100 Financing For Investment Property

100% Financing For Investment Property: Unlocking Real Estate Opportunities with Zero Down Payment

Imagine venturing into the world of real estate investment without having to break your bank account. Sounds impossible? Not anymore, thanks to the innovative concept of 100% financing for investment property. This strategy, although not traditionally common, is gaining traction among both novice and experienced investors, offering a promising route to delve into real estate without fronting any money. In this blog post, we’ll be embarking on a comprehensive journey to explore this topic—understanding its nuances and how you can use it strategically to build your real estate portfolio.

Traditionally, investing in real estate demands a significant upfront capital investment, often a daunting barrier for many aspiring investors. The prospect of scraping together a substantial down payment can be overwhelming, making the real estate market seem inaccessible. However, 100% financing opportunities provide a refreshing alternative, breaking down these barriers and democratizing access to property ownership. It’s a concept that paves the way for ambitious investors who are asset-rich but cash-strapped.

But what exactly does 100% financing entail? And how does it function in the realm of investment properties? Essentially, it allows investors to finance the entire purchase price of a property using borrowed funds. This means you can own an income-generating property without the traditionally required cash outlay. While this can be a game-changer, it also comes with its fair share of complexities and considerations that any savvy investor must navigate meticulously.

Throughout this blog post, we’ll dissect the intricacies of 100% financing in real estate investment, shedding light on its advantages and potential pitfalls. We’ll delve into the mechanics of how such financing structures operate and unravel the primary sources available to investors looking to capitalize on this opportunity. You will learn about traditional and non-traditional lending avenues, dive into the relevant financial metrics, and uncover tips on leveraging this strategy to maximize returns while minimizing risks.

Moreover, we’ll highlight the importance of creditworthiness and its impact on securing financing with no down payment. Understanding the lender’s perspective will be key to positioning yourself as a viable candidate for zero down payment loans. Our exploration will also cover creative financing methods that can mimic the benefits of 100% financing, offering additional flexibility in how you approach investment opportunities.

Alongside these insights, we will address the spectrum of risks associated with highly-leveraged investments. While 100% financing enables you to enter the market with minimal upfront costs, it inherently carries higher repayment obligations. Managing your financing carefully can mean the difference between amplifying your wealth and finding yourself in a precarious financial situation. Strategies around risk management and ensuring profitable investment decisions will form a critical component of our discussion.

As we progress, case studies and testimonials from successful investors who have effectively wielded 100% financing will serve to illustrate inherent challenges and creative solutions. Hearing from those who have already trod this path can provide invaluable lessons and inspiration for your own journey.

Lastly, we’ll explore the future prospects of 100% financing as a tool for real estate investment. The economic landscape and lending practices are continually evolving, and understanding future trends could offer foresight into how best to prepare and leverage your investment strategies moving forward.

Whether you’re an aspiring real estate investor eager to get your foot in the door, or a seasoned professional looking to expand your portfolio creatively, this blog post will serve as your guide to unlocking the potential of 100% financing for investment properties. So, gear up for a deep dive into a transformative investment avenue that might just redefine how you perceive real estate opportunities.

Understanding 100% Financing

100% financing, in the context of real estate investments, implies acquiring a property entirely through borrowed funds. While this might sound like an ideal scenario, especially for investors keen on preserving cash reserves, navigating such financings demands an understanding of risk, creativity in securing funding, and a well-strategized approach to leverage.

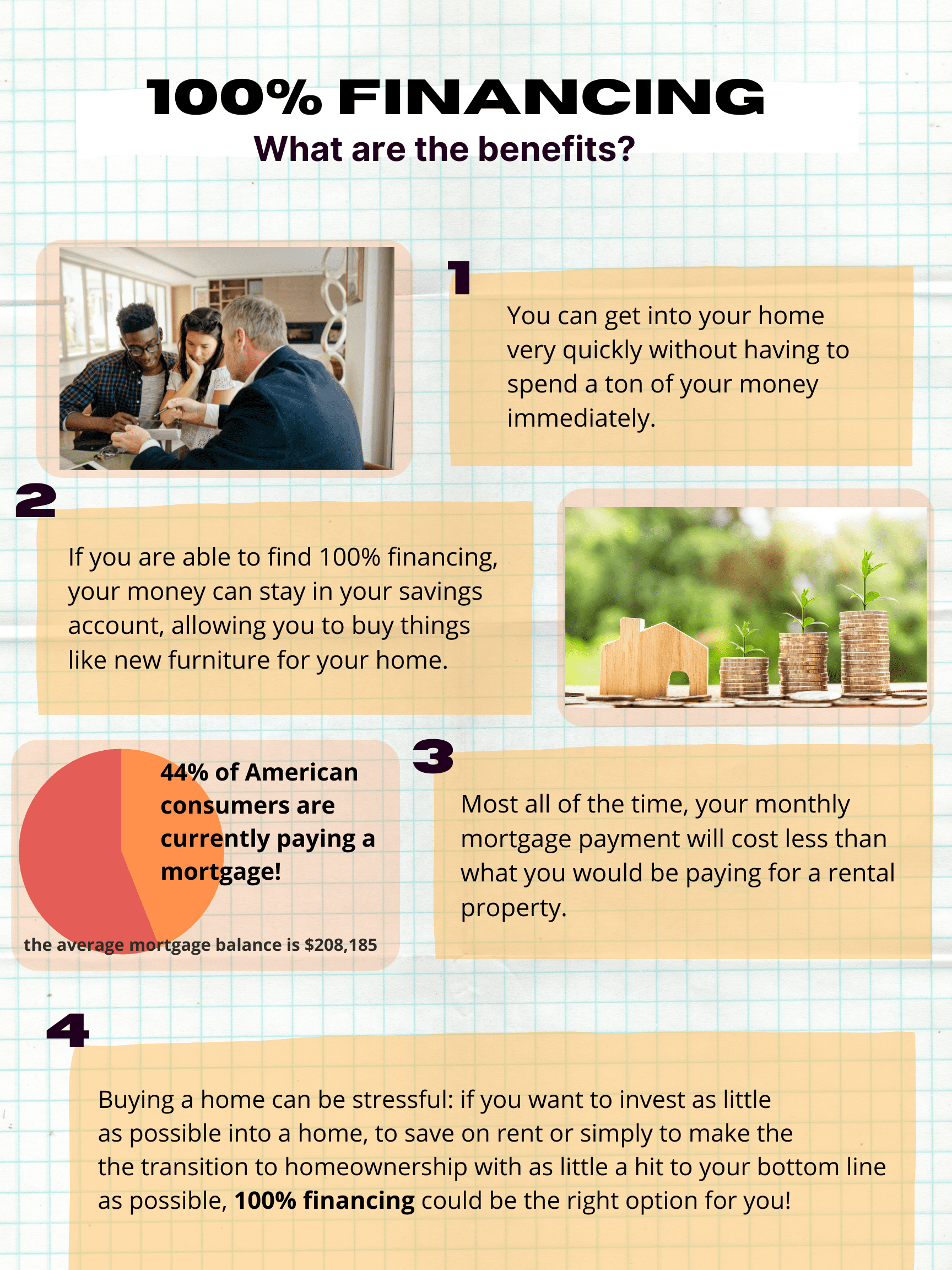

Benefits of 100% Financing

The primary advantage of using 100% financing for investment properties is the ability to preserve personal capital. This approach enables investors to enter the market or expand their portfolio without draining their financial resources. Additional benefits include:

- Leverage: Maximizing leverage in property investment allows for potentially higher returns on equity as the investor is utilizing other people’s money rather than their own.

- Tax Advantages: Financing costs such as interest on loans are typically tax-deductible, proving advantageous from a taxation perspective.

- Cash Flow Maximization: Maintaining sufficient liquidity allows investors to capitalize on unforeseen opportunities, resolve emergencies, or diversify portfolios.

Common 100% Financing Strategies

While traditional bank loans might not cover 100% of an investment property’s purchase price, several strategies can help investors achieve full financing. Here’s how:

Seller Financing

Also known as owner financing, this approach allows the property seller to finance the purchase for the buyer. Instead of receiving full payment at closing, the seller provides a loan, usually with an interest rate, to the buyer. This method can be advantageous when:

- The property has been on the market for a while, giving the seller an incentive to close a deal.

- The seller wants to continue generating income post-sale through interest payments.

Partnering Up

Strategic partnerships can facilitate 100% financing. By collaborating with an equity partner who can bring in the required capital, you leverage their resources while offering a stake in the investment. This is beneficial for:

- Spreading risk, as the financial burden is shared.

- Tapping into your partner’s expertise or contacts, enhancing deal prospects.

Hard Money Loans

These are short-term loans secured by real estate, provided by private investors or companies. They are often faster to obtain than traditional loans but come with higher interest rates. However, they can be useful when:

- Quick closing is required.

- The property has value-add potential, where profit comes from improvement and resale rather than cash flow alone.

Risks Associated with 100% Financing

While leveraging borrowed funds can amplify profits, it also amplifies losses. Investors need to weigh these risks carefully:

Market Fluctuations

The real estate market is not immune to downturns. 100% financing increases financial exposure during periods of devaluation, which can lead to negative equity situations where the property’s value declines below the outstanding loan amount.

Cash Flow Constraints

Using 100% financing means higher monthly expenses due to loan repayments. Without adequate rental income or value addition, investors may find themselves in a financially precarious situation, straining their operational cash flow.

Creditworthiness

Securing 100% financing typically requires excellent creditworthiness. Even marginal declines in credit scores can affect interest rates or fees, impacting overall profitability. Additionally, leveraging significantly impacts debt-to-income ratios, potentially affecting future borrowing capability.

Best Practices for Successful 100% Financing

Maximizing your real estate portfolio with 100% financing demands a meticulous approach:

Due Diligence

Engage in comprehensive research and financial modeling before purchasing property. This includes assessing the potential for rental income, future appreciation, and understanding the local market dynamics. Use data analytics where possible to predict trends and outcomes.

Diversification

Avoid concentrating your investments in a single market or type of property. Diversifying can mitigate risks associated with market volatility and economic downturns. Consider varying property types, locations, and income strategies to spread risk effectively.

Exit Strategies

Always plan for clear exit strategies before committing to an investment. Whether through reselling after property value appreciation, refinancing at lower rates, or preparing an option for tenancy waiver, having multiple ways to exit the investment minimizes risk and maximizes flexibility.

Technology as an Ally in Financing

The advent of technology is reshaping how investors approach 100% financing. Platforms offering real estate crowdfunding, virtual deal rooms for partnerships, and AI-driven analytics for market predictions are becoming powerful tools in an investor’s arsenal.

Real Estate Crowdfunding

Joining platforms that hail collective investments enables tapping into small-scale collaborators worldwide. This often reduces the need for traditional financing, pushing up your leverage potential and reducing reliance on a single financing source.

Data-Driven Decision Making

Utilizing technology for predictive analytics can refine property selection processes, calculating the financial viability of full-financed properties. Such tools enhance strategic planning, mitigating risk through informed decisions.

Conclusion

In conclusion, leveraging 100% financing strategies in real estate investment requires a thoughtful approach that balances risks and rewards. By understanding different financing techniques and implementing sound risk management practices, investors can realize the potential to significantly expand their real estate portfolios. However, due diligence, strategic partnerships, and the utilization of technology to guide investment decisions are crucial in navigating the complexities of fully financed property investments.

Mastering Real Estate Investing with 100% Financing Techniques

To become a successful real estate investor leveraging 100% financing, one has to be both strategic and well-informed. Throughout this blog post, we have journeyed through various techniques and strategies that enable you to invest with little to no upfront cash. These exciting methods open doors to property investments without the need for substantial capital, an appealing aspect for many budding investors.

Key Takeaways

In the introductory segment, we established the critical importance of gaining a strong understanding of finance as a fundamental tool in real estate. We explored how traditional ideas of requiring a large savings buffer for property investment can be challenged through powerful and innovative financing solutions.

During the main content sections, we delved deeply into five primary financing techniques that make 100% investment a viable option:

- Utilizing Credit Partnerships: We discussed forming strategic alliances with creditworthy partners. By teaming up with partners who can provide the financial backing necessary, investors can initiate projects that may have seemed out of reach previously. This approach underscores the power of relationships and network-building in real estate.

- Seller Financing: This technique allows buyers to work directly with sellers to finance a property purchase. By bypassing the traditional mortgage route, investors can often negotiate terms that offer greater flexibility and cost-effectiveness, enabling a zero-money-down purchase.

- Master Lease Agreements: These contracts provide a way to control a property without immediate ownership. Such agreements allow investors to manage and profit from properties while deferring the purchasing payments and potentially locking in favorable terms.

- Using Hard Money Loans: We explored how hard money lenders can offer quick capital based on asset value rather than personal credit scores. Investors can leverage this short-term financing tool to secure properties and refinance later under better terms.

- Private Lending and Syndication: By tapping into a network of private lenders and investors willing to pool resources, one can finance large projects that would be unattainable individually. This technique showcases the strength of collective investment.

Furthermore, we have discussed how these methods are not without risks. Having a comprehensive understanding of the drawbacks, such as higher interest rates, complex legal implications, and partnership disputes, is crucial to mitigate potential pitfalls effectively.

Moreover, technology and digital platforms have reshaped real estate, offering more accessible tools and resources to support these financing methods. Keeping abreast of tech advancements can enhance your strategy, providing valuable data insights and process efficiencies.

The Path Forward

Embarking on a real estate investment journey using 100% financing techniques is undoubtedly ambitious. However, armed with the right knowledge and mindset, it is a journey filled with potential and opportunity. Real estate, as we have outlined, is a sector ripe with possibilities for wealth accumulation and financial independence.

In conclusion, mastering these financing avenues requires diligence, continuous learning, and a willingness to adapt to market changes. As the real estate landscape evolves, staying informed about legal, financial, and technological trends will be vital to maintaining a competitive edge. With commitment and the strategic application of the techniques discussed, budding investors can carve out successful pathways even in competitive markets.

Call to Action

Now that you have a solid understanding of how to approach real estate investment with 100% financing techniques, it’s time to take action:

- Assess your financial readiness and determine which technique aligns best with your investment goals and current situation.

- Start building a robust network of professionals, including real estate agents, financial advisors, and potential credit partners.

- Engage with communities and forums specializing in property investment for continued learning and support.

- Explore platforms and tools that can automate or streamline parts of the investment process.

For further insights and expert advice, consider subscribing to our newsletter, where we dive deeper into advanced real estate strategies and market updates. Join our community of like-minded investors and get exclusive access to tools and resources that can aid your investment journey.

We also encourage you to share your experiences and questions in the comments below. Let’s form a collaborative space where knowledge and opportunities grow, helping each other leverage 100% financing to achieve real estate investment success.

Together, let’s redefine how we view property investments, break through the traditional barriers, and champion innovative pathways to financial freedom.

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology