100% Investment Property Financing A Guide to Funding Your Next Venture

100 investment property financing – 100% investment property financing, also known as no-money-down financing, presents an intriguing opportunity for real estate investors seeking to acquire properties without a significant upfront investment. This approach involves securing a loan that covers the entire purchase price of the property, including closing costs, leaving no out-of-pocket expenses for the investor. While this strategy can be highly advantageous, it’s crucial to understand the intricacies and potential risks associated with 100% financing.

This comprehensive guide delves into the world of 100% investment property financing, covering key aspects such as eligibility criteria, benefits, drawbacks, finding suitable lenders, and effective management strategies. We aim to equip you with the knowledge and insights needed to make informed decisions regarding this unique financing option.

Understanding 100 Investment Property Financing

Securing 100% financing for an investment property, also known as no-money-down financing, is a strategy that allows investors to acquire a property without any upfront cash investment. This approach can be appealing for investors seeking to maximize their return on investment and minimize their initial capital outlay.

Types of 100% Financing Options, 100 investment property financing

There are various types of financing options that can provide 100% financing for investment properties. These options typically involve specific criteria and requirements that borrowers must meet.

- Hard Money Loans: Hard money loans are short-term loans offered by private lenders, often with higher interest rates and fees compared to traditional mortgages. These loans are frequently used by investors who need quick financing for investment properties, particularly for renovations or fix-and-flip projects. Hard money lenders typically focus on the property’s potential value rather than the borrower’s credit score, making them an option for borrowers with less-than-perfect credit.

- Seller Financing: In a seller financing arrangement, the property seller provides the financing instead of a traditional lender. This option can be attractive to both buyers and sellers, as it can streamline the transaction and offer flexibility. Sellers may offer seller financing to expedite the sale or to achieve a specific return on their investment.

- Private Lenders: Private lenders, such as family offices, high-net-worth individuals, or private investment firms, can offer financing options tailored to specific investment properties. These lenders often have less stringent requirements than traditional lenders, making them an alternative for borrowers who may not qualify for conventional financing.

Examples of Lenders

Several lenders specialize in providing 100% financing for investment properties. While specific offerings may vary depending on the lender and the property’s characteristics, some examples include:

- Hard Money Lenders:

- Hard Money Solutions

- Capital Fund

- New York Private Money

- Private Lenders:

- Fundrise

- CrowdStreet

- RealtyMogul

Eligibility Criteria for 100% Financing

Securing 100% financing for an investment property is a significant feat, requiring meticulous planning and meeting stringent eligibility criteria. Lenders are cautious when offering this level of funding, as they bear a higher risk compared to conventional mortgages. This section delves into the key eligibility requirements, comparing the criteria of different lenders and highlighting the critical role of credit score and debt-to-income ratio.

Credit Score and Debt-to-Income Ratio

A strong credit score is paramount for securing 100% financing. Lenders view a high credit score as an indicator of your financial responsibility and ability to manage debt effectively. A credit score typically above 700 is considered favorable for obtaining this type of financing.

A higher credit score usually translates to better interest rates and loan terms.

Your debt-to-income ratio (DTI) represents the percentage of your gross monthly income that goes towards debt payments. Lenders typically prefer a DTI below 43% for 100% financing. This ratio assesses your ability to handle additional debt payments.

A lower DTI signifies a stronger financial position and a greater likelihood of loan approval.

Lender Eligibility Criteria

Different lenders have varying eligibility requirements for 100% financing.

- Down Payment: While 100% financing implies no down payment, some lenders may require a small down payment, usually around 5% of the property value, to mitigate their risk.

- Income Verification: Lenders will scrutinize your income history and stability, often requiring tax returns and pay stubs.

- Property Type: The type of investment property, such as residential or commercial, can influence eligibility. Some lenders specialize in specific property types.

- Property Location: The location of the property can also be a factor. Lenders may favor properties in desirable areas with strong rental demand.

- Rental History: If you intend to rent out the property, lenders may review your rental history to assess your experience as a landlord.

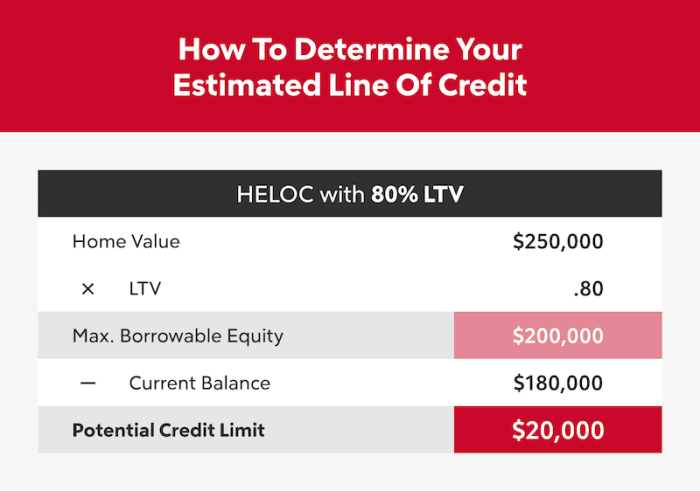

- Debt-to-Equity Ratio: Some lenders may consider your debt-to-equity ratio, which compares your total debt to your total assets. A lower ratio generally signifies a stronger financial position.

Benefits and Drawbacks of 100% Financing

Securing 100% financing for an investment property can be a game-changer for real estate investors, potentially unlocking opportunities that might otherwise be out of reach. However, it’s crucial to understand both the potential benefits and drawbacks associated with this type of financing before making a decision.

Benefits of 100% Financing

100% financing can provide significant advantages for investors, primarily by removing the barrier of a down payment and allowing for greater leverage.

- Increased Investment Potential: By eliminating the need for a down payment, 100% financing allows investors to acquire more properties with the same amount of capital. This can significantly increase the potential return on investment (ROI) over time.

- Faster Entry into the Market: Investors can enter the real estate market faster, potentially capitalizing on emerging trends and market opportunities. This can be particularly advantageous in rapidly appreciating markets.

- Leverage for Growth: 100% financing allows investors to leverage their capital to acquire more properties, potentially leading to faster wealth accumulation through appreciation and rental income.

Drawbacks of 100% Financing

While 100% financing offers benefits, it also comes with inherent risks that investors must carefully consider.

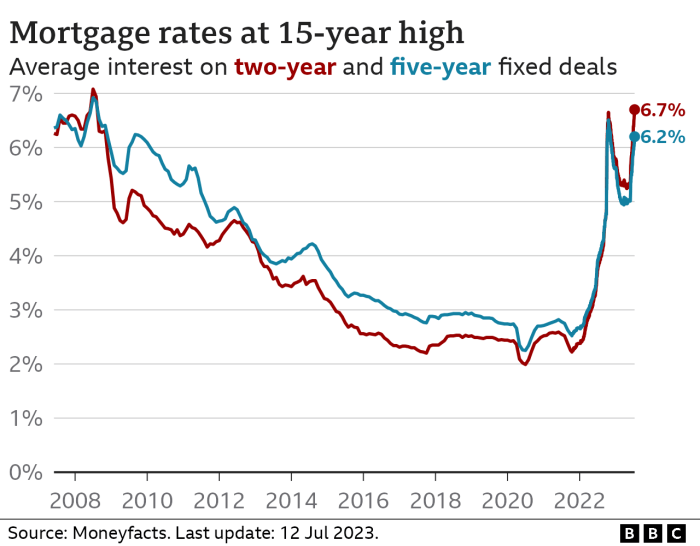

- Higher Interest Rates: Lenders typically charge higher interest rates for 100% financing compared to traditional mortgages with a down payment. This can significantly increase the overall cost of borrowing and reduce profitability.

- Increased Financial Risk: Without a down payment, investors are exposed to greater financial risk. If property values decline or rental income falls, the investor may be at risk of losing their investment.

- Limited Flexibility: 100% financing often comes with stricter terms and conditions, limiting flexibility in managing the property and potentially restricting refinancing options.

Comparison to Traditional Mortgages

100% financing differs significantly from traditional mortgages with a down payment.

- Down Payment: Traditional mortgages require a down payment, typically between 5% and 20% of the purchase price, while 100% financing eliminates this requirement.

- Interest Rates: Traditional mortgages generally have lower interest rates compared to 100% financing due to the reduced risk for lenders.

- Flexibility: Traditional mortgages often offer greater flexibility in terms and conditions, allowing for easier refinancing and potentially lower closing costs.

Finding the Right Lender for 100% Financing

Securing 100% financing for an investment property is a challenging but achievable feat. Finding the right lender who understands your needs and offers competitive terms is crucial. The process involves careful research, effective communication, and a bit of negotiation.

Identifying Potential Lenders

Identifying potential lenders is the first step. Here are some tips to find suitable lenders for 100% financing:

- Start with your existing bank or credit union. They may offer specialized investment property loan programs, including 100% financing options. Familiarize yourself with their requirements and loan terms.

- Explore online lenders. Online lenders often specialize in niche markets, such as investment property financing. Research their loan products, interest rates, and eligibility criteria.

- Consult a mortgage broker. Mortgage brokers have access to a wide network of lenders and can help you find the best options for your specific situation. They can also guide you through the loan application process and negotiate favorable terms.

- Attend real estate investment conferences and workshops. These events often feature lenders specializing in investment property financing. Network with lenders and learn about their offerings.

Evaluating Lender Credentials

Once you’ve identified potential lenders, it’s crucial to evaluate their credentials. Here are some key factors to consider:

- Reputation and experience: Research the lender’s reputation and experience in investment property financing. Look for lenders with a strong track record and positive customer reviews.

- Loan terms and interest rates: Compare loan terms and interest rates from different lenders. Consider factors such as loan-to-value ratios, interest rates, fees, and repayment terms.

- Customer service and communication: Evaluate the lender’s customer service and communication style. Look for lenders who are responsive, transparent, and easy to work with.

- Financial stability: Ensure the lender is financially stable and has a strong track record of successful loan originations.

Negotiating Favorable Loan Terms

Negotiating favorable loan terms can significantly impact your overall investment return. Here are some tips for effective negotiation:

- Shop around: Compare loan offers from multiple lenders to leverage competition and secure the best terms.

- Focus on your strengths: Highlight your strong credit score, solid financial history, and experience in real estate investment. This can improve your negotiating position.

- Be prepared to walk away: If you’re not satisfied with the offered terms, be prepared to walk away and explore other options. This can encourage lenders to offer more favorable terms.

- Negotiate fees and closing costs: Explore options to reduce or waive fees and closing costs associated with the loan. This can save you significant upfront expenses.

Resources and Tools for Finding 100% Financing

Several resources and tools can assist you in finding the best 100% financing options. Here are some helpful resources:

- Online mortgage calculators: Use online mortgage calculators to estimate monthly payments, interest costs, and loan-to-value ratios. This can help you compare different loan options and make informed decisions.

- Real estate investment websites and forums: Online forums and websites dedicated to real estate investment often feature discussions about financing options, including 100% financing. Engage in these discussions to learn from experienced investors and gather valuable insights.

- Real estate professionals: Consult with real estate agents, brokers, and property managers for their insights and recommendations on finding suitable lenders for 100% financing. They may have connections with lenders specializing in investment property financing.

- Financial advisors: Seek advice from a financial advisor to develop a comprehensive financial plan that includes investment property financing. They can help you assess your financial situation, determine your borrowing capacity, and make informed decisions about financing options.

Strategies for Managing 100% Financed Investment Properties: 100 Investment Property Financing

Securing 100% financing for an investment property can be a significant achievement, but it also presents unique challenges. Effective management is crucial to ensure profitability and long-term success. This section will explore strategies for maximizing rental income, minimizing expenses, and navigating the complexities of property management.

Maximizing Rental Income

A key aspect of successful investment property management is maximizing rental income. This involves finding the right tenants, setting competitive rental rates, and ensuring consistent occupancy. Here are some strategies to consider:

- Thorough Tenant Screening: Conduct comprehensive background checks, credit history reviews, and reference checks to select reliable tenants who are likely to pay rent on time and maintain the property. This minimizes the risk of costly vacancies and legal issues.

- Competitive Rental Rates: Research local market conditions and comparable properties to determine an appropriate rental rate that attracts tenants while maximizing your return on investment. Consider factors such as property size, amenities, location, and market demand.

- Effective Marketing: Utilize various online platforms, local listings, and networking to reach a wide audience of potential tenants. High-quality photos, detailed descriptions, and professional marketing materials can attract more interest and help secure tenants quickly.

- Lease Agreements: Implement clear and comprehensive lease agreements that Artikel tenant responsibilities, payment terms, and termination clauses. This provides legal protection and minimizes potential disputes.

Minimizing Expenses

Controlling expenses is essential for profitability, especially when managing a 100% financed property. Strategies for minimizing expenses include:

- Energy Efficiency: Implement energy-saving measures such as upgrading appliances, installing energy-efficient lighting, and sealing air leaks. This reduces utility costs and increases the property’s appeal to tenants.

- Preventive Maintenance: Regularly inspect and maintain the property to address minor issues before they escalate into costly repairs. This includes tasks such as checking plumbing, HVAC systems, and electrical wiring.

- Negotiating with Vendors: Shop around for competitive rates from contractors, landscapers, and other service providers. Consider negotiating bulk discounts or long-term contracts for recurring services.

- Property Management Software: Utilize property management software to automate tasks, streamline communication with tenants, and track expenses. This can save time and reduce administrative costs.

Property Management and Maintenance

Effective property management is crucial for maintaining a positive tenant experience and maximizing the property’s value. This involves:

- Regular Communication: Establish clear communication channels with tenants, promptly addressing their concerns and requests. This fosters a positive relationship and reduces the risk of tenant dissatisfaction.

- Emergency Response: Have a plan in place to address emergencies such as plumbing leaks, power outages, or security breaches. This ensures prompt response and minimizes damage to the property.

- Tenant Retention: Focus on providing excellent tenant experiences to encourage long-term occupancy. This can involve offering incentives, resolving issues promptly, and maintaining a well-maintained property.

- Compliance with Laws: Stay informed about local landlord-tenant laws and regulations. Ensure compliance with all applicable laws to avoid legal issues and maintain a safe and habitable property.

Building Equity and Preparing for Refinancing

Building equity in your investment property is essential for long-term financial success. This involves making regular mortgage payments, managing expenses effectively, and potentially increasing the property’s value through improvements. Here’s how to build equity and prepare for refinancing:

- Consistent Mortgage Payments: Make consistent mortgage payments to reduce the principal balance and build equity over time. Early repayment or additional principal payments can accelerate the equity-building process.

- Property Value Appreciation: Invest in improvements that increase the property’s value and market appeal. This can include renovations, landscaping, or energy-efficient upgrades. Factors such as market demand, location, and economic conditions can also influence property value appreciation.

- Refinancing Strategies: Consider refinancing your mortgage when interest rates fall or when you have built significant equity. This can lower your monthly payments, free up cash flow, or access additional funds for further investment.

Securing 100% investment property financing can be a powerful tool for building a robust real estate portfolio. However, it’s essential to carefully weigh the benefits and risks, understand the eligibility requirements, and choose a lender who aligns with your investment goals. By navigating the intricacies of this financing strategy, you can unlock opportunities for growth and potentially achieve significant financial returns.

Questions and Answers

What are the typical interest rates for 100% investment property financing?

Interest rates for 100% investment property financing are generally higher than traditional mortgages due to the increased risk for lenders. They can vary depending on factors such as the borrower’s credit score, debt-to-income ratio, property type, and the specific lender’s policies.

What are the common loan terms for 100% investment property financing?

Loan terms for 100% financing can range from 15 to 30 years, similar to traditional mortgages. However, some lenders may offer shorter terms or balloon payments, which require a lump-sum payment at the end of the loan period.

Are there any specific requirements for the investment property itself?

Yes, lenders typically have requirements for the investment property, such as minimum property value, acceptable condition, and potential rental income. These requirements vary depending on the lender’s policies and the specific property type.

Securing 100% financing for an investment property can be challenging, but it’s not impossible. Understanding the intricacies of real estate finance, including loan terms and market trends, can be a significant advantage. For those seeking to enhance their financial acumen, consider pursuing an cheap MBA online program. An MBA can equip you with the knowledge and skills to navigate the complex world of real estate investments, potentially opening doors to more favorable financing options.

Securing financing for a 100% investment property can be a challenge, requiring a strong financial profile and a solid investment strategy. However, pursuing an MBA can equip you with the knowledge and skills to navigate complex financial situations, including investment property financing. If you’re looking to enhance your business acumen without the GMAT hurdle, consider exploring options for a best online MBA no GMAT.

A well-rounded MBA can provide valuable insights into real estate investment, market analysis, and financial management, ultimately bolstering your chances of securing financing for your 100% investment property.

Securing 100% financing for an investment property can be a challenge, but it’s not impossible. Many lenders offer creative solutions, like bridging loans or private financing, to help investors achieve their goals. To learn more about these options and the intricacies of the financing process, consider exploring resources like this comprehensive guide on asynchronous online classes , which can provide valuable insights into navigating the complex world of real estate investment.

By understanding the available financing options and leveraging the right resources, investors can increase their chances of securing the funding needed to acquire their dream investment property.

Securing financing for a 100% investment property can be challenging, but it’s not impossible. You might consider taking a course like the UIUC online MBA to gain valuable insights into real estate finance and investment strategies. This knowledge could help you build a compelling case to lenders, demonstrating your understanding of the market and your ability to manage the investment effectively.