10 Down Investment Property Loan

Mastering the Art of Real Estate Investment: The 10 Down Investment Property Loan

In the dynamic and ever-evolving landscape of real estate, investors are constantly on the lookout for opportunities to maximize their returns while minimizing risks. Among the plethora of financing options available, the 10 Down Investment Property Loan stands out for its potential to offer greater leverage, flexibility, and profitability to both new and seasoned investors. But before diving headfirst into this enticing financial avenue, it is crucial to understand what this loan entails, its pros and cons, and how it can be strategically utilized to build a lucrative real estate portfolio.

At its core, a 10 Down Investment Property Loan allows investors to acquire residential or commercial properties by putting down just 10% of the property’s value. This relatively low down payment requirement is particularly attractive because it lowers the initial cash barrier, enabling investors to diversify their holdings and spread their risk. Thoughtfully navigating this financing option can open up a world of wealth-building possibilities, but it requires a clear understanding of the terms, conditions, and long-term implications.

Why choose a 10 down investment property loan? For many, the answer lies in the ability to control and expand assets without tying up large amounts of capital. A lower down payment may free up more funds for renovating the property, covering closing costs, or investing in additional properties. However, potential risks exist, such as higher mortgage insurance premiums and stricter lending criteria, which must be carefully weighed against the benefits.

What does the journey of acquiring a 10 down investment property loan look like? It begins with understanding your creditworthiness and the specific eligibility requirements set by lenders. For a successful application, having a strong financial background and a sound investment strategy is paramount. Yet, even riskier profiles can sometimes find paths to approval by exploring alternative lending solutions or partnering with co-investors who can strengthen the financial proposition.

Equally essential is mastering the art of property selection. Not every property is a suitable candidate for such a financing arrangement. Investors must be adept at analyzing market trends, property values, and potential rental income to ensure that their investment will pay off. Conducting a thorough risk assessment and planning for contingencies, such as vacancies or market slowdowns, can safeguard against potential pitfalls.

Long-term success with a 10 down investment property loan hinges on effective management and optimization of the acquired property. This includes regular maintenance, implementing strategies to increase property value, and adopting efficient property management practices. The goal is to not just break even but to generate a steady and growing stream of income.

Are you ready to delve deeper into the world of 10 Down Investment Property Loans? Whether you’re looking to kickstart your real estate journey or expand your existing portfolio, understanding these loans and how to effectively leverage them can dramatically enhance your investment success. Join us as we unravel the intricate details, advantages, challenges, and growth strategies associated with this enticing financial tool.

In the following sections, we will navigate the intricacies of this loan type, providing you with actionable insights and expert tips to empower your investment journey. From approval processes and market analysis to maximizing cash flow and scaling up your investments, the road to real estate success is paved with knowledge and strategy.

Let’s get started on this exciting exploration that can potentially reshape your investment horizon with wisdom and foresight.

Understanding the 10% Down Investment Property Loan

Investing in real estate can offer lucrative opportunities, but the financial barrier can be a significant hurdle. Traditional loans often require hefty down payments ranging from 20% to 30%. However, a 10% down investment property loan provides a more accessible pathway for investors eager to enter or expand their real estate portfolio. Understanding how this loan works, its benefits, and its challenges is crucial for making informed decisions.

Key Features of 10% Down Investment Property Loan

The 10% down investment property loan is a unique product that aims to reduce the entry cost for real estate investors. Unlike conventional loans, this type of loan allows you to acquire new properties with a significantly lower initial cash outlay. Here are some key features:

- Lower Initial Investment: With just 10% down, you retain more capital for other investments or property improvements.

- Flexible Terms: Some lenders offer flexible repayment options and terms tailored to your financial situation.

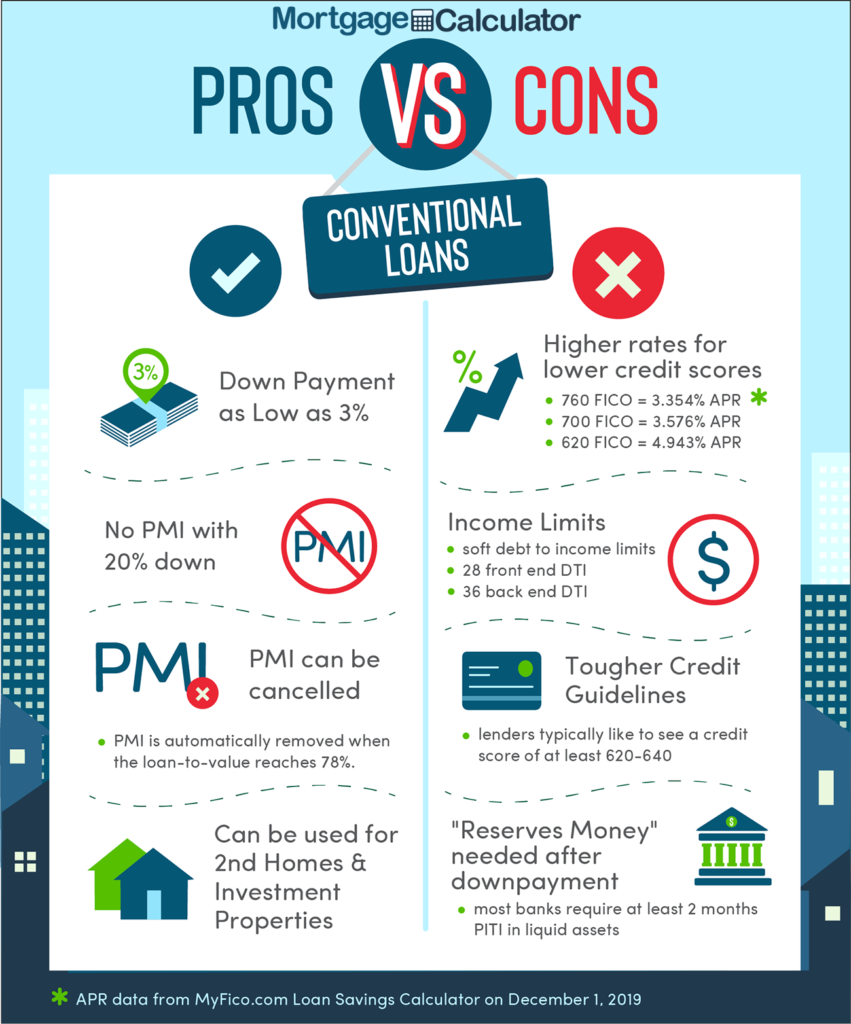

- Private Mortgage Insurance (PMI): Typically required when putting less than 20% down, lenders may include PMI which adds to your monthly payments.

- Qualification Criteria: Although less stringent than traditional loans, they still assess your creditworthiness and financial health.

Benefits of a 10% Down Payment

Increased Leverage

One of the main advantages of a 10% down loan is increased leverage. By putting less money down, you can acquire multiple properties and diversify your investment portfolio without depleting your cash reserves. This strategy can enhance your potential returns as you capitalize on rental income and property appreciation across several holdings.

Cash Flow Management

Having more liquidity can significantly improve your cash flow management. The funds saved from a lower down payment can be allocated to other essential areas such as:

- Property renovations and repairs to enhance value.

- Marketing to attract tenants.

- Emergency funds for unforeseen expenses.

Opportunity to Enter Markets Sooner

In competitive real estate markets, time is often of the essence. A 10% down loan allows you to move quickly and secure a property before prices rise or demand increases. This proactive approach can lead to early investments in high-growth areas, maximizing potential profits.

Challenges of 10% Down Investment Property Loans

Higher Monthly Expenses

One of the drawbacks of a smaller down payment is the resultant higher loan amount, which translates to increased monthly payments. This situation is further compounded by PMI, which raises the cost of ownership. Calculating whether rental income can cover these expenses is pivotal to sustaining positive cash flow.

Risk of Over-leveraging

Leverage can be a double-edged sword. While it increases purchasing power, it also heightens risk. Carrying a larger debt load increases vulnerability to market volatility. A downturn or decrease in rental occupancy can strain your finances, leading to potential defaults or foreclosure.

Stricter Lender Requirements

Despite a lower down payment requirement, lenders may impose stricter underwriting criteria. You may face higher interest rates compared to standard investment loans. Additionally, lenders may require a solid credit score and a stable financial background to mitigate their risk.

Strategies for Success with a 10% Down Investment Loan

Conduct Thorough Market Research

A successful investment starts with understanding the market to ensure profitability. Consider factors such as local rental demand, economic growth, and property value trends. Tools like real estate market reports and demographic studies can provide valuable insights.

Calculate Affordability Accurately

Ensure that you comprehensively analyze all financial aspects involved. Use calculators to determine your debt-service ratio, potential returns, and break-even points. It’s crucial to verify that rental income will cover monthly obligations and leave room for profit.

Improve Your Credit Profile

Enhancing your credit score can improve loan terms and reduce costs. Pay off existing debts, ensure timely payments, and refrain from taking on new debts before your application. A higher credit score can also grant you better bargaining power.

Engage a Real Estate Agent or Financial Advisor

Navigating the complexities of investment loans can be daunting. Consider hiring professionals who can provide expert guidance on market strategies and financial planning. Their insights can help avoid costly mistakes and optimize your investment approach.

Final Thoughts

The allure of a 10% down investment property loan is strong, offering a blend of accessibility and leverage not typically available with more substantial down payments. However, potential investors must weigh these benefits against the increased financial commitments and risks. By employing strategic planning and expert advice, you can leverage these loans effectively to pave the way for real estate success.

Strategizing for Ultimate Real Estate Growth with Low Down Payments

As we reach the conclusion of our exploration into 10 Down Investment Property Loans and their role in strategizing for ultimate real estate growth, it’s important to reflect on the key insights we’ve gathered throughout this journey. When considering real estate investment, the allure of entering the market with low down payments is compelling. It offers investors a chance to diversify portfolios, leverage financial institutions’ capital, and maximize returns without tying up a significant portion of their own funds from the outset.

Revisiting the Core Themes

We began this discussion by introducing the fundamental appeal of real estate investment through low down payment strategies. The primary advantage here is accessibility; you can enter lucrative markets with relatively minimal cash contributions, freeing up capital for other investments or expenses. By employing this approach, investors can diversify their risk, invest in multiple properties, or reserve funds for inevitable property improvements and maintenance.

Throughout the main content, we delved deep into several vital aspects of utilizing a 10 Down Investment Property Loan to its fullest potential:

- Maximizing Leverage: Leverage is a quintessential component of real estate investment strategy. With a 10% down payment, investors are effectively controlling assets worth ten times their initial investment. This amplifies potential returns, but also necessitates prudent risk management.

- Understanding Loan Structures and Terms: Navigating the terms of investment loans can be complex. Knowing the fine print, such as interest rates, payoff timelines, and potential penalties, is crucial. This knowledge allows investors to choose structures that best fit their financial goals and property management strategies.

- Diversifying Investment Portfolios: As highlighted, low down payments provide the flexibility needed for diversifying investment portfolios. By spreading investments across various properties or geographic locations, investors can mitigate risks and ensure more stable returns even amidst market fluctuations.

- Factoring in Cash Flow and Income Potential: Understanding the potential cash flow and income from rental properties is critical. This includes assessing rental yields, focusing on properties with high occupancy potential, and realistic pricing to ensure consistent rental income that surpasses mortgage commitments and operational costs.

- Emphasizing Property Selection and Due Diligence: The strategy of low down payment investment necessitates keen property selection and thorough due diligence. This includes evaluating the local real estate market, understanding property demand, and ensuring future resale potential, all of which are fundamental for securing profitable investments.

Putting Strategy into Action

We must also remember the value of strategic partnerships with financial advisors, real estate agents, and experienced mentors within the field. Leveraging these relationships can provide insights that might not be immediately apparent from data and statistics alone, guiding you to the most rewarding investment decisions.

Taking a holistic, informed approach to real estate investment not only maximizes the advantages of a 10 Down Investment Property Loan but also circumvents potential pitfalls. This strategy is not about securing as many properties as possible with low down payments but about smart, calculated growth that integrates market knowledge, financial acuity, and strategic planning.

Call to Action

As you contemplate your next steps, we encourage you to apply the insights and strategies we’ve discussed to your personal investment strategy.

Engage With The Market: Begin by evaluating your current investment portfolio and financial situation. Look for opportunities where a low down payment investment property might fit into your growth strategy. Analyze markets or locations that have strong economic forecasts and demographic growth which might benefit from inventive financing strategies.

Seek Expert Advice: Don’t hesitate to reach out to real estate advisors or experienced mentors who can offer guidance tailored to your specific investment goals and market conditions.

Continue Learning: The world of real estate is dynamic, and staying informed is crucial. Engage with up-to-date resources, forums, and communities where investors share insights on low down payment strategies and other innovative investment approaches.

Feel free to contact us with any questions or for more detailed guidance. Subscribe to our newsletter for continuous updates on the latest real estate investment trends and insights. And most importantly, persist in exploring how 10 Down Investment Property Loans can become a transformative element in your financial growth strategy.

Remember, successful investing is not merely about acquiring property; it’s about making decisions that align with long-term financial goals while managing risks effectively. With this knowledge, you are now well-equipped to navigate the intricate yet exciting landscape of real estate investment, leveraging opportunities to their maximum potential.

Thank you for joining us on this exploration. We hope you’re inspired to take actionable steps in your investment journey. Until next time, keep investing intelligently and strategically!

News

News Review

Review Startup

Startup Strategy

Strategy Technology

Technology