verifies the property’s value and your ownership.

- Loan Application: Complete a loan application form that provides details about your loan request, the property, and your financial information.

Credit Score and Debt-to-Income Ratio

A strong credit score and a manageable debt-to-income ratio are crucial for obtaining an LLC loan. Lenders use these metrics to assess your creditworthiness and ability to repay the loan.

- Credit Score: A credit score of 680 or higher is generally considered good for obtaining an LLC loan. A higher credit score indicates a lower risk to the lender, potentially leading to better interest rates and loan terms.

- Debt-to-Income Ratio (DTI): Lenders prefer a DTI below 43%, which means that less than 43% of your monthly income goes towards debt payments. A lower DTI demonstrates your ability to manage existing debt obligations while comfortably making loan payments.

Types of LLC Loans

Understanding the different types of LLC loans available for investment properties is crucial for making informed decisions about financing your real estate ventures. Each loan type comes with its own set of features, benefits, and drawbacks, and selecting the right one depends on your specific investment goals, financial situation, and risk tolerance.

This section delves into the most common LLC loan options, comparing their interest rates, loan terms, and suitability for various investment strategies. We will also examine the pros and cons of each type, considering factors such as flexibility, speed of funding, and overall cost.

Securing an LLC loan for an investment property can be a great way to diversify your portfolio, but it’s important to have a solid understanding of your financial obligations. While you’re working on building your investment strategy, consider exploring alternative career paths like medical coding and billing. You can find reputable online courses, like those offered at medical coding and billing courses online , which can lead to a stable and in-demand profession.

With a well-planned financial strategy and a potentially lucrative new career path, you can achieve your investment goals and enjoy greater financial security.

Commercial Mortgages

Commercial mortgages are specifically designed for businesses, including LLCs, to finance commercial properties, which can include investment properties. They offer longer terms, typically 10 to 30 years, compared to traditional residential mortgages.

Here are some key aspects of commercial mortgages:

- Interest Rates: Generally, commercial mortgage interest rates are higher than residential mortgage rates due to the increased risk associated with commercial properties. However, rates can vary based on factors like loan-to-value ratio, property type, borrower’s credit score, and market conditions.

- Loan Terms: Commercial mortgages typically have longer terms than residential mortgages, ranging from 10 to 30 years. This allows for lower monthly payments, but it also means paying more interest over the life of the loan.

- Loan-to-Value Ratio: Commercial lenders typically have lower loan-to-value (LTV) ratios compared to residential lenders, meaning borrowers need a larger down payment. This requirement is based on the higher risk associated with commercial properties.

- Eligibility Requirements: Lenders have more stringent eligibility requirements for commercial mortgages, including a strong credit history, a proven track record of business success, and a detailed business plan.

Pros:

- Lower monthly payments: Longer loan terms translate to lower monthly payments, making it easier to manage cash flow.

- Flexibility: Commercial mortgages often offer more flexibility in terms of loan terms and repayment options compared to traditional residential mortgages.

- Potential for tax deductions: Interest paid on commercial mortgages is often tax-deductible, which can help reduce your overall tax burden.

Cons:

Securing an LLC loan for an investment property can be a smart move, especially if you’re looking to diversify your portfolio. But before you start flipping houses, it’s crucial to have a solid understanding of the electrical systems involved. Consider taking some online electrical courses to gain valuable knowledge that can help you make informed decisions about renovations and maintenance, ultimately boosting your investment property’s value.

- Higher interest rates: Compared to residential mortgages, commercial mortgages typically have higher interest rates, resulting in higher overall borrowing costs.

- Stricter eligibility requirements: Lenders have more stringent eligibility requirements for commercial mortgages, which can make it more challenging to qualify.

- Longer loan terms: While longer terms offer lower monthly payments, they also mean paying more interest over the life of the loan.

Bridge Loans

Bridge loans, also known as interim financing, are short-term loans designed to bridge the gap between two financial transactions. They are often used when a borrower needs to quickly access funds to purchase a new property before selling their existing property.

Key features of bridge loans include:

- Short-Term Loans: Bridge loans typically have short terms, ranging from a few months to a year or two. This is because they are intended to be temporary financing solutions until a longer-term loan can be secured.

- Higher Interest Rates: Bridge loans often have higher interest rates than traditional mortgages due to their short-term nature and the higher risk associated with them.

- Quick Funding: Bridge loans are typically funded quickly, often within a few days or weeks, making them ideal for time-sensitive transactions.

Pros:

- Fast Funding: Bridge loans can be funded quickly, often within a few days or weeks, making them ideal for time-sensitive transactions.

- Flexibility: Bridge loans offer flexibility in terms of loan terms and repayment options, making them suitable for various situations.

- Potential for higher returns: Using a bridge loan to acquire a property quickly can allow you to capitalize on potential market appreciation or rental income before securing a longer-term loan.

Cons:

- Higher interest rates: Bridge loans typically have higher interest rates than traditional mortgages, resulting in higher overall borrowing costs.

- Short-term nature: Bridge loans are short-term loans, meaning you will need to secure a longer-term loan to repay the bridge loan within the agreed-upon timeframe.

- Potential for higher risk: Bridge loans can be riskier than traditional mortgages due to their short-term nature and the potential for interest rate fluctuations.

Hard Money Loans

Hard money loans are private loans provided by non-traditional lenders, such as individuals or investment firms, who typically focus on lending to borrowers with less-than-perfect credit or for properties that are considered riskier.

Key characteristics of hard money loans include:

- Higher Interest Rates: Hard money loans typically have higher interest rates than traditional mortgages due to the higher risk associated with lending to borrowers with less-than-perfect credit or for properties that are considered riskier.

- Shorter Loan Terms: Hard money loans usually have shorter terms than traditional mortgages, typically ranging from one to five years.

- Faster Funding: Hard money loans are often funded quickly, typically within a few weeks or even days, making them ideal for time-sensitive transactions.

- Lower Loan-to-Value Ratio: Hard money lenders often have lower loan-to-value (LTV) ratios than traditional lenders, requiring borrowers to make larger down payments.

- Flexible Eligibility Requirements: Hard money lenders often have more flexible eligibility requirements than traditional lenders, making them a viable option for borrowers who may not qualify for a traditional mortgage.

Pros:

Securing an LLC loan for an investment property can be a smart move, especially if you’re aiming for a steady stream of passive income. However, if you’re looking for a career change that offers stability and demand, consider exploring online courses for medical assistants. The healthcare field is consistently growing, and a medical assistant certification can open doors to various opportunities.

Once you’ve established your financial footing, you can revisit the idea of an LLC loan for your investment property goals.

- Faster Funding: Hard money loans are often funded quickly, typically within a few weeks or even days, making them ideal for time-sensitive transactions.

- Flexible Eligibility Requirements: Hard money lenders often have more flexible eligibility requirements than traditional lenders, making them a viable option for borrowers who may not qualify for a traditional mortgage.

- Potential for higher returns: Hard money loans can provide access to funds for investment properties that may not qualify for traditional financing, allowing you to capitalize on potential market appreciation or rental income.

Cons:

Securing an LLC loan for an investment property can be a smart move, especially if you’re looking to diversify your portfolio. While you’re focusing on your real estate ventures, consider exploring online CNA courses for a potential career shift. The demand for certified nursing assistants is consistently high, offering a stable path with flexible hours, which can complement your investment property income.

- Higher Interest Rates: Hard money loans typically have higher interest rates than traditional mortgages, resulting in higher overall borrowing costs.

- Shorter Loan Terms: Hard money loans usually have shorter terms than traditional mortgages, meaning you will need to secure a longer-term loan to repay the hard money loan within the agreed-upon timeframe.

- Potential for higher risk: Hard money loans can be riskier than traditional mortgages due to the higher interest rates, shorter terms, and the potential for less stringent underwriting standards.

Finding the Right Lender

Securing the right lender is crucial for your investment property loan. It’s not just about the interest rate; you need a lender who understands your needs, provides transparent terms, and offers excellent customer service.

Choosing the Right Lender

Finding the right lender involves evaluating several factors, including:

- Interest Rates: Lenders offer varying interest rates, which significantly impact your monthly payments and overall loan cost. Look for competitive rates and compare them across different lenders.

- Loan Terms: Consider the loan term (the length of time you have to repay the loan), as it influences your monthly payments and total interest paid. A longer term might result in lower monthly payments but higher overall interest.

- Fees: Be aware of various fees associated with the loan, such as origination fees, closing costs, and appraisal fees. These fees can add up, so factor them into your overall loan cost.

- Customer Service: A responsive and helpful lender can make the loan process smoother. Look for lenders known for their communication and support throughout the process.

Reputable Lenders for LLC Loans

Here are some reputable lenders specializing in LLC loans for investment properties:

| Lender | Loan Offerings | Reputation | Borrower Experience |

|---|---|---|---|

| Bank of America | Commercial real estate loans, including those for LLCs | Large, established bank with a wide range of loan products | Generally positive, but some borrowers report complex processes |

| Wells Fargo | Commercial real estate loans, including those for LLCs | Another large, established bank with a strong reputation | Mixed experiences, with some praising their services and others finding them less responsive |

| Chase | Commercial real estate loans, including those for LLCs | Large bank with a wide range of financial products | Generally positive, but some borrowers report long processing times |

| PNC Bank | Commercial real estate loans, including those for LLCs | Regional bank with a strong focus on commercial lending | Positive experiences, with borrowers praising their personalized approach |

| Regions Bank | Commercial real estate loans, including those for LLCs | Regional bank with a strong presence in the Southeast | Generally positive, with borrowers praising their responsiveness |

Note: This is not an exhaustive list, and it’s crucial to conduct thorough research and compare offers from multiple lenders before making a decision.

The Loan Application Process

Securing an LLC loan for an investment property involves a structured process that requires careful preparation and attention to detail. The lender will assess your financial standing, the property’s value, and the viability of your investment strategy. Understanding the steps involved, the necessary documentation, and negotiation strategies will help you navigate the process effectively and increase your chances of securing favorable loan terms.

Gathering Required Documents

Before you begin the application process, it’s crucial to gather all the necessary documentation. This will demonstrate your financial stability and the potential success of your investment. The following documents are typically required:

- LLC Formation Documents: Provide copies of your LLC’s articles of organization, operating agreement, and any amendments to demonstrate the legal structure and ownership of your business.

- Personal Financial Statements: Lenders will assess your personal creditworthiness and ability to repay the loan. Provide your personal tax returns, bank statements, and credit reports. This includes details on your income, assets, and liabilities.

- Business Financial Statements: Present your LLC’s income statements, balance sheets, and cash flow statements for the past few years. This demonstrates your business’s financial health and ability to manage debt.

- Property Appraisal: A professional appraisal is essential to determine the market value of the investment property. This document will help the lender assess the loan-to-value ratio and the potential collateral for the loan.

- Investment Property Details: Provide a detailed description of the property, including its address, square footage, number of units, and any planned renovations or improvements. This helps the lender understand the investment’s potential and its future income generation.

- Business Plan: A comprehensive business plan Artikels your investment strategy, including the property’s expected cash flow, projected rental income, and exit strategy. This demonstrates your understanding of the investment and your ability to manage the property effectively.

Negotiating Loan Terms

Once you’ve submitted your application and supporting documentation, the lender will review your request and may request additional information. This is your opportunity to negotiate loan terms and secure the best possible interest rate. Here are some key factors to consider:

- Interest Rate: Negotiate for the lowest possible interest rate, taking into account your credit score, loan amount, and the current market conditions. Research different lenders and compare their interest rates and loan terms.

- Loan Term: Choose a loan term that aligns with your investment goals and repayment capacity. Shorter loan terms generally result in higher monthly payments but lower overall interest costs. Longer loan terms provide lower monthly payments but result in higher overall interest costs.

- Loan-to-Value Ratio: The loan-to-value ratio (LTV) is the percentage of the property’s value that the lender is willing to finance. A lower LTV generally results in more favorable loan terms, including a lower interest rate and potentially lower closing costs.

- Prepayment Penalties: Inquire about any prepayment penalties that may apply if you decide to pay off the loan early. Some lenders may charge a fee for early repayment, so it’s important to understand these terms before signing the loan agreement.

- Closing Costs: Negotiate for the lowest possible closing costs, which may include origination fees, appraisal fees, and title insurance. Some lenders may be willing to waive or reduce certain closing costs, especially if you have a strong credit history and a substantial down payment.

Tips for a Successful Loan Application

- Maintain a Good Credit Score: A strong credit score is crucial for securing favorable loan terms. Before applying for a loan, take steps to improve your credit score by paying bills on time, reducing credit card debt, and avoiding unnecessary credit inquiries.

- Shop Around for Lenders: Compare interest rates, loan terms, and fees from multiple lenders. This will help you identify the best option for your specific investment goals and financial situation.

- Prepare a Strong Business Plan: A well-written business plan is essential for demonstrating your understanding of the investment property and your ability to manage it effectively. This document should Artikel your investment strategy, projected cash flow, and exit strategy.

- Be Prepared to Provide Documentation: Gather all the necessary documentation before applying for a loan. This will streamline the application process and reduce the likelihood of delays.

- Be Realistic About Your Loan Amount: Don’t overextend yourself by borrowing more than you can comfortably repay. Consider your financial capacity and the property’s potential income generation when determining the loan amount.

- Negotiate Strategically: Be prepared to negotiate loan terms, including the interest rate, loan term, and closing costs. Research market conditions and compare offers from different lenders to leverage your negotiating power.

Managing Your LLC Loan

Securing an LLC loan for an investment property is just the first step. Effectively managing the loan is crucial to ensure long-term financial success. This involves understanding your responsibilities as a borrower, implementing strategies to minimize costs and maximize returns, and exploring options for refinancing when necessary.

Making Timely Payments and Maintaining Good Credit

Promptly making loan payments is essential for avoiding late fees and penalties. Additionally, maintaining good credit is crucial for accessing favorable loan terms in the future.

- Set up automatic payments to ensure timely payments and avoid potential late fees.

- Review your credit report regularly for any errors and take steps to correct them.

- Keep credit utilization low to maintain a good credit score.

Minimizing Interest Costs and Maximizing Returns

Minimizing interest costs and maximizing returns on your investment property are key to achieving profitability.

- Negotiate a lower interest rate during the loan application process.

- Consider making extra principal payments to shorten the loan term and reduce overall interest costs.

- Explore strategies for increasing rental income, such as improving the property or raising rents.

Refinancing Your LLC Loan

Refinancing your LLC loan can be a strategic move to secure a lower interest rate, extend the loan term, or access a larger loan amount.

- Consider refinancing if interest rates have dropped significantly since you obtained the loan.

- Refinancing can also be beneficial if you need to extend the loan term to manage cash flow.

- Consult with a mortgage lender to determine if refinancing is a suitable option for your situation.

Securing an LLC loan for your investment property can unlock a world of opportunities, enabling you to diversify your portfolio, build wealth, and achieve your financial goals. By carefully considering the factors Artikeld in this guide, you can navigate the process with confidence, making informed decisions that align with your investment objectives.

General Inquiries

What are the tax implications of using an LLC for an investment property?

The tax implications of using an LLC for an investment property can vary depending on the structure of the LLC and your individual tax situation. It’s crucial to consult with a tax professional to understand the specific tax implications for your situation.

Can I use an LLC loan to purchase a residential property for personal use?

Generally, LLC loans are intended for investment properties, not for personal residences. However, there may be exceptions depending on the lender’s specific guidelines.

What is the typical loan-to-value ratio for LLC loans?

The loan-to-value ratio (LTV) for LLC loans can vary depending on the lender and the type of property. It’s essential to discuss LTV requirements with potential lenders to determine the maximum loan amount you can secure.

How do I choose the right lender for my LLC loan?

When choosing a lender for your LLC loan, consider factors such as interest rates, loan terms, fees, reputation, and customer service. It’s also beneficial to compare loan offerings from multiple lenders to find the best fit for your needs.

What happens if my LLC defaults on the loan?

In the event of a default, the lender may pursue legal action to recover the outstanding loan amount. The liability protection of the LLC can limit your personal liability, but it’s crucial to understand the specific terms of your loan agreement.